[ad_1]

-

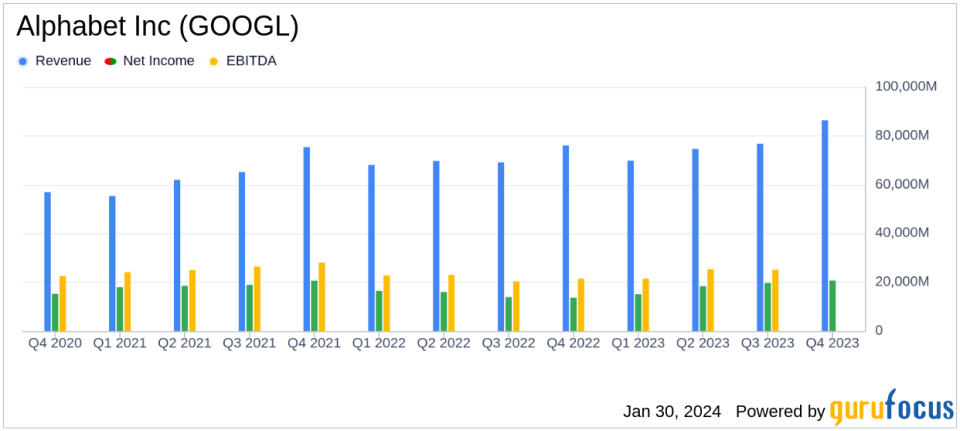

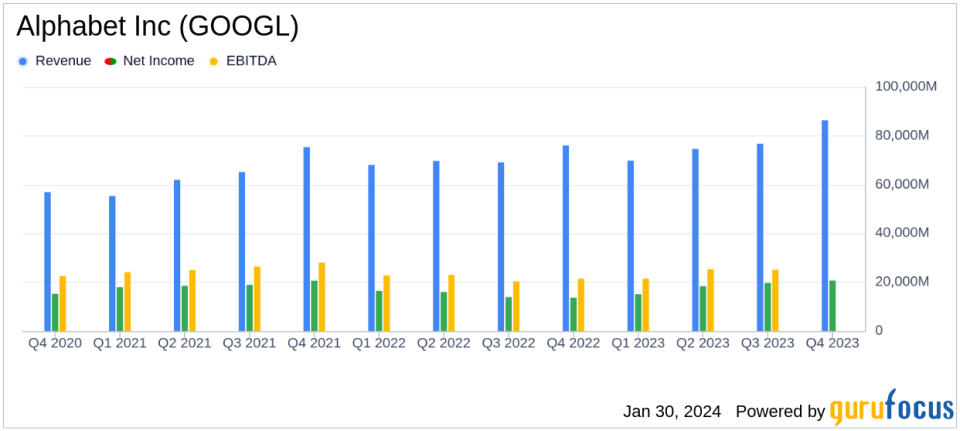

increase in revenue: Alphabet Inc (NASDAQ:GOOGL) reported fourth-quarter revenue of $86.31 billion, an increase of 13% year-over-year.

-

Operating income: Operating income jumped to $23.7 billion in the fourth quarter, reflecting a strong operating margin of 27%.

-

Net income: Fourth-quarter net income jumped to $20.68 billion, and diluted EPS rose to $1.64.

-

Optimize your workforce and office space: Alphabet Inc. (NASDAQ:GOOGL) recorded costs related to employee reductions and office space optimization, impacting its financials.

-

Capital investment amount: The company’s strategic investments in property, plant and equipment are evident in net property, plant and equipment of $134,345 million in fiscal year 2023.

On January 30, 2024, Alphabet Inc. (NASDAQ:GOOGL) released its 8-K filing detailing its financial results for the fourth quarter and fiscal year ended December 31, 2023. The company is the parent company of Internet media giant Google. has reported significant increases in revenue and net income, and attributes much of its success to investments in artificial intelligence (AI) and innovation.

Company Profile

Alphabet Inc (NASDAQ:GOOGL) is a diversified technology conglomerate whose primary subsidiary is Google. Google’s diverse revenue streams include online advertising, app and content sales on Google Play and YouTube, cloud service fees, and hardware sales. Alphabet, through its other betting arm, is also investing in ambitious “moonshot” projects that aim to revolutionize technologies such as health, internet access and self-driving cars.

Financial performance and challenges

Alphabet Inc (NASDAQ:GOOGL) reported strong financial performance with consolidated sales of $86 billion in the fourth quarter, an increase of 13% year-over-year. Growth was consistent even on a constant currency basis. Operating income increased to $23.7 billion from $18.16 billion in the same period last year, and net income increased to $20.68 billion from $13.62 billion. These results highlight the importance of Alphabet’s AI investments, particularly in search, YouTube, and cloud services.

Despite these accomplishments, Alphabet Inc (NASDAQ:GOOGL) faced challenges such as reducing its workforce and optimizing its office space, which led to large bills. In fiscal 2023, the company recorded $2.1 billion in employee severance and related costs and $1.8 billion in office space optimization exit costs. Although these measures were aimed at improving operational efficiency, they resulted in significant costs that impacted the financial statements.

Financial performance and industry importance

The company’s financial results are significant, especially in the interactive media industry. Alphabet’s ability to consistently grow revenue and maintain strong operating margins in a highly competitive and rapidly evolving sector is a testament to the effectiveness of its strategic focus on AI and innovation. Google Cloud’s revenue growth, which reached $9.19 billion in the fourth quarter, highlights the company’s expanding presence in the cloud services market.

Key financial indicators

Alphabet Inc (NASDAQ:GOOGL)’s financial strength is evident from its balance sheet, with total assets increasing from $365.26 billion in 2022 to $402.39 billion in 2023. Masu. The company’s liquidity position is strong, with cash and cash equivalents and marketable securities totaling $110.92 billion. His increase in net worth and equipment to $134.345 billion reflects continued investment in Alphabet’s operational infrastructure.

Key metrics such as operating margin improved to 27% and diluted EPS increased to $1.64 are important indicators of Alphabet’s profitability and efficiency. For investors, these metrics are essential in evaluating a company’s ability to generate profits and effectively manage costs.

Performance analysis

Alphabet Inc’s (NASDAQ:GOOGL) fourth quarter and fiscal year 2023 results are a testament to the company’s strategic vision and execution. Growth in key areas such as search, YouTube, and cloud, as well as careful cost management, have enabled the company to achieve continued success. However, the costs associated with optimizing employees and office space are a reminder of the ongoing need to adapt to market conditions and optimize operations.

Overall, Alphabet Inc (NASDAQ:GOOGL) has leveraged AI capabilities to drive growth and efficiency, demonstrating resilience and adaptability in a dynamic market. Investors and industry observers are wondering how Alphabet’s AI and other technology investments will shape its financial trajectory going forward as the company enters what CEO Sundar Pichai calls the “Gemini era.” People will be paying close attention to how it will develop.

For more information, see Alphabet Inc’s full 8-K earnings release here.

This article first appeared on GuruFocus.

[ad_2]

Source link