[ad_1]

The main factors behind Apple (NASDAQ:AAPL) The stock’s significant expansion over the past five years, with its valuation rising faster than its underlying value, is due to growth in the services sector and associated improvement in profit margins.

During this period, services grew from 15% to 22% of total revenue, which contributed to gross profit growth. Recently, Apple adopted a new strategy of increasing prices to encourage growth in this area. The company has significantly increased prices for TV+ (doubling in just 16 months), Music, News, and Apple Arcade starting from the end of fiscal 2022.

According to analysis by Bernstein analyst Toni Sacconaghi, Apple’s service price increases themselves increased services revenue by 130 basis points year over year, and gross profit and operating profit increased by $1 billion. For fiscal 2024, analysts estimate that the price hike will increase service revenue by 140 bps year over year, pushing gross profit and operating profit by $1.2 billion.

“Remarkably,” Sacconaghi continues, “Apple also increased iCloud prices by 25% in several countries. The global rollout of iCloud price increases could provide further tailwinds to revenue growth.”

However, despite rising prices, growth in services has slowed. Sacconaghi expects sales growth to reach 11% in fiscal 2024, the third consecutive year below 15%. For comparison, his CAGR for Apple’s services over the past 10 years was 22%. Over the next three to five years, Sacconaghi believes that Apple will probably be able to grow the service at a rate in the low double digits.

“While Apple has pricing control over many of its services, future service growth will continue to be largely determined by (1) advertising/Google payments, which account for 60% of services, and the health of the App Store; Note: “revenue; and (2) Apple’s ability to continue offering new services,” the analyst explained.

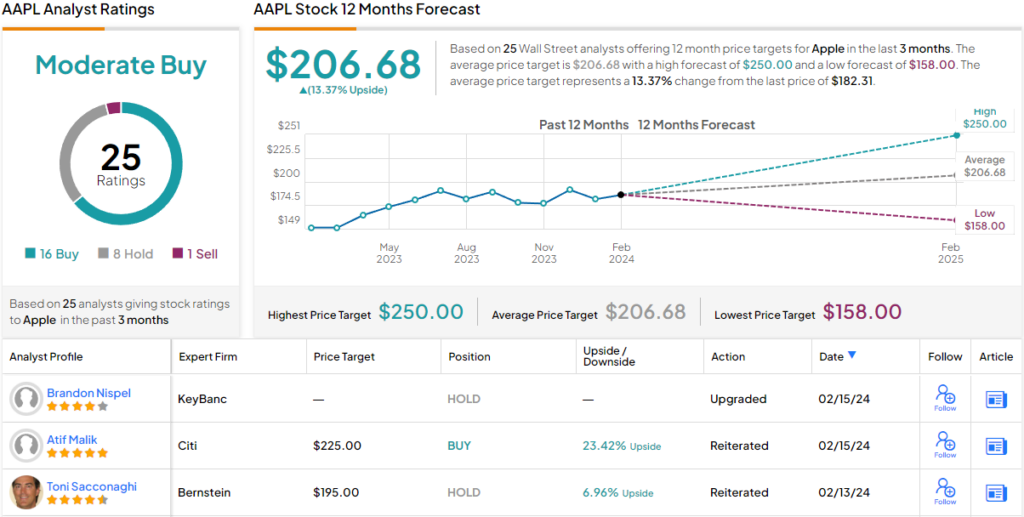

Overall, Sacconaghi sees “neutral risk-reward in the short term,” and prefers to remain on the sidelines with a market perform (or neutral) rating and $195 price target for now. This number suggests that Apple stock has room for 7% growth from current levels. (Click here to see Sacconagi’s track record)

Seven other analysts joined Sacconaghi with an additional 17 buys and 1 sell, giving the company a consensus rating of Moderate Buy. The average price target is currently $206.68, implying a 13% upside for the stock in the coming months. (look Apple stock price prediction)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.

[ad_2]

Source link