[ad_1]

(Bloomberg) — Demand for corporate bonds is so strong that investors are once again willing to fund big mergers and acquisitions, something they haven’t done for much of the last year. I was hesitant.

Most Read Articles on Bloomberg

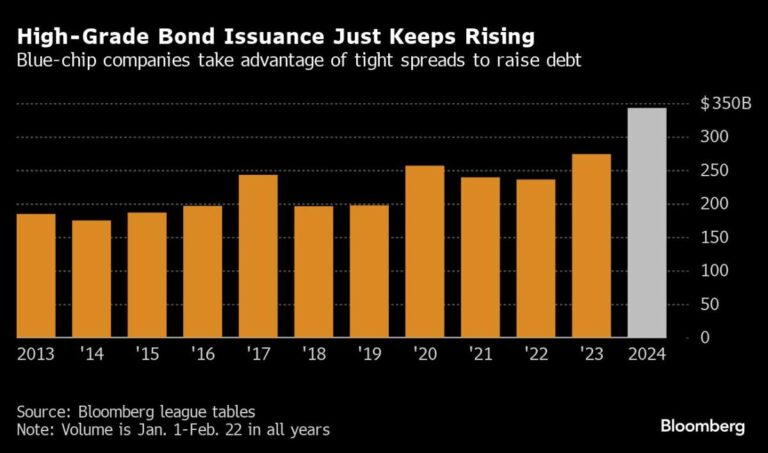

In the past two weeks alone, about $50 billion in bonds have been sold to help finance acquisitions and spinoffs. The deluge includes notes related to AbbVie, Bristol-Myers Squibb and Cisco Systems, marking a surge in M&A lending after the slowest year for deals in a decade.

There’s a lot more to come for Vanguard Group’s Arvind Narayanan. The corporate bond market has been busy as investors look for new bonds with attractive yields before policymakers cut interest rates. Finance managers are therefore encouraged to raise capital while conditions are ideal.

“We think M&A will continue,” Narayanan, the firm’s co-head of investment-grade credit, said in a phone interview. That means “being at the front and being the center.”

The U.S. investment-grade bond market is expected to raise at least $276 billion in pending M&A activity this year, according to data compiled by Bloomberg. Broadcom’s acquisition of VMware is one deal that could lead to more issuance this year.

Acquisition activity is trickling into other markets, from European bonds to U.S. leveraged loans. Not only are many of these products responding to strong demand from asset managers, but borrowing costs have been on a downward trend since October, although they are still higher than they were a few years ago.

Average spreads on high-quality bonds last week traded at their lowest levels since November 2021, as investors bet the U.S. Federal Reserve will ease at some point later this year.

Another $35 billion in high-quality bonds is expected next week, making at least one more big deal possible before the end of the month, according to people familiar with the matter who spoke on condition of anonymity to discuss the deal. There is a possibility that it will happen.

“The ability to command historically low spreads and appeal to yield-focused investors is the perfect storm that forces borrowers to step in and take advantage of a backdrop where the economy is in great shape. ” Megan Graper, global co-head of fixed income capital markets at Barclays, said in a phone interview.

The recent trading success is hard for financial leaders to ignore, as bond buyers from pension funds to individual traders look to take advantage of the currently high all-in yields. AbbVie attracted more than $80 billion in orders from investors, and the Bristol-Myers deal attracted more than $85 billion.

WATCH: AbbVie expects more than $80 billion in demand for bond sale

Strong demand has allowed companies to sell bonds at the same yield they pay on their existing bonds. U.S. high-market borrowers on Thursday paid an average of 0.4 basis points higher yield on new bonds compared to the level of outstanding bonds.

Companies typically have to pay much higher amounts to persuade investors to sell their current stock holdings and buy new bonds. These so-called concessions averaged 8.5 basis points in all of 2023, compared with 13 basis points the year before.

Increased activity

Europe has seen about $72.5 billion worth of M&A deals so far this year, up 77% from a year ago, according to data compiled by Bloomberg.

Even US companies raise money there. Boston Scientific sold Axonics for 2 billion euros to fund its acquisition. The deal met demand at a price point of more than 5.7 billion euros, said the people familiar with the matter, who asked not to be identified discussing personal details. Analysts at CreditSights now expect BAE Systems to tap the market to refinance the $4 billion bridge loan it used to acquire Ball Aerospace.

The junk bond market is also seeing a resurgence of new financing for leveraged buyouts after months of low activity. Clayton Dubilier & Rice and Stone Point Capital’s acquisition of Trust Financial’s insurance brokerage business is expected to bring about $8 billion in debt to market in March.

Banks are increasingly interested in private equity transactions, particularly low-risk purchases that require relatively low levels of debt. JPMorgan Chase & Co. beat private lenders to provide approximately $2.5 billion in debt financing to support Cohesity’s planned acquisition of Veritas Technologies.

“It feels like the market is stabilizing,” said Lauren Basmajian, global head of liquidity credit at Carlyle Group. “This is the most encouraging thing I’ve seen in nearly two years.”

1 week review

-

Investment banks such as Goldman Sachs Group Inc. and Barclays Plc are trying to get their lucrative fee-generating machines running again.

-

The $1.4 trillion U.S. junk bond market is becoming more junk-bound as more bonds are completely downgraded or upgraded from high-yield territory, leaving greater potential risk for investors. There is.

-

A little-noticed corner of Canada’s credit market is being shaken up by the country’s biggest lenders, which are piling up securities that shift credit risk to other investors. This behavior is likely to be copied by Wall Street financiers.

-

Credit markets are expressing optimism about China’s latest stimulus package aimed at easing the property market crisis, ending earlier skepticism about the impact of efforts to strengthen the sector. Some of the restrictions have been eased.

-

Chinese construction company Zinke Properties and its wholly-owned Chongqing unit have applied for restructuring in a district court, saying the company and its subsidiaries are all exposed to capital liquidity risk.

-

A group of bondholders of China Nancheng Holding Co., Ltd. has asked Hong Kong’s securities regulator to investigate the defaulting developer for possible violations of financial rules.

-

Demand for high-end U.S. corporate bonds has been “unusually strong,” Bank of America said, raising the risk of market overshoot as investors soak up the oversupply.

-

According to Ares Management Corporation, lending opportunities for private lenders could reach $1.5 trillion.

-

The U.S. Supreme Court has rejected an appeal that could upend the $1.4 trillion leveraged loan market, leaving a legal victory for JPMorgan Chase & Co. and other banks intact.

move

-

Bank of Nova Scotia has hired Bank of Montreal’s Raad Hossain as director of structured products in the fixed income, currencies and products group.

-

Allen & Overy has hired John Goldfinch from Milbank as a partner in its global structured finance practice.

–With assistance from Ronan Martin and Jill R. Shah.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link