[ad_1]

Automotive finance fintech Carmoola has raised an additional $19.7 million in an extension to its Series A round.

Founded in 2021, the London-based company has developed a digital marketplace for vehicles with a buy now, pay later vehicle financing approach. Users can log into the startup’s app through Carmoola’s platform, set a budget, enter registration plates and categorize loans.

Carmoola utilizes credit scoring through proprietary pricing algorithms and open banking data, with APRs ranging from 6.9% to 14.8%.

“The business is growing strongly, with revenue increasing five times,” Carmoola CEO and co-founder Aidan Rushby told Business Insider.

“We currently have multiple distribution channels and continue to build on what we have been doing despite a challenging market environment with interest rates ranging from 0% to over 5%.”

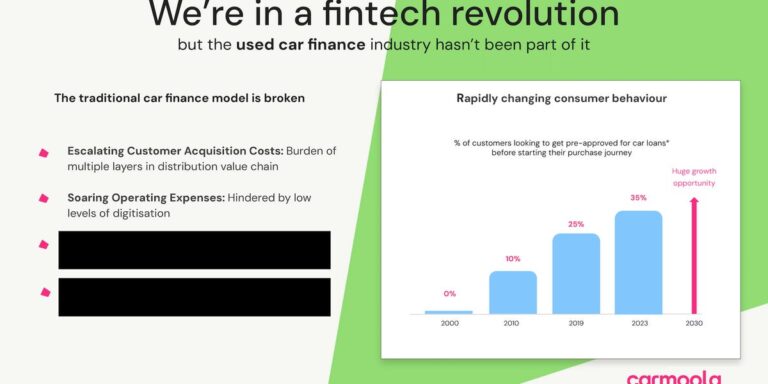

Historically, auto loans have been arranged through broker-dealers, which often charge a fee. The FCA moved to ban these fees in 2021, and Rushby told BI that Carmoola was able to acquire customers at lower costs by cutting out intermediaries.

The company’s new funding round is an extension of its February 2023 Series A round, which came from a similar investor pool: fintech experts QED Investors, VentureFriends, InMotion Ventures, and New York-based investor AlleyCorp. Funded. and Kiev-based u.ventures.

Rushby told BI that the latest round represents a 33% increase from its previous funding, but did not provide details on the company’s valuation. Carmoola investors are approaching the company for a new round, which Rushby claimed could help the company achieve profitability next year.

The new funding will be signed in late summer 2023 and will be used to expand the company’s team from its current staff of around 29 to around 36 over the next 12 months, with a focus on marketing and capital markets. It will be done.

“It’s always been our goal to get back to profitability as quickly as possible. As a lending business, that’s what we’re most focused on,” Rushby added. “Our loss rate is a fraction of existing businesses in this sector, and our marketing channels have a low cost base, so we aim to expand our core business.”

Check out Carmoola’s 14-slide Series A expansion deck below.

[ad_2]

Source link