[ad_1]

(Bloomberg) — For the second year in a row, banks around the world earned more revenue from underwriting bonds and providing financing for environmental projects than from financing oil, gas and coal projects. .

Most Read Articles on Bloomberg

Last year, the world’s largest financial institutions earned about $3 billion in fees totaling debt restructuring for deals they touted as environmentally friendly, according to data compiled by Bloomberg. By comparison, the sector generated less than $2.7 billion in total revenue from fossil fuel trading.

European banks led the transition, with BNP Paribas SA topping the Bloomberg Green Debt League Table. Meanwhile, Wall Street had a monopoly on fossil finance, with Wells Fargo & Co. and JPMorgan Chase & Co. making the most money from oil and gas trading.

BNP, the European Union’s largest bank, earned nearly $130 million from its green finance business last year. Credit Agricole AG was next with $96 million, followed by HSBC Holdings with $94 million.

On the other side of the energy divide, Wells Fargo earned $107 million in fees arranging bonds and loans for the fossil fuel sector, closely followed by JPMorgan and Mitsubishi UFJ Financial Group with $106 million. Ta. Indeed, MUFG was also the world’s top green loan arranger last year.

The move coincides with tightening regulations in Europe, where the European Central Bank and the region’s top banking authorities have made clear they want to accelerate the green transition of the financial industry. European financial institutions now face the threat of fines and increased capital requirements if they mishandle climate change. In response, many banks have placed clear limits on fossil fuel financing.

Meanwhile, in the U.S., the regulatory outlook remains uncertain and fragmented as many Republican states have set hurdles to the green transition. Retaliation against banks suspected of withholding loans from the oil and gas sector is increasing, with Texas among states threatening to end partnerships with Wall Street companies with net-zero emissions targets.

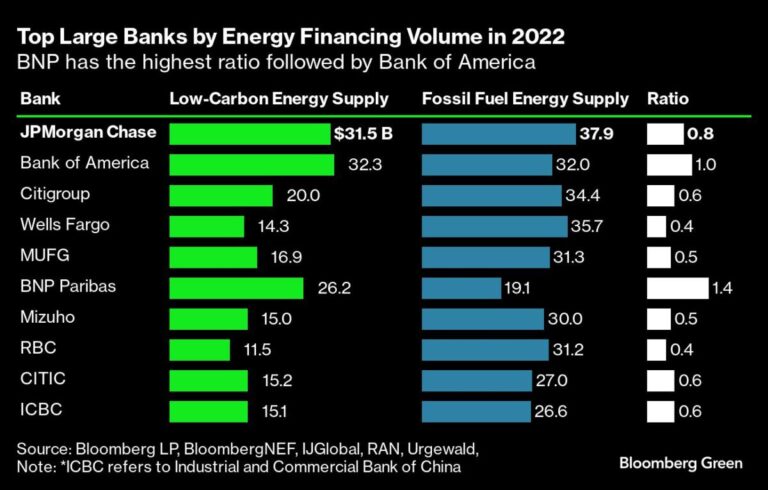

Against this backdrop, the global financial industry is well short of the stage needed to achieve the goals of the Paris Climate Change Agreement. Achieving net-zero emissions targets will require four times more capital to be allocated to green projects than fossil fuels by 2030, according to a BloombergNEF analysis. However, according to the latest statistics from BNEF, the ratio was just 0.7:1 at the end of 2022, almost unchanged from the previous year.

BNEF sustainable finance analyst Trina White said at the report’s release in December that bank lending was “nowhere near” the required transition level.

Read more: Wall Street isn’t making any progress in transitioning to energy finance

Environmentalists are sounding the alarm as global banks are perceived to be dragging their feet.

Jason Schwartz, senior communications strategist at the nonprofit Sunrise Project, which focuses on the financial sector’s contribution to global warming, said: have not yet caught up,” he said.

According to the Global Carbon Project, last year was the hottest on record. The group, which represents an international collaboration of scientists, said carbon dioxide emissions from fossil fuel combustion will increase by 1.1%, reaching a new high in 2023, and the planet will warm by 1.5 degrees by the end of 2020. It is estimated that Japan will be on track to exceed its carbon budget. Ten years.

Overall, banks financed $583 billion in green bonds and loans last year, compared to $527 billion in fossil fuel debt. In 2022, banks pumped $594 billion into environmental projects and $558 billion into oil, gas and coal, according to Bloomberg data.

Read more: Global carbon emissions from fossil fuels to reach new peak in 2023

In recent years, the world’s biggest banks have released reports showing the vast sums of money they say they are putting toward a greener, fairer planet. However, some of these claims are now being questioned in the absence of regulatory guidance to help stakeholders understand them.

Read more: What banks really mean when they spend trillions on ESG

(Added reference to MUFG as top green loan provider in fifth paragraph.)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link