[ad_1]

After last year’s strong performance, the largest publicly traded business development companies (BDCs) appear poised to challenge the all-time highs they set in 2022. Ares Capital Corporation (New York-based)NASDAQ:ARCC) also offers an incredible dividend yield, so I’m bullish on the stock for 2024.

Last year, the market recovered after a disastrous 2022. S&P 500 (SPX) ended 2023 with a solid 24% gain. But much of that was thanks to the so-called Magnificent Seven, a group of Big Tech stocks that drove a sizable portion of S&P’s annual profits, driven largely by the artificial intelligence craze.

The news was warmly welcomed by growth investors, but most tech stocks don’t pay dividends. Meanwhile, many well-known dividend-paying companies have failed to generate stable profits in addition to their reliable yields, resulting in many income investors being left behind.

Dividend kings (stocks that have increased their dividends for at least 50 consecutive years) such as Coca-Cola (New York Stock Exchange:KO), Altria Group (New York Stock Exchange: Missouri), 3M (New York Stock Exchange:MMM) fell by 2.32%, 18.95%, and 39.25%, respectively. But while these blue-chip stocks failed to generate profits, lesser-known companies with notable dividends were offering shareholders better performance and higher yields. Based on analyst consensus, that trend is expected to continue in 2024.

BDC leader

Ares Capital ended 2023 in the black, finishing the year with a return of over 7% (not including dividends) and hitting a 52-week high in the final month. While this return falls short of the S&P 500’s strong year of 9.4%, ARCC’s dividends are still far better than those offered by index funds that track the S&P, such as the 1.4% that shareholders receive from the SPDR S&P 500 ETF Trust. small. (NYSEARCA:Spy).

This might lead some to think that the company’s yield is a dividend trap aimed at luring yield-seeking investors, but that is far from the truth. Founded in 2004, the company has a strong fundamental track record, with long-term debt decreasing by 5.7% from $12.2 billion to $11.5 billion from 2022 to 2023.

Additionally, total assets increased from $8.9 billion in March 2015 to $22.9 billion in September 2023, an increase of over 61%. Annual net income has similarly experienced explosive growth, rising from $379 million in 2015 to $600 million in 2022, with trailing-twelve-month net income at the end of Q3 2023. It was $1.28 billion.

Operating in the financial sector, Ares Capital provides financing solutions to middle market companies primarily through debt and equity investments. The trade-off of investing in BDCs is often to assume increased risk in exchange for higher yields. But ARCC specifically aims to invest in “market-leading companies with a history of stable cash flow, key differentiators and experienced management teams,” according to the company’s website. That’s what it means.

For these reasons, Ares Capital is more than just a BDC. With a market capitalization of $11.5 billion, it is the largest publicly traded BDC, comparable in size to well-known companies such as Morningstar (NASDAQ:Morning), CarMax (New York Stock Exchange:KMX), ZoomInfo (NASDAQ:ZI). The firm holds approximately $21.9 billion in total investments in his 490-company portfolio and has managed to return an average annual return of 13% to shareholders since his IPO, taking into account reinvested dividends. .

Attractiveness for income investors

With the exception of two outliers, one in the midst of the Great Recession and the other during the pandemic-induced market downturn, Ares Capital has traded within a fairly well-defined range. Since debuting at $15.30 per share in 2004, the company’s stock has traded between $12.75 and an all-time high of $21.92.

Even considering the two aforementioned outliers, the stock was able to recover in a short period of time. ARCC rose 378% from its all-time low in March 2009 during the Great Recession through April 2010. Following a five-year low in April 2020, the stock price rose 85% by the end of the year.

Meanwhile, Ares Capital continues its history of strong dividend payments. From September 2013 to December 2023, the company paid quarterly dividends ranging from a minimum of $0.38 to a maximum of $0.51 per share, and ARCC’s annual dividend in 2023 is expected to be $1.92 per share. .

The company’s commitment to paying a healthy dividend is factored into analysts’ bullish views on the stock. Insider trading also supports this theory. From January 2, 2024 to January 4, 2024, Warren Buffett’s Berkshire Hathaway will invest in Berkshire’s Class A (NYSE:BRK.A) and class B (New York Stock Exchange:BRK.B) held. As a result, Berkshire Hathaway’s total number of ARCC shares increased to 44.88 million shares.

Promising technical indicators

Beyond healthy fundamentals, ARCC is showing strength on several technical indicators. Over the past month, technical sentiment has been overwhelmingly bullish, with the 5-day, 10-day, 20-day, 50-day, and 100-day simple moving averages and exponential moving averages all pointing to an upward move ahead. The stock is trading above its 50-day and 200-day simple moving averages, which are both short-term and long-term bullish criteria.

Ares Capital also proves there is a potential near-term opportunity given its Relative Strength Index (RSI) reading. After the stock reached 70, considered overbought, in the first week of this year, its current RSI value is rapidly approaching oversold territory at around 40, which suggests a short-term price reversal. It may be showing.

Is ARCC stock a buy, according to analysts?

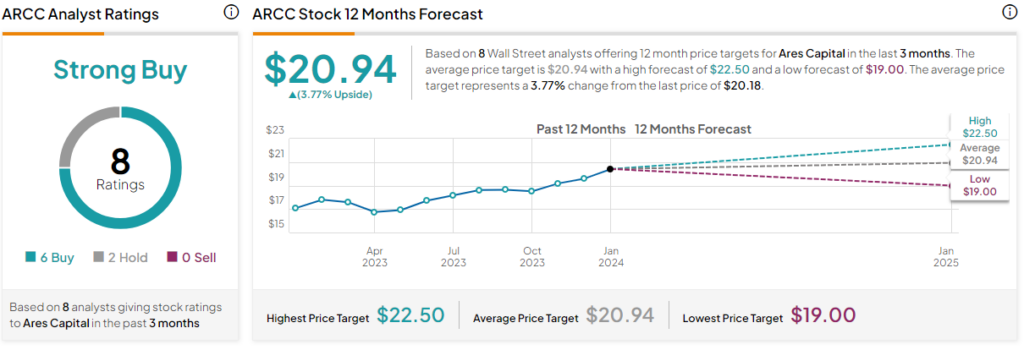

ARCC’s current average price target of $20.94 suggests an upside potential of 3.8%. Even though this estimate is only slightly higher than the stock’s price, its high yield of 9.4% puts the stock on the market based on 6 buys, 2 holds, and 0 sells assigned over the past three months. It has a “strong buy” consensus.

Take-out

ARCC’s stock price is expected to rise modestly over the next year, but as the largest publicly traded BDC, it doesn’t face as much downside risk as other BDCs. Moreover, its generous high yield continues to benefit shareholders. Based on sound fundamentals and positive technical indicator readings, Ares Capital believes he could be a profitable addition to your portfolio in 2024.

disclosure

[ad_2]

Source link