[ad_1]

Basically, the bullish story for semiconductor and technology giant Advanced Micro Devices (NASDAQ:AMD) is intuitive and logical. However, these characteristics do not necessarily imply accuracy. In other words, AMD stock’s stratospheric rise is largely dependent on the promise of artificial intelligence. However, there is growing evidence that this may not be the case, and I have no choice but to become bearish on Advanced Micro Devices.

AMD stock is riding on an interesting but potentially flawed story

It doesn’t take much effort to understand and appreciate the bullish story behind AMD stock. Advanced Micro primarily manufactures graphics processing units, or GPUs. These highly specialized semiconductors address the incredible bandwidth requirements of leading generative AI platforms. Indeed, Nvidia’s popularity (NASDAQ:NVDA) comes from world-class GPUs.

especially, bloomberg reports that generative AI could become a $1.3 trillion market by 2032. GPU sales should increase across the broader technology industry to support this growing demand. Not surprisingly, Previous research states that the global GPU sector will be valued at $42.2 billion in 2022. By 2032, the industry could be worth $773.07 billion, with a compound annual growth rate of 33.8%.

Clearly, it’s more than just simple scale predictions that make the AI story compelling for AMD stock and its ilk. Rather, it is an implied economic benefit. In particular, MIT Sloan reported that research studies have shown that when highly skilled workers use AI protocols that operate within their capabilities, their performance increases by as much as 40%.

For now, companies can only dream of a 40% performance increase. So it’s no surprise that more and more companies are jumping on the AI hype. Some companies are even going so far as to impose layoffs in order to invest further in AI.

Given the aforementioned improvements, such instructions can be incredibly valuable. However, this argument only holds if the AI is as good as advertised. That’s a big “what if”.

If you use a generative AI program long enough, you’ll discover an unmanageable reality. At the moment, AI makes mistakes, but too many of them. Without going too far into granularity, AI suffers from the “black box” problem. Basically, it is difficult to understand what it is thinking and why it reaches such conclusions.

In other words, AI cannot be trusted due to the nature of the problem. That is not a speculative opinion, but rather harvard business review. Without trust, a human must oversee every process his AI implements. If so, why bother using an AI intermediary?

Smart Money seems skeptical of AMD

In an academic study last year, researchers found that 52% of ChatGPT answers are incorrect. If this holds true for other areas of chatbots’ so-called expertise, this is a surprising finding. If more than half of the answers are inaccurate, it is virtually impossible for digital intelligence to improve performance by 40%.

to harvard business review In other words, humans need to verify whether the answer is correct. He adds one more step to the process, which means it would have been better to have a human operator do the work from the beginning. This is not value creation. That is value destruction.

As a result, major companies appear to be skeptical of AMD stock. Advanced Micro stock initially benefited from Nvidia’s explosive profits, but sentiment turned negative on Friday. Once the issue was resolved, the security lost his 3% of its value. However, the derivatives market presented a more troubling picture.

An unusual options screen for AMD stock shows that the majority of trades from both puts and calls were concentrated in contracts that expired when Friday’s closing bell rang. It seems clear here that the speculators were trying to scalp some short-term gains based on the market’s digestion of Nvidia’s profits.

But traders also bought puts that expire in the next few months. In particular, there was active trading in puts with strike prices of $150 and $170, which expire on May 17 of this year. These traders may be expecting AMD stock to fall to these levels, or they may be taking out volatility insurance in case the stock price falls significantly.

What’s even more surprising is the large number of call sales. Specifically, one trader sold his 4,093 contract on the July 19, 180.00 call, and in the process he paid a premium of $802,000. This move hints at the idea that AMD stock will not rise above the $180 strike. Considering the widespread enthusiasm for AI, this seems like a pretty bold bet.

Ratings may need to be readjusted

Assuming the GPU market grows at a CAGR of approximately 34% due to accelerated demand for AI, AMD stock may be undervalued. Analysts, on average, expect Advanced Micro’s sales to reach $23.83 billion in 2024 and $30 billion in 2025. From $22.7 billion in revenue in 2023, AMD’s expected revenue CAGR is approximately 9.7%.

However, such concepts assume that AI increases value. Unfortunately, high-level sources suggest that AI will consume current value. Again, its insights and output require human validation. If so, AI would become an unnecessary intermediary and values would need to be rebalanced to the downside.

Is AMD stock a buy, according to analysts?

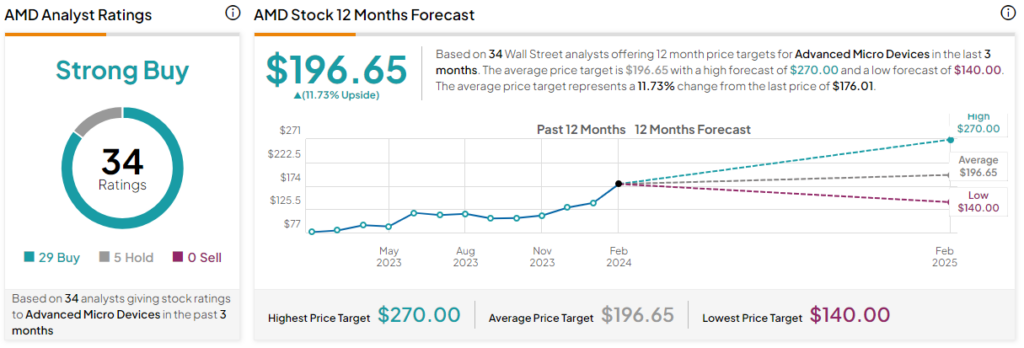

Turning to Wall Street, AMD stock has a “Strong Buy” consensus rating based on 29 buys, 5 holds, and zero sell ratings. AMD’s average price target is $196.65, suggesting 11.7% upside potential.

Lesson: AMD stock works if AI predictions are correct

If AI predictions hold, advanced micro devices could represent a potentially lucrative but undervalued opportunity. However, that depends on the usefulness of digital intelligence, and so far the evidence shows that AI hinders rather than creates value. Given this surprising framework, AMD stock may need a correction, and it appears that major traders are already trading on this assumption.

disclosure

[ad_2]

Source link