[ad_1]

Advanced Micro Devices (NASDAQ: AMD) and symbolic (NASDAQ:SYM) Both companies have posted explosive stock performance over the past year. As of this writing, both companies’ stock prices are up 130% and 180%, respectively, and both look poised to benefit long-term from the rise of artificial intelligence (AI).

While AMD has made big profits thanks to excitement surrounding the company’s opportunity to provide semiconductors that power AI, Symbotic has seen its stock soar thanks to strong sales growth and interest in robotics technology. There is. Which of the leading companies in next-generation technology trends is a better buy for investors at today’s prices?

Advanced microdevices could become a boom

Paluev Tatevosyan (AMD): For investors looking to take advantage of the growth in artificial intelligence, Advanced Micro Devices is an excellent choice. The company has had a solid track record of growing revenue and profits over the past 10 years, and is selling at a reasonable valuation.

AMD’s revenue jumped from $5.3 billion in 2013 to $23.6 billion in 2022. Given the increased demand for CPUs and GPUs due to the increased use of artificial intelligence, it’s no surprise that AMD’s revenue continues to grow. Importantly for investors, AMD has demonstrated economies of scale. As revenue increased, so did operating profit. From 2013 to 2022, AMD’s operating profit increased from $89 million to $1.3 billion.

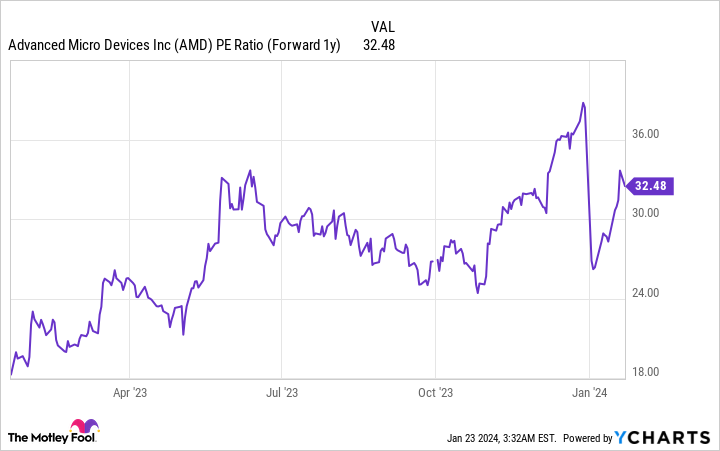

AMD’s stock price seems reasonable.

AMD’s stock price, selling at 32 times forward earnings, is a good value for a company with such a strong outlook.Unlike Nvidiahas already seen rapid growth in revenue, profits, and valuations due to the power unleashed by AI, while AMD has yet to experience similar increases. This could be good news for investors who want to jump in now.

Symbotic is a small company with big opportunities

Keith Noonan (Symbolic): Symbotic is a leading provider of AI-powered robotics technology for warehouse and supply chain automation. Large companies have the opportunity to dramatically increase profit margins by automating key parts of their operations, and this dynamic is leading to strong sales growth for robotics professionals.

In the last fiscal year, which ended Sept. 30, sales rose 98% to $1.8 billion. The company is not yet profitable, posting a net loss of $208 million in the same period, but its business is growing rapidly. As the company continues to grow and leverage economies of scale, I think there is a good chance it will turn a profit and return to regular earnings growth.

Importantly, Symbotic is still in the early stages of developing a huge market opportunity. The company’s hardware is already in strong demand, and the company will have the opportunity to introduce new industrial robotics technology to address other automation needs and drive sales growth. Advances in AI software should also help increase the machine’s capabilities and market appeal.

Symbolic stocks are still somewhat of a speculative investment, given that the business is not yet profitable. On the other hand, the company’s average sales forecast for this year is estimated to be lower than 2.2 times. With this business posting such explosive sales growth, that multiple is actually quite reasonable considering the viable path to profitability for robotics experts. It looks like there is.

Additionally, the company’s technology strengths and rapid revenue growth make it a potential acquisition target. I think Symbotic has what it takes to be a winner if it continues to fly solo, but a potential acquisition could help set a floor for the stock price, and if an acquisition If done at a premium to today’s prices, it could yield significant profits.

With a market cap of about $3.8 billion, Symbotic stock is an attractive bet for growth, yet large enough to generate explosive returns for investors who buy the stock at its current price.

Which stocks should I buy?

For investors looking for a solid growth strategy and a balanced risk-reward profile in an established industry, AMD stock is a better buy. Similarly, investors who are more interested in owning semiconductor stocks than robot stocks have an easy choice here.

On the other hand, investors willing to take on the higher risks associated with backing young players in a nascent industry may find Symbotic a good fit for their portfolio. Symbolic is certainly the riskier of the two stocks, but its small size combined with huge market opportunity could give way to explosive long-term performance.

AMD and Symbotic are both growth stocks in the tech sector. Both companies operate in different industry segments and are at different stages of business development. While AMD is a major player in the semiconductor industry, Symbotic is at the forefront of the much younger industrial robotics field.

Both of these business units look poised for expansion, and AMD and Symbotic each have strengths that could make them long-term winners. Depending on your portfolio goals and risk tolerance, owning both stocks could be the right choice.

Should you invest $1,000 in Advanced Micro Devices right now?

Before buying Advanced Micro Devices stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Advanced Micro Devices wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of January 22, 2024

Keith Noonan has no position in any stocks mentioned. CFA Parkev Tatevosyan has no position in any stocks mentioned. The Motley Fool has a position in and recommends Advanced Micro Devices and his Nvidia. The Motley Fool has a disclosure policy.

“Better AI Buy: AMD vs. Symbotic Stock” was originally published by The Motley Fool.

[ad_2]

Source link