[ad_1]

-

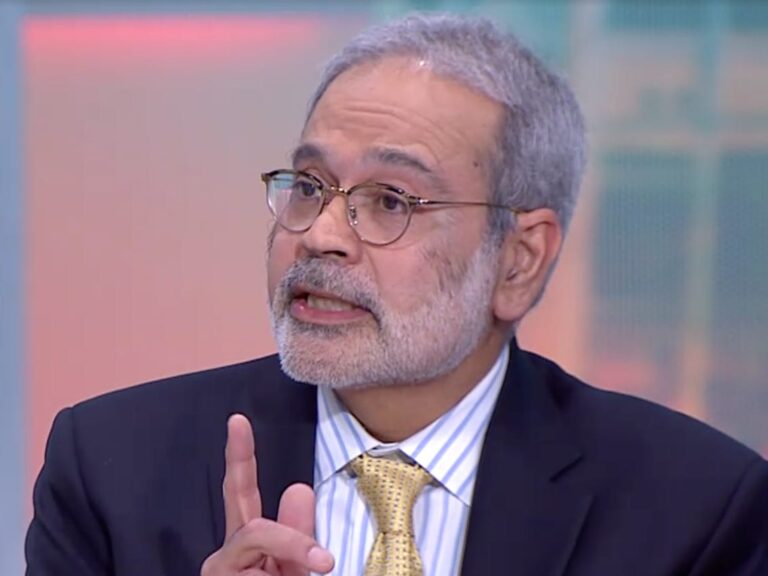

Binky Chadha told CNBC that a recession is coming and investors should focus on three sectors that are pricing in a recession.

-

Deutsche Bank equity strategists said the consumer cycle, financials and materials are pricing in the possibility of a recession.

-

“If a lot of things are already priced in, even if that happens, the risk reward is still positive.”

Deutsche Bank’s top equity strategist said some sectors of the stock market were already pricing in an economic slowdown, and investors should flock to the economy as it arrives in the first half of this year.

Deutsche Bank’s Binky Chadha said in an interview with CNBC on Friday that markets are nervous about a possible recession in the first half of 2024 and investors should use that to their advantage.

“What you have to think about is that recession is basically priced in across sectors and industry groups,” he said. “If a lot of things are already priced in, even if that happens, the risk reward is still positive.”

According to Chadha, some markets are already pricing in the coming recession, including financials, consumer cycles, and materials. Sentiment among these groups appears to be subdued, suggesting a built-in economic slowdown risk. So even if the U.S. does indeed experience a recession, sentiment is unlikely to drop significantly.

Cyclical sectors like auto manufacturing and restaurants don’t reflect the broad market rally that ended 2023. Meanwhile, the S&P 500 Financial Index remains at its highest level in nearly two years.

“The most important catalyst is the actual revenue,” Chadha added. “We start next Friday, but the thing to keep in mind here on earnings is that if you basically look at the bottom-up consensus expected on earnings, it’s one of the worst quarters in terms of international growth. I think it’s going to be one thing because of the recession. ”

Nonfarm jobs data released Friday showed the U.S. economy added 216,000 jobs, beating expectations and confirming that the economy remains strong. But as U.S. stocks enter the year on a slippery slope, Wall Street is wary of the risk of further declines.

Read the original article on Business Insider

[ad_2]

Source link