[ad_1]

-

The RBA said a once-in-a-generation buying opportunity for the stock market was on the horizon.

-

The investment firm pointed to expectations of weak earnings for major tech companies next year.

-

The bursting of the tech bubble means other areas of the market could benefit as leadership balances out.

Richard Bernstein Advisors says bearish signals are flashing across some of the market’s most popular stocks, a sign that an investment opportunity you can’t miss is just around the corner.

Dan Suzuki, RBA’s deputy chief CIO, said the investment firm has been claiming for months that a “once-in-a-generation opportunity is upon us” and it may finally be on the horizon. He said there is.

The theory, first proposed by the firm late last year, hinges on the extreme market leadership of a small number of stocks that tap into the broader market, with the other 493 stocks in the S&P 500 experiencing stronger gains after dominant growth. It turns out. In the case of the so-called Magnificent Seven.

While tech stocks have accounted for the lion’s share of the market’s gains over the past 15 years, corporate profits for big tech companies will slow over the next quarter, Suzuki said.

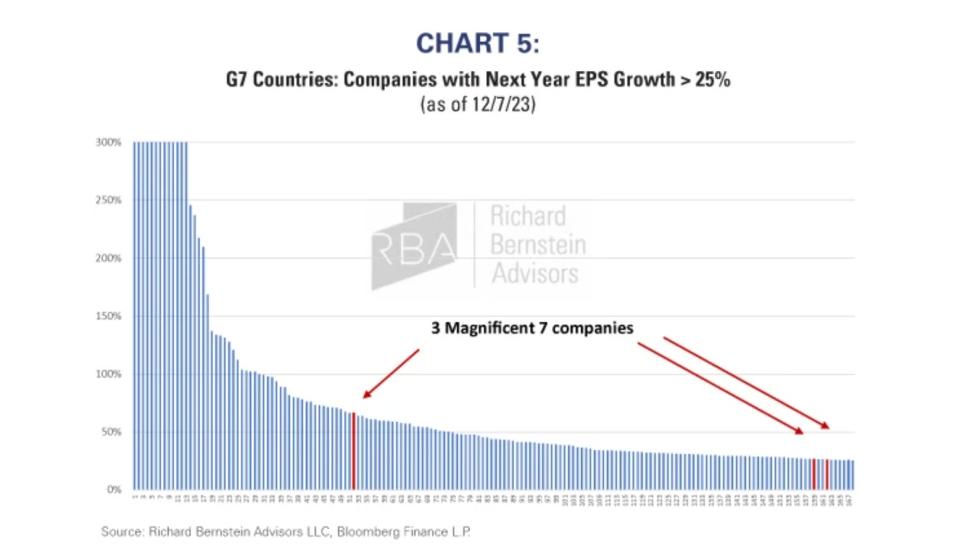

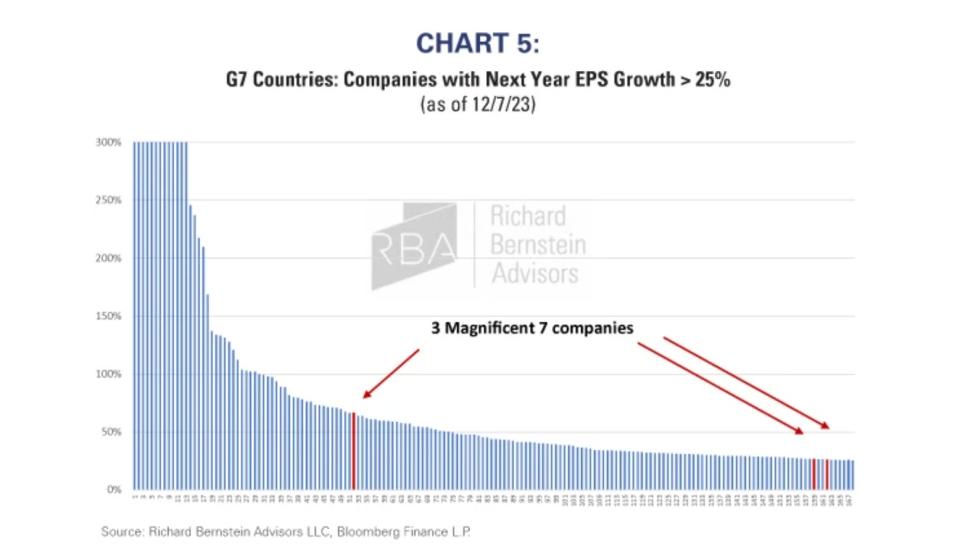

In a recent note, the RBA said only three of the seven Magnificent companies – Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Metaplatform – are expected to grow profits by more than 25% in 2024. Stated.

This is different from areas such as small-cap stocks, industrial stocks, energy stocks and emerging market stocks, where earnings are expected to accelerate next year.

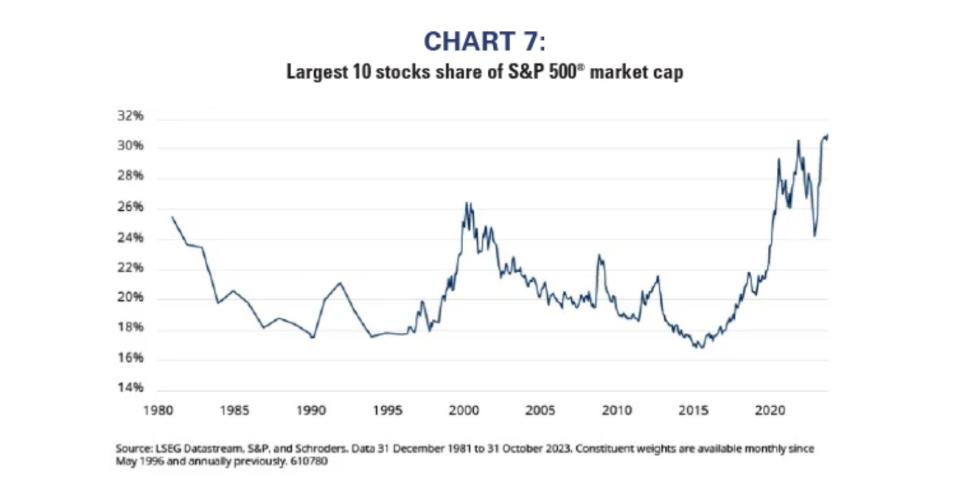

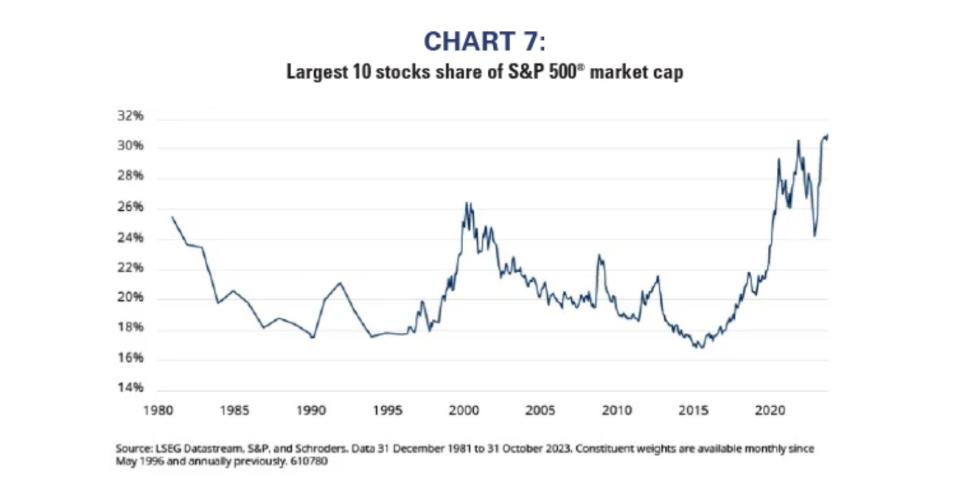

Meanwhile, Suzuki said valuations and investor concentration in big-cap tech companies have become extreme and even worse than seen during past stock market bubbles. The top 10 stocks in the S&P 500 currently account for more than 30% of the index’s market capitalization, the largest share in the past 40 years.

At this level of boom, these companies risk underperforming, causing investors to jump to other areas of the market, Suzuki said. He points to the dot-com bubble that burst in the early 2000s, followed by a decade of anemic returns.

“I think we’re going to end up in a bear market,” Suzuki said of large-cap tech stocks in an interview with Bloomberg on Friday. “I went so far as to say that I think this is a bubble, and I don’t use that term lightly. So it suggests that eventually there will be a liquidation.”

But the RBA says this is actually good news for almost all sectors of the market, as investors will eventually move on to other stocks, allowing the pendulum to swing in the other direction.

While the Nasdaq crashed during the dot.com crash, less popular sectors such as energy and emerging markets actually posted “monster” returns in the years that followed, says RBA founder Richard Bernstein. he told Business Insider in a December interview.

The firm expects a similar phenomenon to occur as the extreme valuations of tech stocks look set to collapse. Bernstein said Magnificent Seven stocks could wipe out 20% to 25% of their value over the next 10 years, while small-cap Russell 2000 stocks could gain about the same amount. I showed my point of view.

“I think this is a once-in-a-generation opportunity,” Suzuki said.

Other Wall Street experts are warning of a major correction in tech stocks, which have rallied to dizzying heights as investors jumped on the generative AI hype. Investor veteran Bill Smead calls the Magnificent Seven stock boom a “speculative orgy” that could soon end and lead to what he calls a “stock market failure.” He said there is.

Read the original article on Business Insider

[ad_2]

Source link