[ad_1]

Given its history and reputation, it may seem a little strange to condemn Apple (NASDAQ:AAPL) Although a lack of innovation is to blame, one Street analyst believes that may be holding the tech giant back at the moment.

DA Davidson analyst Gil Luria believes Apple’s current stock price reflects high expectations for a strong rebound in growth. But unless there is a breakthrough innovation, Luria doesn’t expect this scenario to materialize anytime soon.

“We’re waiting for Apple to break free from the ‘stuck’ in terms of innovation to generate upgrade growth for existing products and further growth through new products,” the five-star analyst recently wrote. Stated. “Apple continues to introduce new form factors, especially within the wearables category, but cell phone and watch form factors seem to have plateaued in the last three to four years.”

Meanwhile, other forward-thinking companies are pushing the boundaries of traditional handset design with innovations like foldable handsets, as well as introducing new form factors like AI pins and AR glasses. While Apple currently has strong control over existing smartphone owners due to the robustness of its ecosystem, Luria said the company needs to be more creative in attracting new consumers to the iOS ecosystem. I think it is necessary to do so.

This is especially important in “protected markets” like China, where domestic competitors enjoy certain advantages, or in low-cost markets like India. In these regions, Apple must make its products more compelling to consumers to allocate a larger portion of their income than in the United States.

But where will this innovation come from? New GenAI applications, of course. Although the idea of a GenAI app store isn’t very convincing, Luria believes Apple is “positioned to leverage its unparalleled walled garden consumer data set to deliver new apps and experiences.” Masu.

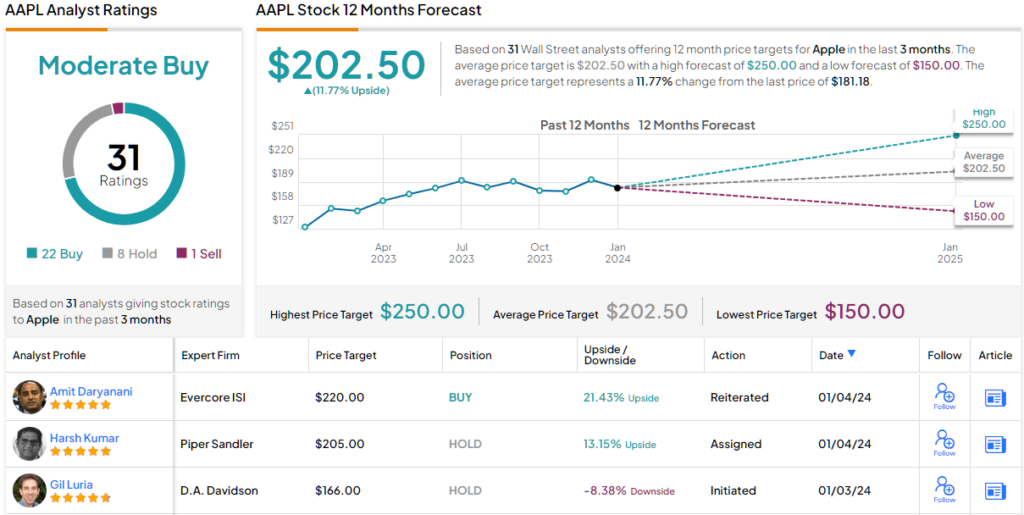

But Apple isn’t there yet, and Luria currently assumes coverage of the stock with a “neutral” rating and a $166 price target, indicating Apple’s stock is overvalued by 8%. ing. (Click here to see Luria’s track record)

Looking at the consensus breakdown, 7 other analysts are on the fence for AAPL and 1 has a bearish stance, while 22 positive reviews give the stock a consensus rating of Medium Buy. ‘. Going with the average target of $202.50, the stock would trade at a premium of ~12% a year from now. (look Apple stock price prediction)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.

[ad_2]

Source link