[ad_1]

(Bloomberg) – Abu Dhabi is building a technology investment firm focused on artificial intelligence and semiconductor deals that could exceed $100 billion in assets under management within a few years, according to people familiar with the matter.

Most Read Articles on Bloomberg

The company, called MGX, will add sovereign wealth fund Mubadala Investment Company and AI firm G42 as founding partners. Ahmed Yahia Al Idrisi, CEO of Mubadala’s direct investment platform, will become CEO of the new company, the statement said.

The Mubadala and G42 portfolios remain as they are for now, and MGX is pursuing its own deal, which was initially funded by the Abu Dhabi government, said the people, who requested anonymity because the matter is private. That’s what it means. The entity said it will pursue the best partners across three key areas: AI infrastructure, semiconductors, and AI core technologies and applications.

The decision to establish MGX further strengthens the UAE’s commitment to this sector. The Gulf country, of which Abu Dhabi is the capital, aims to become a world leader in testing and regulating AI technology, officials said.

Read more: OpenAI’s Altman sees UAE as testing ground for global AI regulation

MGX will be chaired by Sheikh Tahnoun bin Zayed Al Nahyan, UAE National Security Adviser, and Khaldun Al Mubarak, CEO of Mubadala, will serve as vice chair. Board members include Jassem Al Zaabi, Vice Chairman of the UAE Central Bank, Peng Xiao, CEO of G42, and Mr. Al Idrissi.

abu dhabi wealth fund

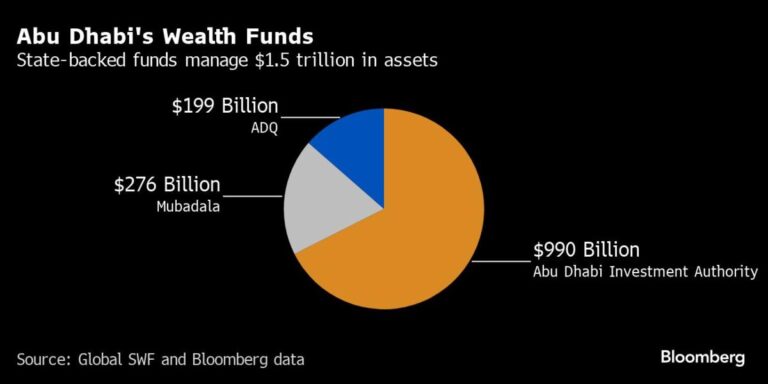

The firm joins a group of wealth funds in Abu Dhabi, one of the few cities in the world that manages about $1.5 trillion in government assets. Mubadala is worth $276 billion and is one of three Emirati government-backed investors.

“With the launch of MGX, Abu Dhabi is entering a new era in which it is not only a global technology leader, but also shaping the world’s AI roadmap,” said Xiao. Mubadala declined to comment.

G42 is part of the $1.5 trillion empire controlled by Sheikh Tahnoun and is at the forefront of the country’s AI efforts. The company’s partnerships also include one with OpenAI, which is partnering with Gulf companies as part of its expansion within the UAE and wider region. Bloomberg reported last year that OpenAI was in talks with G42 to raise funding for a new chip venture.

Read more: Gulf Royal’s $1.5 trillion empire attracts bankers and billionaires

The company is currently scaling back its presence in China and has pledged to invest in Western markets to allay U.S. concerns about relations with China, CEO Xiao told Bloomberg News last month. Told. Xiao said G42 will focus on deploying capital to the U.S. and other markets where major AI partners operate.

–With assistance from Katerina Kadabashi.

(Updated Abu Dhabi wealth fund details)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link