[ad_1]

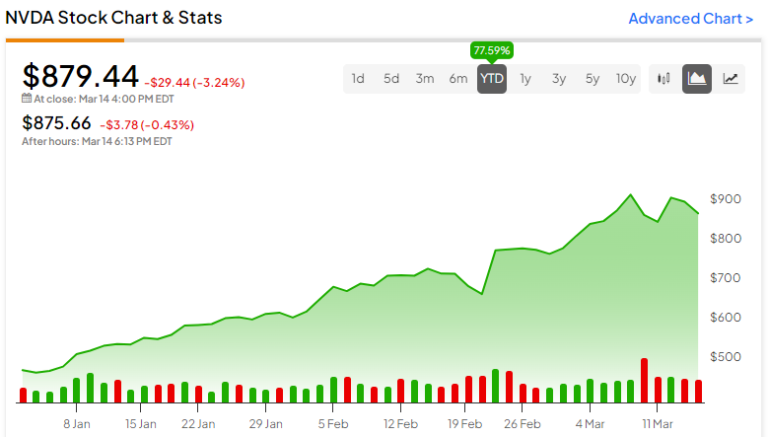

Chipmaker and AI genius Nvidia (NASDAQ:NVDA) has been on an unstoppable upward journey, more than tripling in value in 2023 and gaining about 78% since the beginning of the year. The recent strong fourth quarter has been impressive, propelling NVDA to all-time highs. My bullish stance on NVDA remains as it stands at the helm of the AI revolution. I believe in the company’s long-term growth potential due to the artificial intelligence (AI) boom and relatively favorable valuation. Therefore, I would buy the stock at current levels.

NVDA Announces Explosive Earnings Again in Q4

Nvidia, currently the world’s third-largest company, reported another blowout fourth-quarter earnings report on February 21, driven by momentum in accelerated computing and generative AI. Adjusted earnings were $5.16 per share, easily beating analysts’ expectations of $4.59 per share. This number was also significantly higher (+486%) than his $0.88 per share in the fourth quarter of 2023 (ending January 2023).

Impressively, fourth-quarter revenue increased 265% year-over-year to $22.1 billion, beating consensus estimates of $20.5 billion. In addition, the adjusted gross profit margin increased by 10.6 percentage points to 76.7% from 66.1% in the same period last year.

Importantly, NVDA’s most important segment, data center revenue, more than tripled year-over-year to $47.5 billion in fiscal 2024. The division’s fourth-quarter revenue also saw impressive growth, increasing 409% year-over-year to $18.4 billion.

As expected, U.S. export control regulations led to lower revenues in China. Management asserted in the earnings call that China accounted for only a mid-single-digit percentage of data center revenue in the fourth quarter, compared to an average of 20-25% over the past few quarters. .

Looking ahead, Q1 guidance looks promising, with sales expected to hover around $24 billion. Adjusted gross margin is expected to be approximately 77%.

CEO Jensen Huang expressed great optimism for the future on the conference call, commenting: The first is the transition from general computing to accelerated computing. [and] “It’s a second industry-wide shift called generative AI.”

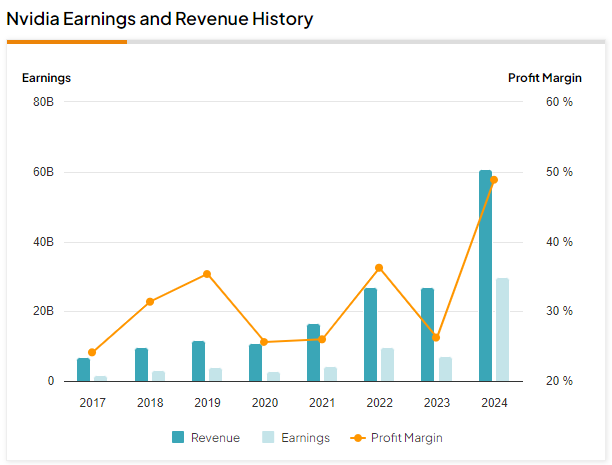

NVDA’s long-term trajectory remains impressive

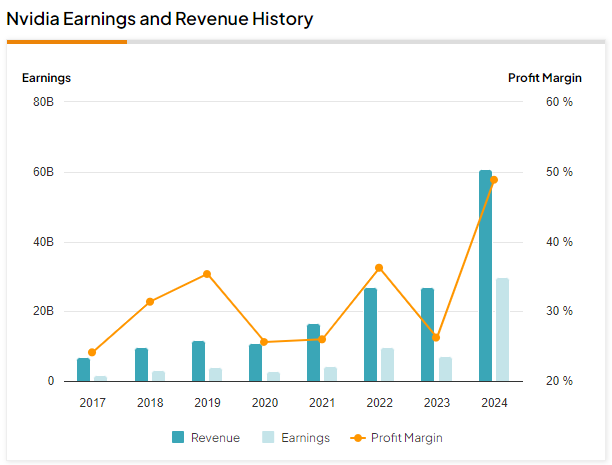

There’s a good reason why NVDA is popular on Wall Street. Over the past six years, Nvidia’s revenue has jumped nearly nine times, from his $6.91 billion in fiscal year 2017 to his $60.9 billion in fiscal year 2024 (see below). What’s even more commendable is that profits increased 18 times over the same period, from $1.67 billion to $29.8 billion, due to higher profit margins. This data gave me deep confidence in NVDA’s strong business fundamentals and expected growth trajectory with AI.

According to Wall Street estimates, NVDA is expected to achieve net income of $64.3 billion in fiscal year 2025, doubling from the $32.3 billion reported in the recently ended fiscal year 2024. Furthermore, revenue is expected to exceed the monumental milestone of $100 billion. These impressive growth expectations provide a compelling reason to continue investing in this AI giant, especially considering that the growth story for disruptive generative AI is just beginning.

NVDA may conduct a stock split

Many Wall Street analysts believe a stock split could happen in the next year or so as the stock inclines toward the $1,000 milestone. NVDA conducted a 4:1 stock split in May 2021, and the stock price at that time was approximately $600. This move made it easier for small retail investors to buy stocks. Stock splits do not inherently change a company’s valuation or fundamentals, but they expand the investor base by attracting smaller investors.

Other notable companies that have opted for stock splits include EV maker Tesla (NASDAQ:TSLA) (2020 and 2022) and Apple (NASDAQ:AAPL),Amazon(NASDAQ:AMZN),alphabet(NASDAQ:Google). Therefore, NVDA may consider further stock splits in the near future.

Considering its earning power, NVDA’s valuation is still not high

Many investors are hesitant to buy NVDA stock, which has overtaken Amazon in market capitalization and is on the verge of overtaking Apple’s market capitalization, due to its impressive rally and concerns about overvaluation.

But on the contrary, NVDA stock isn’t expensive at all. The company currently trades at an attractive forward P/E ratio of 36.9x (based on FY2025 earnings estimates). This is relatively cheaper than peer multiples. For example, the US-based semiconductor company Advanced Micro Devices (NASDAQ:AMD)’s forward P/E ratio is 53.4 times.

Additionally, the current valuation reflects a discount from the five-year average of 46x. These are attractive discount levels and could represent a great buying opportunity given AI market giant NVDA’s insane growth potential.

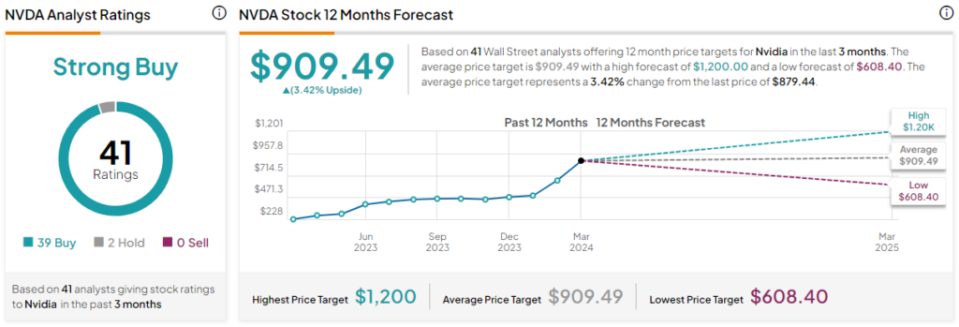

Is NVDA stock a buy, according to analysts?

NVDA is a stock that attracts widespread attention as an unstoppable force. With his 39 Buy ratings and his 2 Hold ratings by analysts over the past three months, the consensus rating is unmistakably Strong Buy. Nevertheless, NVIDIA’s average price target of $909.49 suggests that the company’s stock will return 3.4% over the next 12 months.

Interestingly, the average price target has increased incredibly as analysts strive to match NVDA’s continued record-breaking highs each month. The price has increased to $909 from $661 just three months ago.

Bottom line: Consider purchasing NVDA for its long-term AI potential

NVDA stock is poised to soar to unprecedented heights, driven by extraordinary growth expectations in the AI space. As an industry frontrunner, NVDA maintains a significant lead over its competitors, with nearly 80% market share and near-monopoly position in AI chips. This dominant position ensures a strong moat and solidifies control over a thriving AI environment.

The insatiable demand for all things AI far exceeds the available supply, highlighting the potential to accelerate the adoption of computing and generative AI across industries and geographies. This trend is expected to be the main driving force driving NVDA’s revenue and profit growth in the coming years.

With NVDA’s much-anticipated live GTC conference scheduled for March 18-21, my bullish outlook on NVDA remains solid, prompting me to buy the stock at current levels.

disclosure

[ad_2]

Source link