[ad_1]

It’s a lonely profession betting on semiconductor giant Nvidia (NASDAQ:NVDA) That’s why no one does it. Only a few Hold ratings can be found among Wall Street experts. But as everyone seems excited about the company’s upcoming earnings report, relatively few are aware of the risks involved in trying to meet ever-increasing financial targets. Considering the data, I’m bearish on NVDA stock in the near term.

NVDA stock needs a breather too

Fundamentally, the core concerns surrounding NVDA stock center on the underlying company’s ability to continue to impress. For example, a couch potato determined to achieve a New Year’s health and fitness resolution can reap big results with relatively little effort. But Usain Bolt, a track and field superstar in his prime, would likely only see a gradual performance return, if any at all.

Obviously, because you start from a lower base, you benefit from the presence of low-hanging fruit. In the case of Bolt and his NVDA stock, these elite players only face a difficult accomplishment. Moreover, expectations continue to accelerate as NVIDIA continues to impress onlookers with its impressive financial performance. At one point, the fruit hangs so high that you have to use a crane to reach it.

On the scheduled date of February 21st, NVIDIA is scheduled to announce its financial results for the fourth quarter of fiscal year 2024. Analysts are calling for the company to deliver earnings of $4.59 per share, significantly higher than the 81 cents earned in the fourth quarter last year. In the third quarter, Nvidia posted an EPS of $4.02 versus the consensus $3.37. So another beat is not out of the question.

Additionally, those bullish on NVDA stock will point to NVIDIA’s dominance in AI-centric graphics processing units (GPUs). Similarly, a surge in demand in the data center ecosystem could help support Nvidia’s revenue and profits. Finally, several industry analysts are talking about a second wave of AI that could drive amazing advances in machine learning and neural networks.

Few would disagree with the underlying factors driving NVDA’s stock price. However, these are also known catalysts that are likely to be factored in.

Too much bullishness seeps into Nvidia’s trade

Fundamentally, one of the biggest problems with NVDA stock is that based on the trades recorded on the Unusual Option Activity Screener (which is probably the area where the smart money is most active) When trading for intrinsic value, there is not much incentive for bearish traders. (a gamble on an increase in external value).

For example, for an option with unusual activity that expires on June 21, 2024, the cheapest call based on total cost (i.e., total contract premium plus exercise cost) is a $675 call. So your expenses will be $79,220. Based on the linear trajectory of the most optimistic price targets, his NVDA stock could be worth $884.09 per share to him by the June 21 deadline, although the stock price is rising sharply. there is.

Multiplying the above number by 100 shares yields a value of $88,409. However, the cost of acquiring this position was $79,220, so you will make a profit.

Next, consider the put side of the argument. The cheapest June 21st put that even has a potential for profit (i.e., the strike price is higher than the market price) is the $675 put. Based on the most pessimistic price target, NVDA stock could fall to $670.75 by expiration. At the gross level, you would have a deal that would allow you to sell NVDA for $675 instead of closer to $671.

However, the premium on this put is $52.40. Multiplying this by 100 shares adds the exercise cost. If you’re strictly looking for intrinsic value, all of a sudden it doesn’t make any sense to buy this put.

Additionally, considering the February 21, 2025 expiration date, the cheapest call in terms of total contract value is a $700 strike. In this case, the investor can expect him to pay $86,880 (contract premium of $168.8 multiplied by his 100 shares, plus his exercise of his 100 shares at $700). However, if NVDA stock can reach his $1,200 high target, the position would net him a profit of $33,120.

Conversely, the cheapest put expiring on February 21st is a $730 put. In this case, the investor would have to pay a total of $84,600 (contract premium of $116 multiplied by his 100 shares, plus the exercise of his 100 shares at $730). If NVDA stock falls to the minimum target price of $560, the profit on his position would only be $5,400.

Of course, you could always buy, say, a January 2025 $600 put and speculate that the value of the contract will increase ahead of schedule. However, such bets imply a more serious risk that the option will not be recoverable, or close to being recoverable. In contrast, callers have many avenues to speculate at relatively attractive rates.

After all, the framework incentivizes traders to go long, which seems aggressive. Yes, Nvidia is a true giant, but no company stays at the top forever.

A serious warning has been issued

Another factor that irritates me about the over-bullishness in NVDA stock stems from a major warning sign that emerged last Friday. Super microcomputer stock (NASDAQ:SMCI) has fallen 20% after hitting the stratosphere since the beginning of the year. Despite SMCI’s decline, it is still up over 182% year-to-date.

Nevertheless, this is a deafening statement of AI-driven enthusiasm for the company. Yes, the company’s server and storage solutions have a significant impact on digital intelligence. But some analysts argue that this story is already woven in.

Frankly, the same can be said about NVDA stock. Once again, no one doubts that NVIDIA will play a dominant role in the future process. However, sentiment is too biased towards one side of the trade.

Is NVDA stock a buy, according to analysts?

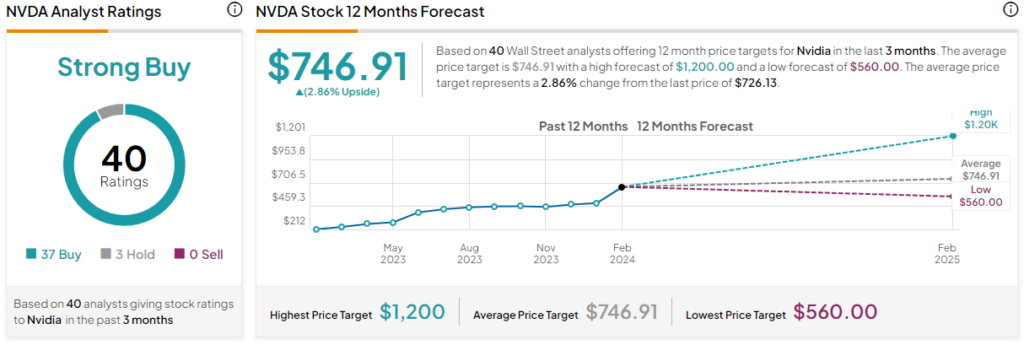

Turning to Wall Street, NVDA stock has a “Strong Buy” consensus rating based on 37 buys, 3 holds, and zero sell ratings. NVDA’s average price target is $746.91, suggesting 2.86% upside potential.

Bottom line: NVDA stock will need a break soon.

Nvidia is a great company with a very encouraging future ahead. The company is well-positioned for the long term with its advantages in GPUs that help drive the latest AI-based innovations. However, options market data suggests that sentiment is tilted too far in favor of the bulls. Investors should be careful with NVDA stock in the short term given the increasingly high expectations.

disclosure

[ad_2]

Source link