[ad_1]

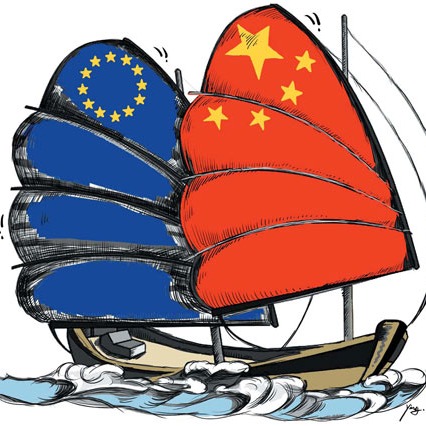

Banks in China and the European Union hope to take advantage of opportunities to support expanded bilateral trade and investment, including through green finance and cross-border renminbi operations.

Speaking at a seminar on the cross-border renminbi and beyond in Luxembourg on Friday, European Bank of China Chairman Xu Chen said that the great progress in the internationalization of the renminbi in recent years has contributed to China’s influence on the world stage. It not only symbolizes growing power, but also provides a new avenue for economic cooperation between China and Europe.

Mr. Xu, who is also chairman of the Chinese Chamber of Commerce and Industry, said: “The journey of the renminbi from a national currency to one of the world’s leading currencies for trade, investment, and foreign exchange reserves is an important step in our commitment to fostering a more diverse and resilient global financial system.” It reflects the shared commitment of the to the EU or CCCEU.

The CCCEU on Friday announced a finance working group, in addition to its two existing digital and green groups.

Mr. Xu said there is great potential for cooperation between China and the EU in areas such as green economy, technological innovation and addressing global challenges.

“Our cooperation is therefore not only beneficial, but essential for sustainable growth and stability in the world,” he said.

The 2023-24 CCCEU annual report showed that Chinese companies’ overall assessment of the EU’s business environment declined for the fourth consecutive year. However, Chinese companies remain largely “optimistic and enthusiastic” about operating in the EU, and see great potential for cooperation in green and digital fields.

Mr. Xu said the adoption of the renminbi in cross-border transactions will bring unparalleled opportunities for European and Chinese businesses.

“It can provide a more direct, cost-effective and efficient means of conducting trade and investment activities, reduce dependence on third-party currencies and increase financial efficiency,” he said. Ta.

He also noted the challenges ahead for deeper financial integration and cooperation between the two countries, including regulatory differences, limited market access, and the need to strengthen financial infrastructure.

Huaning, Chinese Ambassador to Luxembourg, said that China has created the world’s largest banking sector and the second largest insurance market.

“In short, expanding financial opening up will not only help promote the high-quality development of China’s economic growth, grow the financial sector and create a new development paradigm, but more importantly, it will help the international financial “It means it’s a way for the industry to overcome challenges and sustain growth,” he said.

He listed China’s recent efforts at a high level of financial openness, including the removal of various quota restrictions on various foreign financial companies.

At the 10th China-EU High-Level Economic and Trade Dialogue held in Beijing in September, both sides proposed the establishment of a ministerial-level financial working group to promote green finance, two-way financial opening, and cooperation in the financial field. We agreed to strengthen it. We aim to strengthen regulation and respond collaboratively to global economic and financial challenges.

high level of openness

“We hope that more companies from Europe, including from Luxembourg, will join China’s high level of financial openness and share development opportunities,” Hua said.

Qiu Yunping, president of Deutsche Bank (China), said the popularity of the renminbi is increasing, citing the fact that the renminbi surpassed the US dollar for the first time in March 2023 and became the mainstream currency for cross-border payments in China. Stated.

He said China’s transition to a sustainable economy is an opportunity for companies and investors and is a core part of Deutsche Bank’s sustainability strategy, adding that the bank is actively participating in green finance in China. He added that it was accurate.

“We believe that continued business relations between these two regions will be mutually beneficial for the development of the global economy,” he said via video link.

Liang Jian, head of the China market at Luxembourg’s international bank, said the bank has set up a China market team to focus on bridging Chinese customers coming to Europe and vice versa, helping European customers access the Chinese market. He said that

“We are delighted to be the gateway to the Chinese and European markets for our customers,” she said.

[ad_2]

Source link