[ad_1]

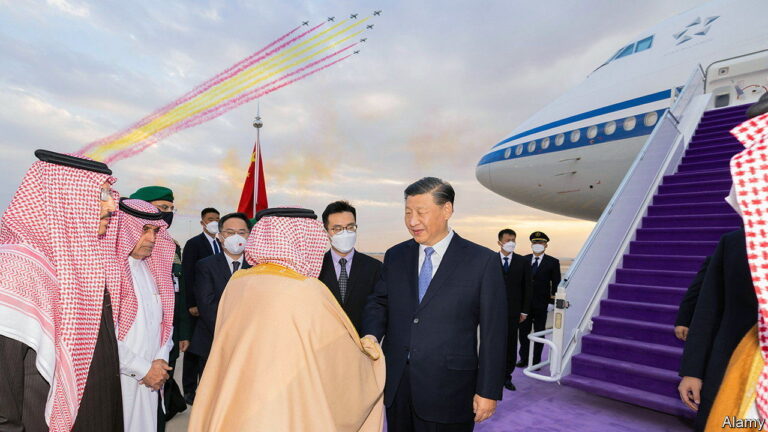

Whentai chinese Meetings with wealthy people in the Middle East usually take place behind closed doors. Last month, they openly interacted in the lobby of the Hong Kong Stock Exchange.FII “Priorities” Summit, an event hosted by the Public Investment Fund (PIF), a $780 billion vehicle for Saudi Arabia’s sovereign wealth. This was the first meeting of its kind in East Asia. It won’t be the last.of PIF announced plans to establish an office in China. Mubadala, Dubai Investment Corporation and the UAE’s two sovereign wealth funds, Qatar Investment Authority and Kuwait Investment Authority, are all said to be preparing to inject further capital into the world’s second-largest economy. There is. They think they can do this without angering Western countries, which are increasingly wary of China. “We’re friendly people and we’re friends with everyone,” said executive Jerry Todd. PIFhe said at a press conference in Hong Kong.

Chinese investment firms and the companies they support need friends now. As China’s geopolitics deteriorated, US investment in China collapsed. Chinese tech companies received $1.2 billion from U.S. venture capitalists in 2022, down from $14 billion in 2018. Mergers and acquisitions (M&a) sales of U.S. companies in China will fall to below $9 billion in 2023, down from $20 billion five years ago.meanwhile M&a Transactions by Gulf companies have ballooned, reaching nearly $9 billion in 2023 from almost nothing in 2019, data shows. LSEGa financial information company (see graph).

last month NIOA Chinese Tesla wannabe said he received $2.2 billion from. shivn Holdings, a company controlled by the Abu Dhabi government, had previously invested more than $1 billion in the electric car maker.of neom The pony was backed by an investment fund that is part of Saudi Arabia’s Pharaoh Project, which is building futuristic cities in the desert.A.I., some Chinese developers of self-driving technology. Earlier this year, Saudi oil giant Saudi Aramco invested $3.6 billion in a petrochemical refinery in China called Rongsheng and entered into a joint venture with Saudi Aramco. PIF The company will produce high-quality metal sheets in Saudi Arabia with Baosteel, one of China’s largest steel manufacturers.Chinese V.C. The companies have been tight-lipped publicly about limited partners, but privately they have acknowledged a surge in interest from Middle Eastern companies over the past two years.

Although the Gulf region is short, China’s wealth of high-tech talent is flowing in another direction. The Chinese University of Hong Kong’s Shenzhen Campus and Shenzhen Big Data Institute support King Abdullah University of Science and Technology in Saudi Arabia (Kaust) Build an artificial intelligence model to power an Arabic chatbot called AceGPT.Approximately 1 in 5 people KaustOne in three students and postdoctoral fellows are Chinese.

The budding Sino-Arabian relationship will not replace the declining Sino-American relationship. Dubai and Riyadh cannot match the depth of expertise of Silicon Valley and the capital markets of New York. Gulf wealth funds are primarily writing checks for hundreds of millions of dollars, but Americans are also backing early-stage startups that need millions of dollars. And for the Gulf, the United States remains an important partner. emirates in december A.I. called a startup GThe 42 companies, whose backers include Mubadala and American investor Silver Lake, said they would sever ties with Chinese companies rather than lose access to American technology. “We cannot cooperate with both sides,” said Xiao Peng, the company’s chief executive. financial times. That’s enough to be friends with everyone. ■

To stay on top of the biggest news in business and technology, sign up for Bottom Line, our subscriber-only weekly newsletter.

[ad_2]

Source link