[ad_1]

-

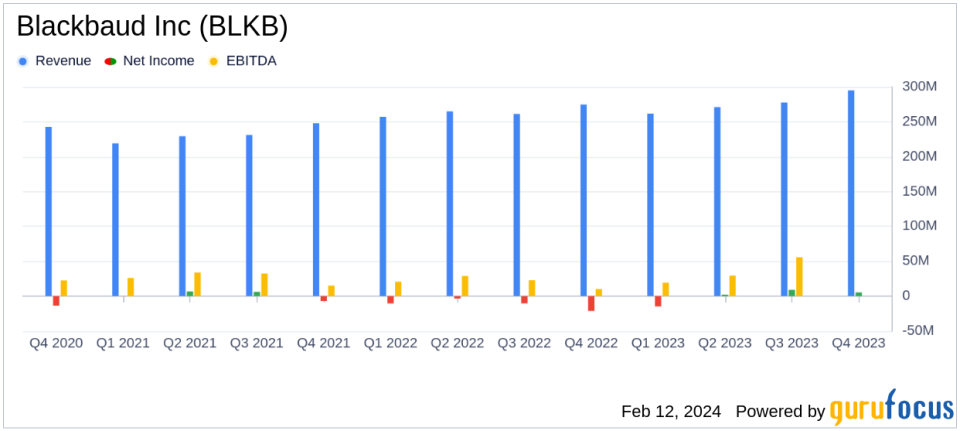

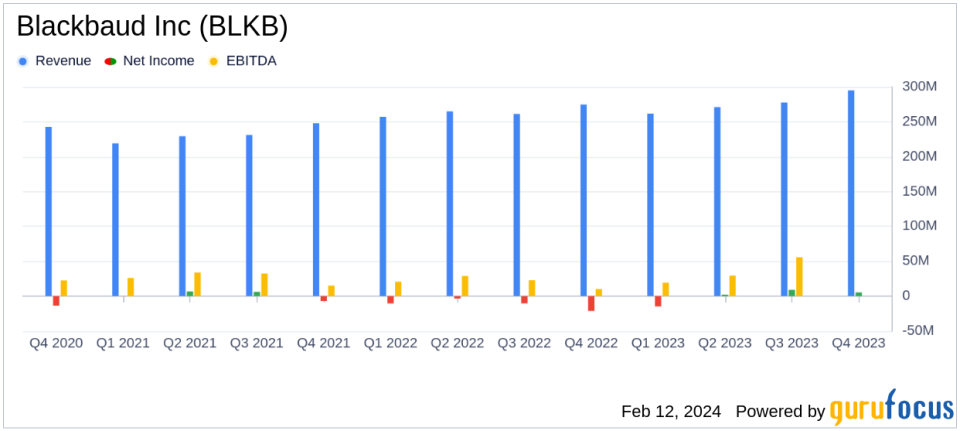

revenue: GAAP total revenue increased 7.4% to $295 million in the fourth quarter and 4.5% for the full year to $1.1 billion.

-

Earnings per share (EPS): Fourth quarter GAAP diluted EPS increased $0.51 per share to $0.10 and non-GAAP diluted EPS increased $0.46 per share to $1.14.

-

Adjusted EBITDA: Fourth quarter non-GAAP adjusted EBITDA margin improved 890 basis points to 33.6%.

-

free cash flow: Non-GAAP adjusted free cash flow increased $28.7 million to $36.3 million in the fourth quarter.

-

Stock buyback: Blackbaud announced that it will reauthorize, expand and supplement its $500 million stock repurchase program.

On February 12, 2024, Blackbaud Inc (NASDAQ:BLKB), a leading provider of social impact software, announced its 8-K filing for the fourth quarter and full year ended December 31, 2023. Announced financial results. serves the “Social Good” community, including nonprofits, foundations, corporations, educational institutions, and healthcare organizations, with over $100 billion in annual giving across his 40,000+ clients in over 100 countries. It has come true.

Financial performance and challenges

Blackbaud’s fourth quarter results capped a transformational year with strong performance that met or exceeded the company’s financial guidance. The company’s GAAP total revenue for the fourth quarter was $295 million, an increase of 7.4% year over year, and GAAP recurring revenue accounted for 97% of total revenue. Non-GAAP organic recurring revenue also increased 8.4%. This growth is significant because it reflects the company’s successful transition to a more predictable subscription-based revenue model, which is critical to the stability and reputation of the software industry.

However, the company faced challenges, including GAAP net cash used in operating activities of ($3.3 million), which included $54.9 million in payments related to security incidents. As a result, GAAP operating cash flow margin decreased by $17.4 million and 620 basis points. Security incident-related costs have been a drag on the company’s cash flow, but management’s proactive measures to address these issues resulted in an increase in non-GAAP adjusted free cash flow of $28.7 million. It is clear from this.

Financial performance and industry relevance

Blackbaud’s fourth quarter and full year 2023 financial results are particularly important given the company’s focus on the software industry for social good. Non-GAAP operating income for the quarter was $83.8 million, and non-GAAP operating margin increased 840 basis points to 28.4%. For the year, non-GAAP net income was $213.6 million and non-GAAP diluted earnings per share were $3.98, an increase of $1.29 per share. These results support our ability to efficiently scale our business while continuing to invest in product innovation and market expansion.

Key financial indicators and their importance

Blackbaud’s fourth quarter and full year 2023 key financial metrics highlight the company’s strong financial health and operational efficiency. Non-GAAP Adjusted EBITDA for the quarter was $99.3 million, with a margin of 33.6%, reflecting the company’s strong profitability and cash generation capabilities. The ‘Rule of 40’, a key metric in the software industry that combines revenue growth and EBITDA margin, was 41.0% for the quarter, demonstrating Blackbaud’s performance above standards that typically indicates a healthy balance between growth and profitability. It shows that it continues.

“The fourth quarter demonstrated continued progress on our five-point operating plan and transformed our financial results,” said Tony Bua, Blackbaud’s executive vice president and chief financial officer. ” he said. “For the full year 2023, revenue achieved our guidance range and adjusted EBITDA margin, non-GAAP EPS and adjusted free cash flow exceeded the high end of our guidance range.”

Analysis of company performance

Blackbaud’s 2023 performance reflects a company successfully navigating the market and executing on its strategic initiatives. The company’s revamped capital allocation strategy, including the approval of significant share repurchases, demonstrates confidence in its future cash flow generation and commitment to delivering shareholder value. Blackbaud is poised for sustainable growth and profitability with a focus on becoming a Rule of 40 company for the full year of 2024.

For more information and updates on Blackbaud’s financial performance and strategic direction, please visit GuruFocus.com.

For more information, see Blackbaud Inc’s full 8-K earnings release here.

This article first appeared on GuruFocus.

[ad_2]

Source link