[ad_1]

Gartner Inc (NYSE:IT), a leading research and advisory firm that provides insights, advice, and tools to leaders in IT, finance, human resources, legal and compliance, marketing, sales, and supply chain sectors around the world, Information has been reported by. The sale according to recent SEC filings.

On February 28, 2024, Akhil Jain, VP of Consulting sold 250 shares of Gartner Inc stock at an average price of $464.55 per share. As a result of this transaction, the total amount he paid was $116,137.50. After this transaction, Akhil Jain’s holdings in the company decreased, reflecting changes in the insider’s investment portfolio.

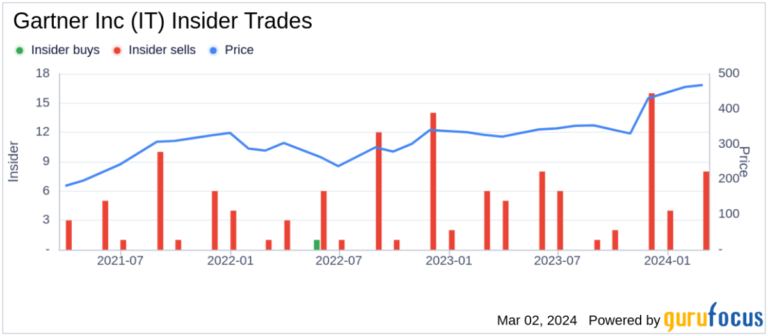

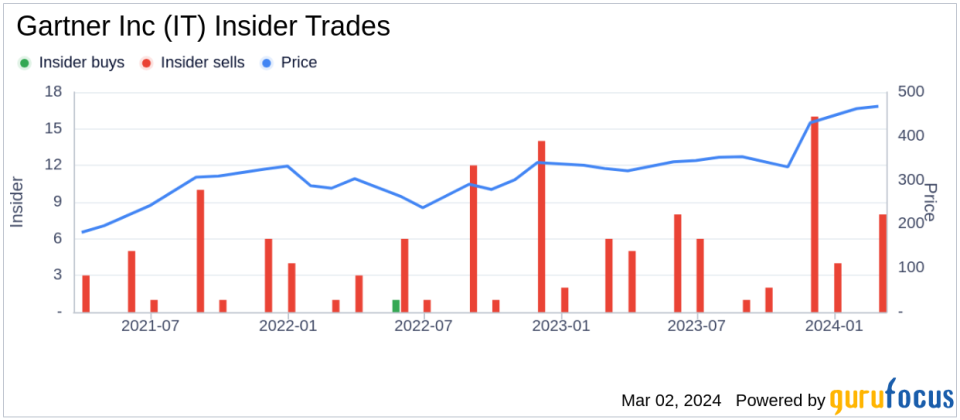

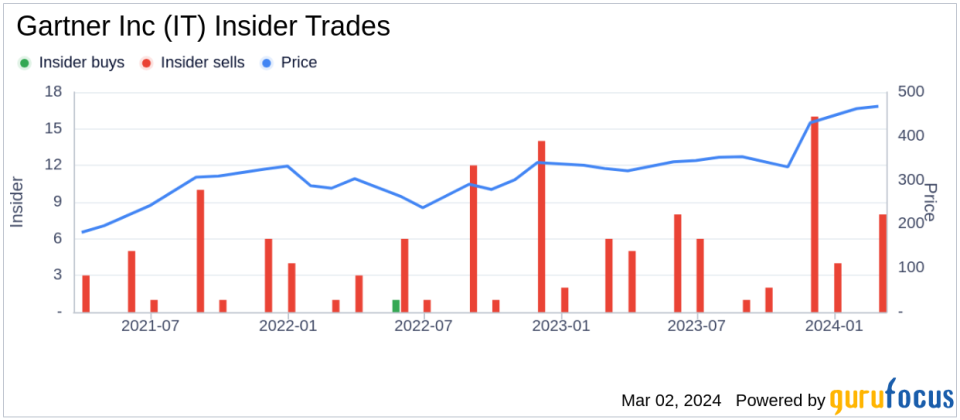

In the past year, Akhil Jain sold a total of 600 shares of Gartner Inc stock, but did not buy any shares. This latest transaction continues the trend observed over the past year, with no insider buying, but a total of 50 insider selling for the company.

Gartner Inc’s stock traded at $464.55 on the trading day, giving the company a market cap of $36.76 billion. The company’s price-to-earnings ratio of 42.63x exceeds both the industry median of 28.125x and the company’s historical median price-to-earnings ratio, indicating a high valuation compared to its peers.

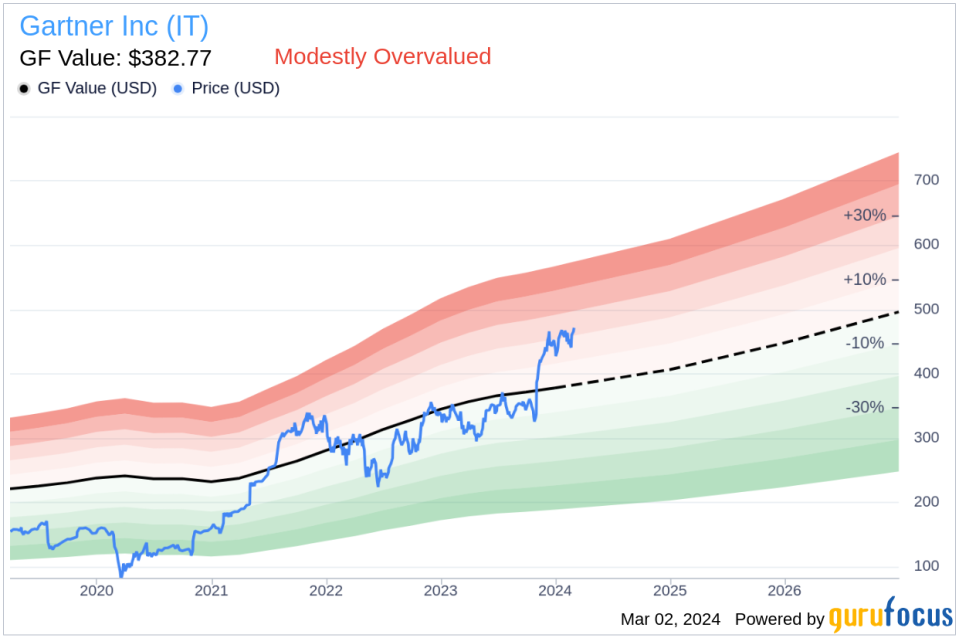

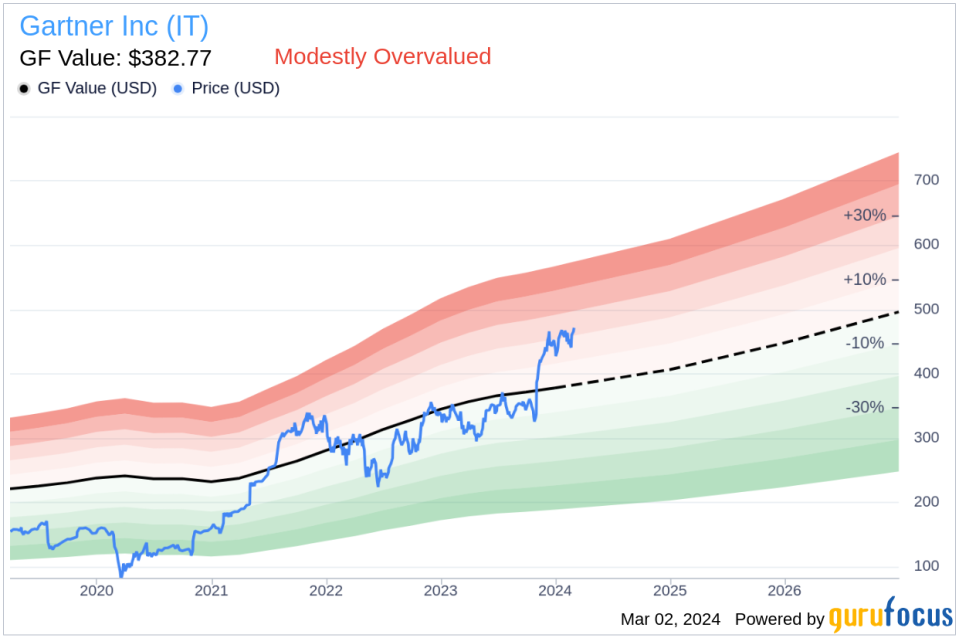

Also worth noting is the current stock price compared to GuruFocus Value (GF Value). Gartner Inc’s stock price is $464.55 and its GF value is $382.77, with a price to GF value ratio of 1.21, which suggests that the stock is moderately overvalued according to this metric.

GF Value is calculated by considering historical trading multiples, GuruFocus adjustment factors based on the company’s past performance, and future performance estimates provided by Morningstar analysts.

The Insider Trends image above visually depicts insider transactions over the past year, highlighting the absence of buying and the prevalence of selling among insiders.

The GF Value image provides insight into the stock’s valuation relative to its intrinsic value estimate and supports the assessment that Gartner Inc is currently trading at a premium relative to GF Value.

Investors and analysts often monitor insider transactions as they can glean valuable insight into company insider views on a stock’s value and future prospects. His Akhil Jain’s recent sale of EVP Consulting may be of interest to current and potential shareholders evaluating their investment in Gartner Inc.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link