[ad_1]

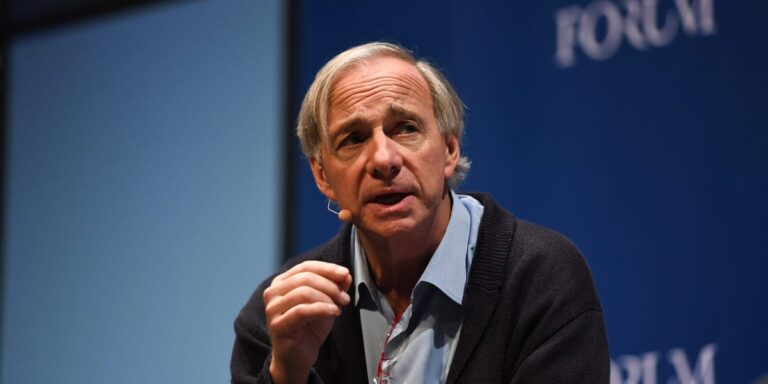

- Bridgewater founder Ray Dalio said the current stock market does not resemble a “full-blown” bubble.

- He admitted that the Magnificent Seven’s name seemed “a little bubbly”.

- ”[O]I can still imagine these names being revised significantly if the generative AI fails to live up to the impact factored in. ”

Bridgewater founder Ray Dalio said he doesn’t think the stock market resembles a bubble.

The legendary hedge fund investor said in a new note that despite the recent market euphoria and rally, the situation does not quite meet the criteria for a bubble. Among the factors he notes are high prices relative to value, signs of unsustainable growth, a rush of naive buyers to speculate, and a large proportion of debt-financed purchases.

“When you look at the U.S. stock market using these metrics, even some of the stocks that have risen the most and received the most media attention don’t look all that vibrant,” Dalio wrote.

The S&P 500 broke a series of records in 2024, rising more than 8% year-to-date.

The Magnificent Seven stocks (Apple, Amazon, Tesla, Nvidia, Microsoft, Alphabet, and Meta) remain in the spotlight, but Wall Street experts say they’re still in the spotlight, especially with Tesla’s stock plummeting. Apple has stumbled this year, with some arguing that the group should be disbanded.

Dalio acknowledged that this set of stocks has driven overall market gains, with the group’s market capitalization increasing by more than 80% since January 2023.

“Mag-7 has been measured to be a little bubbly, but not completely bubbly,” Dalio asserted. “Valuations are moderately expensive given current and expected earnings, and sentiment appears bullish but not overly bullish. We don’t see excessive leverage or a rush of new naive buyers.”

He points out that Bank of America’s recent fund manager survey showed investors haven’t been more bullish in the past two years. Charles Schwab’s Customer Sentiment Report shows similar enthusiasm for the first quarter of 2024.

However, downside risks still remain.

“That said, it is still possible that these names could be significantly revised if the generated AI does not match the built-in impact,” Dalio said.

In any case, past trends may support Dalio’s assessment that stocks are not in bubble territory.

Datatrek Research co-founders Nicholas Colas and Jessica Raab said in a note last week that the S&P 500’s three-year gain of 31% on a price return basis reflects a bubble that forms before a crash. He pointed out that the return was well below the typical return shown.

“Investor confidence is currently below levels that would indicate that it has not reached an unhealthy maximum,” the researchers said. “While this does not guarantee further profits, it safely removes ‘bubble risk’ from stock market concerns.”

[ad_2]

Source link