[ad_1]

-

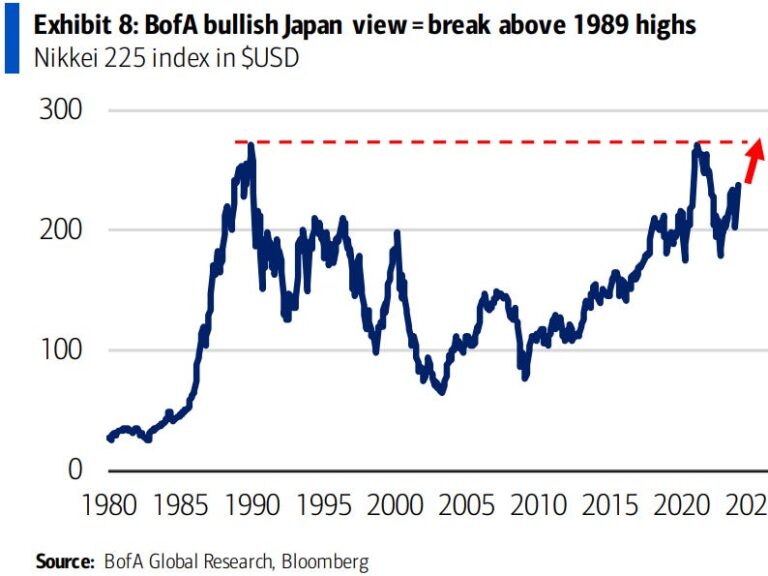

After 35 years of stagnation, Japan’s stock market could hit a new record high in 2024, according to Bank of America.

-

The bank said the Nikkei stock average is expected to rise 13% this year as Japanese companies increase profits.

-

“Japan’s economy is resilient, undervalued, and productive.”

Today’s chart is from Bank of America, and it is expected that the Nikkei Stock Average will break its all-time high set in 1989.

Masashi Akutsu, chief Japanese equity strategist at Bank of America, expects Japan’s stock market to rise 13% this year, hitting a new all-time high and surpassing its peak 35 years ago.

While Japan’s resilient economy and improving corporate profits should drive much of the upside for Japanese stocks, Akutsu argues that Japanese stocks are undervalued.

“Less than 24 hours after the magnitude 7.5 earthquake struck, bullet trains resumed in the same area. Japan’s economy is resilient, undervalued and production is slowing,” Bank of America said in a Tuesday report. “Sex is improving,” he said.

This idea echoes that of billionaire investor Warren Buffett, who made big bets on five Japanese trading companies in the summer of 2020 through his conglomerate Berkshire Hathaway.

Buffett said he bought these companies because they were “ridiculously” cheap, and his stake has since tripled to more than $17 billion.

Bank of America expects Japanese companies’ profits to increase going forward as corporate directors become more serious about finding new efficiencies in their operations.

“We expect recent corporate governance reforms and restructuring to bear fruit in the form of improved returns on equity, management buyouts, and share buybacks,” the report said.

And compared to the US, Japanese stocks look cheap. As of September, Japan’s stock market was trading at a 20% discount to the S&P 500 index. This should bode well for Japan’s stock market to rise to record highs as long as the global economy grows at a steady pace.

Read the original article on Business Insider

[ad_2]

Source link