[ad_1]

warren buffett and his team berkshire hathaway They became famous for the investments they have made over the decades. As a result, it has gained a significant following among investors interested in Berkshire’s stock holdings.

While the overall performance of Berkshire’s portfolio is enviable, not all of Buffett’s stocks are good buys right now (for a variety of reasons) for an investor with $300. But there are still some things worth considering. If he doesn’t need $300 to pay monthly bills, reduce short-term debt, or build up his emergency fund, it’s worth taking a closer look at these three stocks owned by Berkshire. maybe. All three companies trade for less than $300 per share.

1. Amazon

most people know Amazon‘s (NASDAQ:AMZN) That’s because the company started as an e-commerce site more than 20 years ago. However, what many may not know is that Amazon has been transitioning its business to a service-based model over time. Thanks to the rise of various divisions such as third-party seller services, advertising services, and the Amazon Web Services (AWS) cloud computing division, Amazon actually generates more revenue from its various services divisions than its commerce division. .

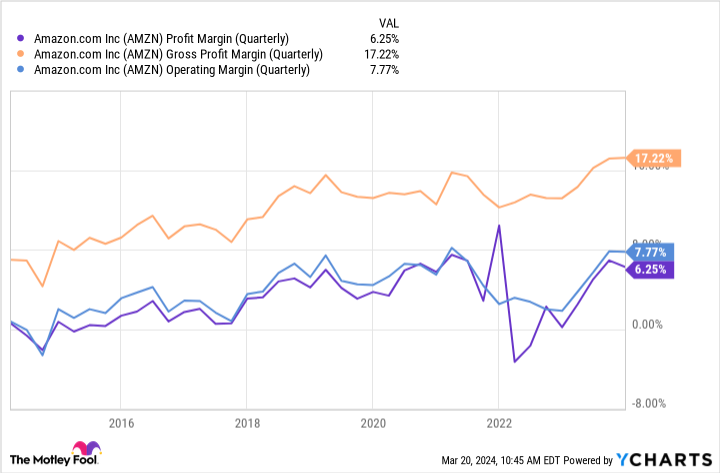

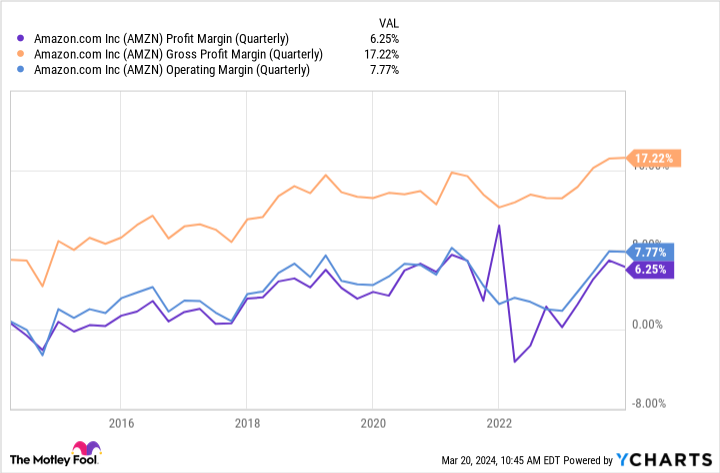

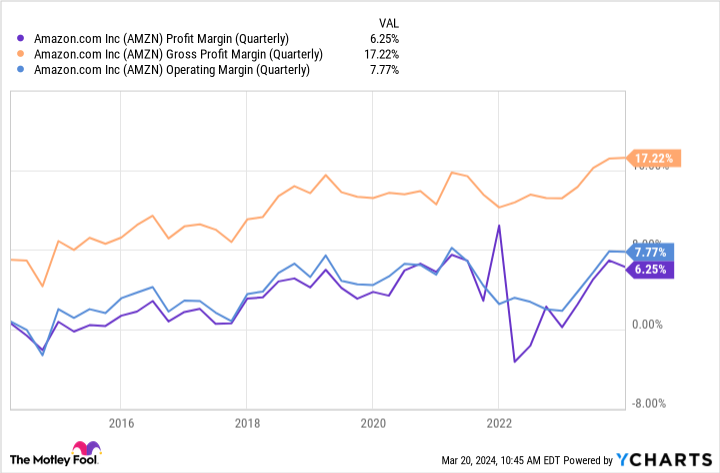

This change helped Amazon boost profits, as service businesses tend to be much more profitable than retail businesses.

As profit margins rise, Amazon’s profit growth rate has increased over the past decade (excluding the unusual pandemic year). Amazon’s profits and margins have been steadily increasing along with strong sales growth, and the company’s stock price is expected to rise further.

2. Visa

visa (NYSE:V) Our business operations are the most mature of the trio, and it shows in our performance. The company, a major multinational payment card services company, saw a 20% increase in EPS in the first quarter of its fiscal year 2024 (ending December 31, 2023), although its sales increased only 9% year-on-year. Visa did this by cutting operating expenses and reducing its share count through share buybacks.

When you combine these two factors with increased revenue, you get an effect similar to what Amazon is experiencing. Visa has been able to continue to grow its profits at a high pace, which is the driving force behind its stock price beating the market.

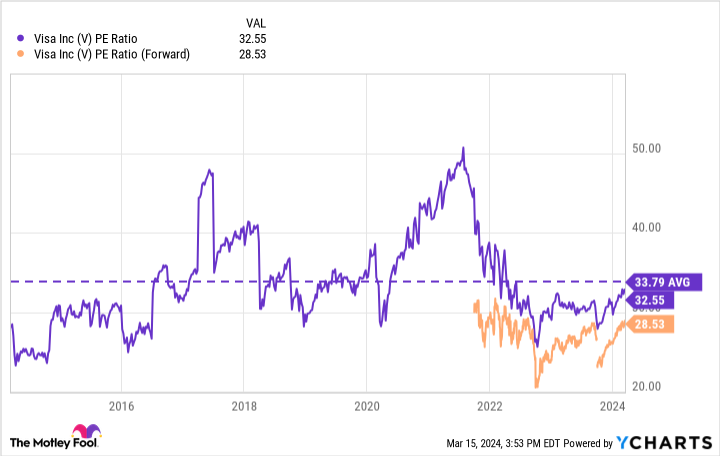

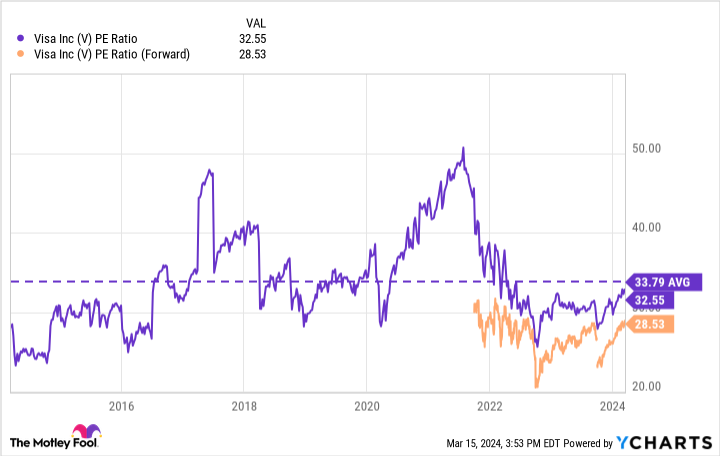

Visa stock is also undervalued, at least from a historical perspective.

The company’s stock is trading at a forward P/E ratio of 28 times, which is below its historical average and well below its trailing P/E ratio of around 34 times. If Visa meets analysts’ earnings expectations and rises to a valuation of 34 times trailing earnings within a year, the company’s stock price will rise. 18% increase — an impressive return for a mature stock like Visa.

3. Snowflake

Some investors may be surprised to learn that Berkshire owns stocks in high-growth companies such as: snowflake (New York Stock Exchange: Snow). But Buffett isn’t the only one using Berkshire’s money to make investment choices. Another Berkshire executive, Todd Combs, is known for making more growth-oriented investments and is likely behind the Snowflake investment. But Berkshire bought Snowflake stock at an extreme valuation before its IPO, so Mr. Combs likely needed some level of approval from Mr. Buffett. Either way, Snowflake remains a top stock to buy.

Snowflake is a cloud-based data storage and analytics service essential in today’s world where data drives decisions and feeds real-time models. As the artificial intelligence (AI) arms race increases demand for data, Snowflake is well-positioned to benefit in the long term.

Like several tech stocks over the past five years, Snowflake’s valuation rose in 2021 but plummeted in the market correction in 2022. The stock is gradually returning to its previous highs, and we hope the recent additions will further accelerate that effort. A new CEO will take the helm in the form of Sridhar Ramaswamy (he previously led Google’s advertising business).

Snowflake stock currently trades at 18.3 times sales, near the lowest ever for a publicly traded company. With revenue in the latest quarter up 33% year-over-year, now might be the perfect time to take a position in the company.

It may not be Buffett’s favorite stock in his portfolio, but it’s poised to be a winner over the long term.

Should you invest $1,000 in Amazon right now?

Before buying stocks on Amazon, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks For investors to buy now…and Amazon wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 20, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. Keithen Drury has held positions at Alphabet, Amazon, Snowflake, and Visa. The Motley Fool has positions in and recommends Alphabet, Amazon, Snowflake, and Visa. The Motley Fool has a disclosure policy.

“The Best Warren Buffett Stocks to Buy Now for $300” was originally published by The Motley Fool.

[ad_2]

Source link