[ad_1]

Transaction summary

Renowned investment management firm Baillie Gifford (Trades, Portfolios) recently made a significant adjustment to its holdings in Starr Surgical Company (NASDAQ:STAA). On December 1, 2023, the company reduced its internal positions and signaled a strategic shift in its investment portfolio. This move by Baillie Gifford (Trades, Portfolios) has caught the attention of both investors and market analysts as it reflects the company’s ongoing portfolio management decisions.

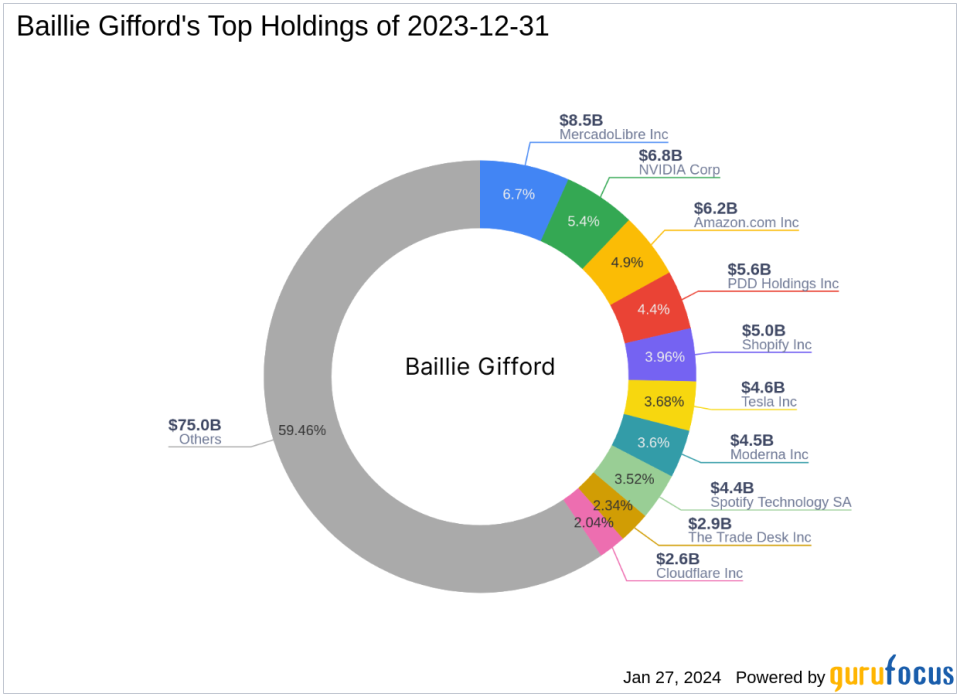

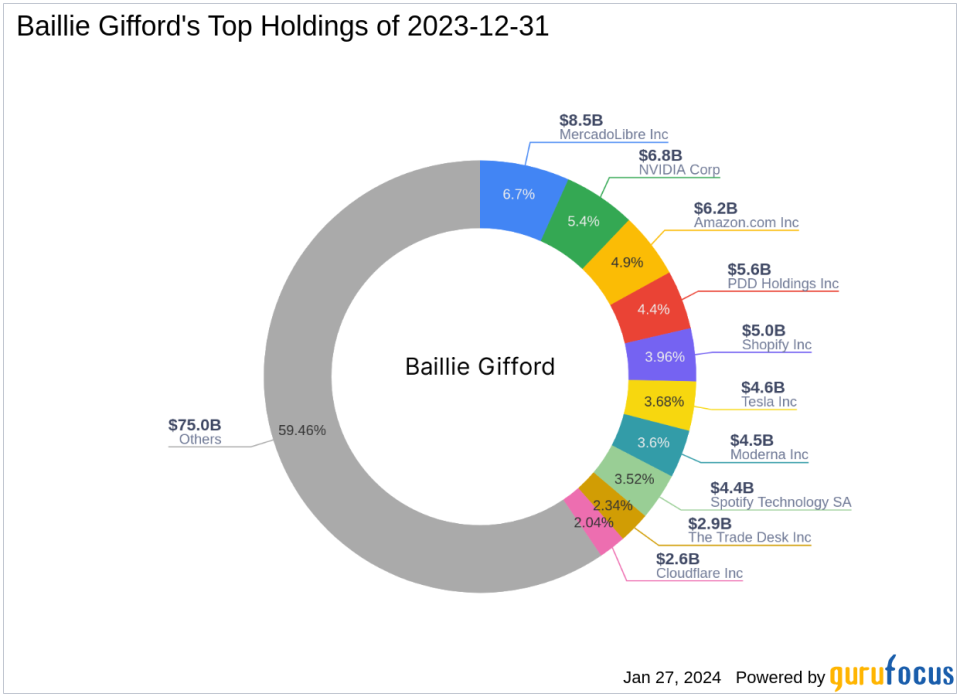

Baillie Gifford (Trade, Portfolio) Profile

With over a century of experience, Baillie Gifford (Trading, Portfolios) is a testament to investment excellence and client-focused strategies. The firm’s commitment to fundamental analysis and proprietary research underpins a long-term, bottom-up investment approach. Baillie Gifford’s (Trade, Portfolio) portfolio reflects the firm’s commitment to identifying companies with sustainable growth potential, which has been the basis of his firm’s success for over 100 years. It’s a philosophy.

Trade measure details

The transaction in question occurred on December 1, 2023, when Baillie Gifford (Trading, Portfolio) decided to reduce its stake in Stahl Surgical. The company sold 469,918 shares, resulting in a position decrease of 9.55%. This reduction had a minor impact on Baillie Gifford (Trades, Portfolio) overall stock by -0.01%, with the trade executed at a price of $32.99 per his share.

Baillie Gifford (Trade, Portfolio) Portfolio Impact

Following this transaction, Baillie Gifford (Trades, Portfolio) will hold 4,448,208 shares of Starar Surgical Co, representing 0.13% of the company’s portfolio and holding 9.11% of the company’s shares. This adjustment reflects Baillie Gifford’s (Trade, Portfolio) strategic portfolio realignment and continued evaluation of investment opportunities.

Starar Surgical Co. stock information

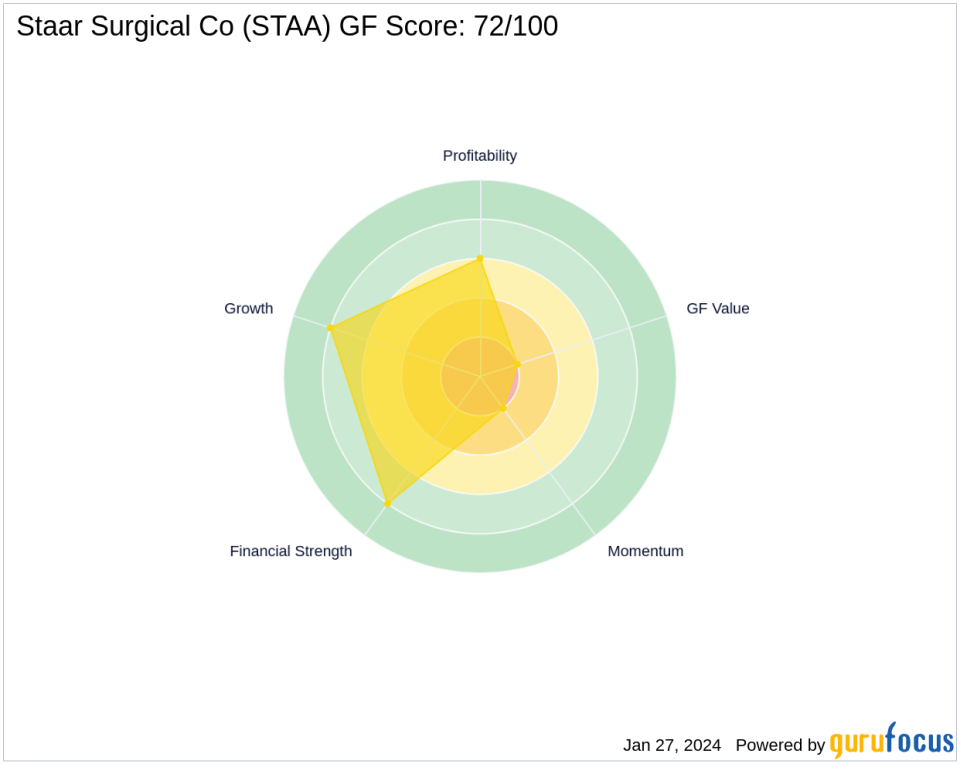

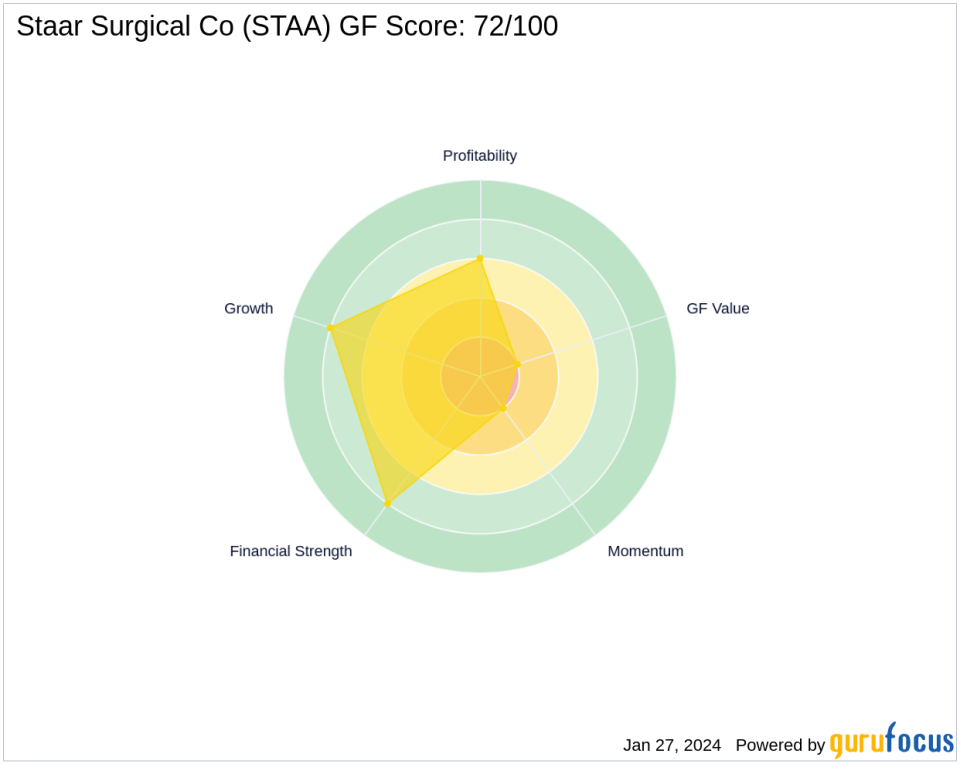

Starar Surgical Co, a US-based medical device manufacturer, specializes in lenses for ophthalmic surgeries such as cataract surgery and refractive surgery. Since his IPO on July 7, 1983, the company has experienced significant growth. With a market capitalization of $1.44 billion and a stock price of $29.58, Staar Surgical Co operates in the highly competitive medical devices and instruments industry. Despite its current P/E ratio of 75.85, the stock is considered a potential value trap by GuruFocus, who urges investors to think twice before investing.

Market status and analysis

Starar Surgical Co’s market capitalization and stock price have fluctuated, with the current stock price down -10.34% since the trading day. The company’s stock has grown 886% since its IPO, but year-to-date performance shows a slight decline of 0.5%. GuruFocus ranks the company’s financial health and growth prospects with his GF score of 72/100, indicating average performance potential.

Other notable investors in Starar Surgical Co.

While Baillie Gifford (Trades, Portfolio) is adjusting her holdings, other prominent investors are maintaining their positions in Starar Surgical Co. Ken Fisher (Trading, Portfolio) is also among the leading owners of the company’s stock, highlighting interest from various investment management firms. .

conclusion

Baillie Gifford (Trades, Portfolio)’s recent transaction into Staar Surgical Co reflects the company’s strategic decision to rebalance its investment portfolio. Despite the cuts, Stahl Surgical Company remains part of Baillie Gifford’s (Trades, Portfolio) diversified holdings, and the company’s future prospects and market position continue to be monitored by the investment community. . Investors and analysts will be watching closely to see how this transaction impacts both Baillie Gifford’s (Trade, Portfolio) portfolio and the performance of Starr Surgical Company’s stock on the market.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link