[ad_1]

Growth stocks will be back in the driver’s seat in 2024, with the Vanguard Russell 1000 Growth ETF (NYSEARCA:Von) is a great and easy way to invest in different things. I’m bullish on this growth-oriented ETF from Vanguard. That’s because of its strong portfolio of highly valued growth stocks, great historical performance, healthy diversification, and low expense ratios.

What is the strategy of VONG ETF?

According to fund sponsor Vanguard, VONG “invests in stocks in the Russell 1000 Growth Index, a broadly diversified index comprised primarily of growth stocks from large U.S. companies.” Vanguard says VONG is “considered a measure of U.S. stock returns driven by large-cap growth.”

The Russell 1000 Index is an index of the top 1,000 stocks from the Russell 3000 Index (which represents approximately 97% of the U.S. public stock market by market capitalization), and this ETF encapsulates the growth stocks within this large cohort. VONG was founded in 2010 and is now a fairly popular fund with $18.8 billion in assets under management (AUM).

Winning record

There’s nothing particularly complicated about this strategy of investing in growth stocks within the Russell 1000, but VONG has long used it to generate superior returns for investors.

As of January 31, the fund had returned a respectable 10.0% on an annualized basis over the past three years. Zooming out, VONG has an impressive return of 18.0% on an annualized basis over the past five years, and an impressive return of 15.4% on an annualized basis over the past 10 years. Since its inception in 2010, VONG has returned 15.9% annually.

From another perspective, this fund has returned 318.1% on a cumulative basis over the past 10 years. This means that if he invested $10,000 10 years ago, that investment is now worth more than $41,800.

What’s more, this growth-oriented fund has returned an even more impressive 618.7% on a cumulative basis since its inception in September 2010. This means that if you invested $10,000 back then, that investment would be worth nearly $72,000 today, demonstrating the power of this fund. Invest in a good fund for the long term.

A diverse portfolio of great growth stocks

VONG holds 442 stocks, offering investors good diversification. However, there is some concentration here as well, as the top 10 stocks account for his 51.6% of the fund’s assets.

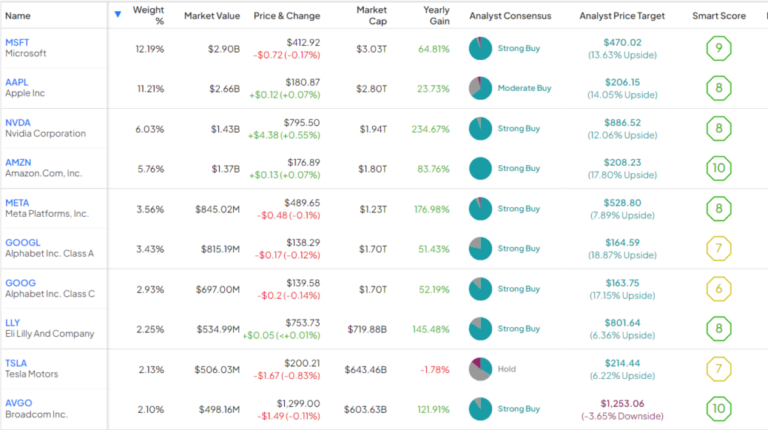

Below is a summary of VONG’s top 10 holdings using TipRanks’ holdings tool.

VONG’s list of top holdings includes the entire “Magnificent Seven” – Microsoft (NASDAQ:MSFT), apple (NASDAQ:AAPL), NVIDIA (NASDAQ:NVDA),Amazon(NASDAQ:AMZN), Metaplatform (Nasdaq:Meta), alphabet (NASDAQ:GOOG) (NASDAQ:Google), Tesla (NASDAQ:TSLA) — Plus Broadcom (NASDAQ:AVGO), may currently be members of this cohort.

The fund’s tech leanings are clear, given how these mega-cap tech stocks came to dominate the overall market, especially growth stocks. Additionally, while the technology sector has by far the largest weighting within the fund at 53.0%, growth is not limited to the technology sector and VONG holds many growth stocks in other industries.

For example, Eli Lilly (New York Stock Exchange: Lilly) is a top 10 fast-growing holding based on the breakthrough success of its GLP-1 drugs for diabetes and weight loss. The company recently reported a 28% year-over-year increase in fourth-quarter revenue. This is significant growth for a company of its size, with 2024 revenue expected to grow by 20% at the midpoint. Given Eli Lilly’s strong performance, some market players are even arguing that Lilly should replace Tesla with the Magnificent Seven.

VONG is just outside the top 10 holdings, with global payments network Visa (New York Stock Exchange:V) and MasterCard (New York Stock Exchange: Massachusetts), as well as Home Depot (New York Stock Exchange:HD) and Costco (Nasdaq:Cost).

VONG’s growth stocks collection is rated favorably by TipRanks’ Smart Score system. Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score of 1 to 10 based on eight key market factors. A score of 8 or higher corresponds to an outperform rating.

Seven of VONG’s top 10 stocks have Smart Scores equivalent to Outperform of 8 points or higher, including Broadcom and Amazon, which have Smart Scores of “Perfect 10s.” Just outside VONG’s top 10 holdings, Costco and Mastercard also receive Smart Scores of 10 out of 10. VONG itself features an ETF Smart Score of 8, which is equivalent to Outperform.

What is VONG’s expense ratio?

Perhaps best of all, VONG is a cost-effective way for investors to take advantage of this diverse collection of strong long-term performance and highly valued growth stocks. VONG has a very low expense ratio of just 0.08%. An investor pays a fee of just $8 per year on his $10,000 investment in VONG. This is a bargain for his ETF, which has delivered returns similar to VONG.

Assuming the fund continues to earn 5% annually and maintains its current expense ratio, an investor who invested an initial $10,000 in VONG would pay just $103 in fees over 10 years. Investing in such low-cost funds helps investors protect their investment capital over the long term, and is an important but often overlooked consideration when building a portfolio.

Is VONG stock a buy, according to analysts?

Turning to Wall Street, VONG has a Moderate Buy consensus rating, based on 357 Buy, 78 Hold, and 8 Sell ratings assigned over the past three months. Masu. VONG’s average price target of $93.84 implies a potential upside of 10.0% from current levels.

Key points for investors

VONG’s strategy of investing in the Russell 1000 Growth Index isn’t particularly flashy or exotic, but it’s a simple and effective way to invest in a large group of the market’s top growth stocks with low fees. I’m bullish on this simple Vanguard ETF based on its track record of long-term performance, favorable expense ratios, and a diversified portfolio of highly valued growth stocks.

disclosure

[ad_2]

Source link