[ad_1]

Recent Acquisitions (Transactions, Portfolios) by Baillie Gifford

Renowned investment management firm Baillie Gifford (Trade, Portfolio) recently increased its investment in premium electric vehicle manufacturer NIO Inc. On December 1, 2023, the company added 19,914 shares to its holdings at a trading price of $7.15 per share. With this transaction, Baillie Gifford (Trades, Portfolio) brings his total number of shares in NIO Inc to his 114,924,231, with a portfolio impact of his 0.75% and equivalent to his 5.97% ownership of the company’s shares .

Baillie Gifford Profile (Trading, Portfolio)

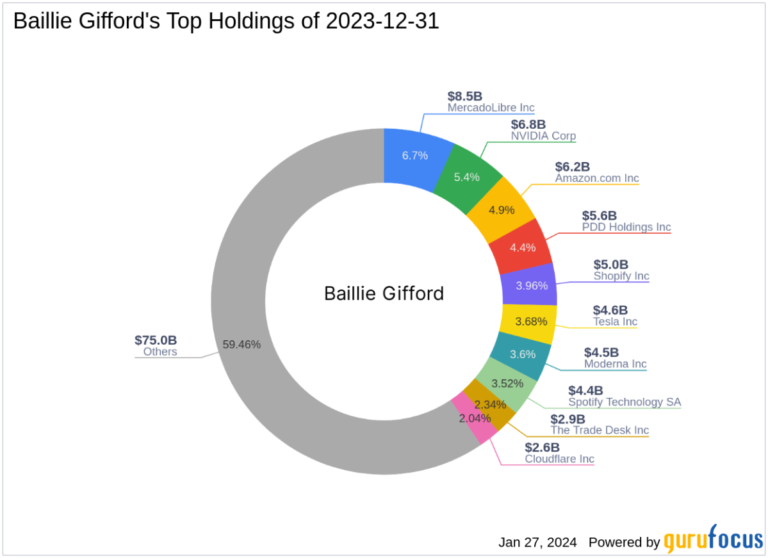

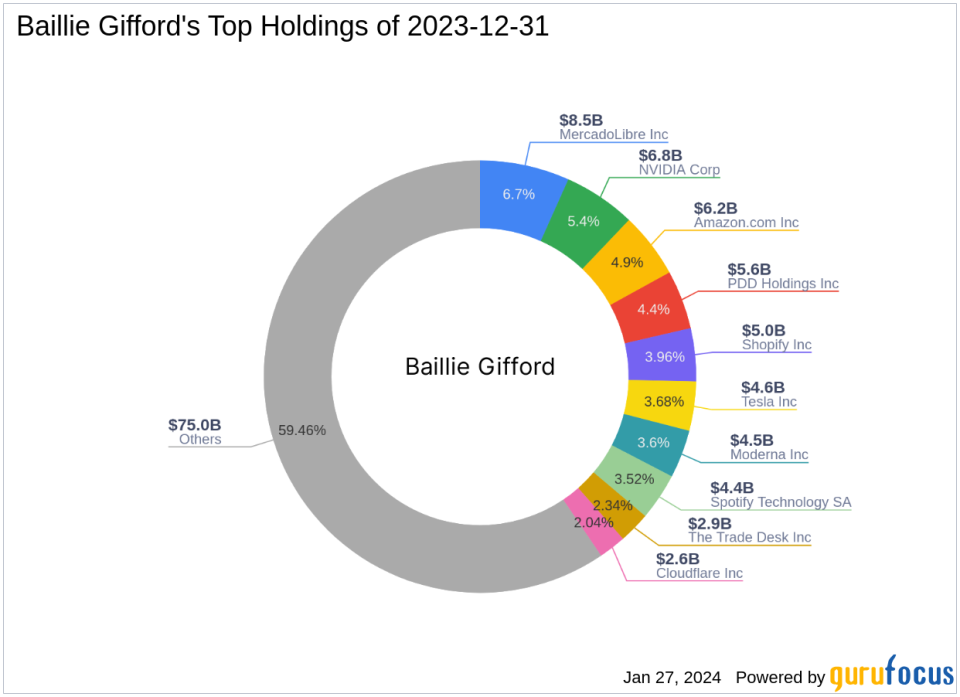

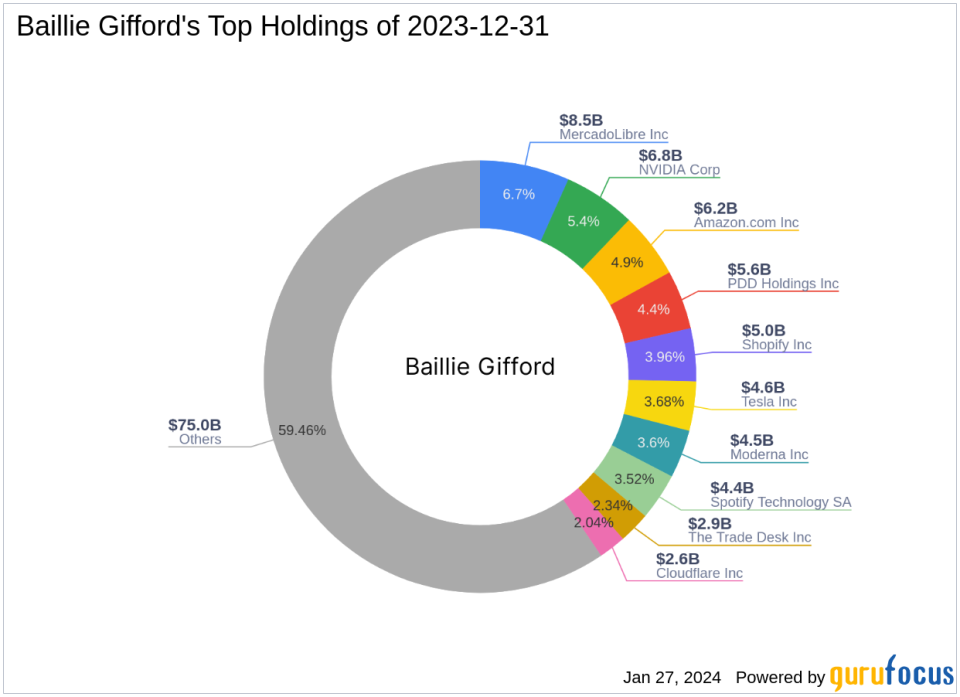

With more than a century of experience, Baillie Gifford (Trading, Portfolios) has established itself as a leading investment management partnership, prioritizing the interests of its clients. The firm is known for its commitment to professional excellence and managing funds for some of the world’s largest professional investors. Baillie Gifford (Trades, Portfolio)’s investment philosophy is centered around long-term, bottom-up investing, with a focus on companies with above-average sustainable growth potential. The company’s main holdings include giants like Amazon.com (NASDAQ:AMZN) and Nvidia (NASDAQ:NVDA), with a strong leaning toward technology and consumer cyclical sectors.

NIO Co., Ltd. Overview

Headquartered in China, NIO Inc has been a significant player in the electric vehicle industry since its IPO on September 12, 2018. The company targets the premium segment, offers a range of electric SUVs and sedans, and is known for its battery innovations. Technology exchange and self-driving technology. Despite the tough market, NIO sold more than 122,000 EVs in 2022 and captured about 2% of China’s new energy passenger vehicle market.

How Baillie Gifford (Trades, Portfolio)’s trades affect your portfolio

Baillie Gifford (Trading, Portfolio)’s recent acquisition of NIO Inc stock is a strategic move that underscores the company’s confidence in the electric vehicle maker’s growth potential. NIO Inc currently holds a significant position in Baillie Gifford’s (Trading, Portfolio) portfolio, reflecting the company’s belief in the long-term prospects of the EV industry and his NIO’s role within it.

Market performance of NIO Inc.

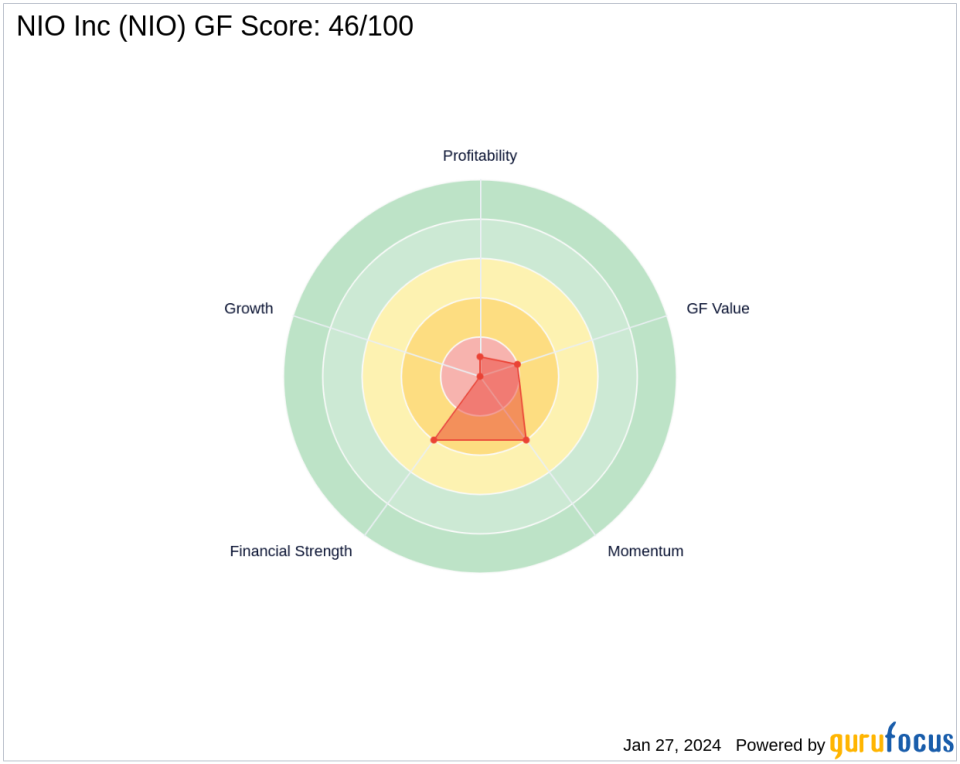

NIO Inc.’s stock price has been volatile since its IPO, with the year-to-date stock price fluctuation rate being -27.08%. The current stock price is $6.14, down 14.13% from the trading day. Nevertheless, the stock price has increased 2.33% since the IPO. GuruFocus’ valuation metrics suggest caution and label the stock as a potential value trap with a GF value of $24.86 and a price to his GF value ratio of 0.25.

Baillie Gifford’s Top Investments and Sectors (Trades, Portfolios)

Baillie Gifford (Trade, Portfolio)’s portfolio is focused on technology and consumer cyclical sectors, with the most investments in industry leaders. His NIO Inc position in the company’s portfolio is proof that Baillie Gifford (Trades, Portfolio) is confident in the growth potential of the electric vehicle sector.

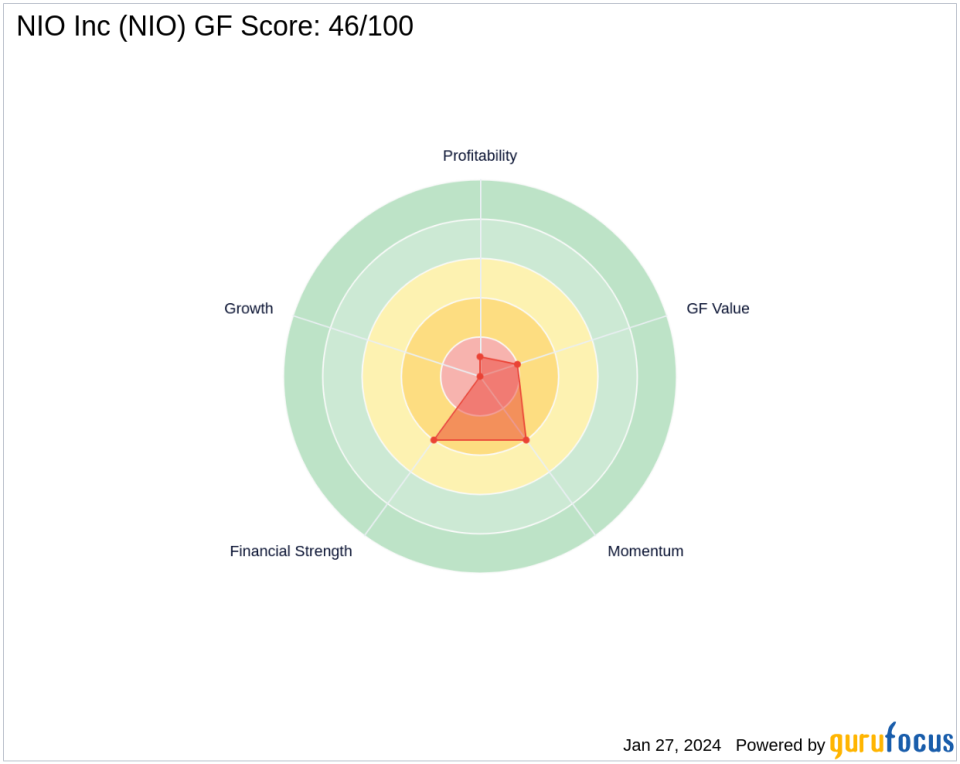

NIO Inc’s financial health and market sentiment

NIO Inc’s financial health presents a mixed picture. The company’s financial strength is rated 5/10, with a Piotroski F-Score of 2, indicating some concerns about its financial stability. The Altman Z-Score of 0.58 and Current Debt Ratio of 1.21 further reflect the company’s financial health. Market sentiment indicators such as the RSI and Momentum Index suggest that the stock is not currently in overbought territory.

Industry perspective and comparative analysis

Within the vehicle and parts industry, NIO Inc plays an important role as a premium electric vehicle manufacturer. When compared to its peers, NIO’s performance is driven by its innovative approach and market share in the growing EV segment. However, the company’s growth and profitability ranks indicate that it faces challenges in these areas.

Transaction analysis and impact

Baillie Gifford’s (Trading, Portfolio) recent trades in NIO Inc stock reflect a strategic investment decision based on the company’s long-term growth expectations for the electric vehicle industry. NIO Inc’s current market performance has shown some volatility, but Baillie Gifford (Trades, Portfolio)’s stock increase may signal confidence in the company’s future. This move could impact other investors’ perception of NIO Inc and contribute to the stock’s future trajectory.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link