[ad_1]

(Bloomberg) — Bond investors who were once confident the Federal Reserve would begin lowering interest rates this week have now resigned to the reality of a prolonged period of rate hikes and market uncertainty. ing.

Most Read Articles on Bloomberg

U.S. Treasury yields have surged in recent days and are on track to hit new highs this year as data continues to show sustained inflation, leading traders to push back the timeline for U.S. monetary easing. .

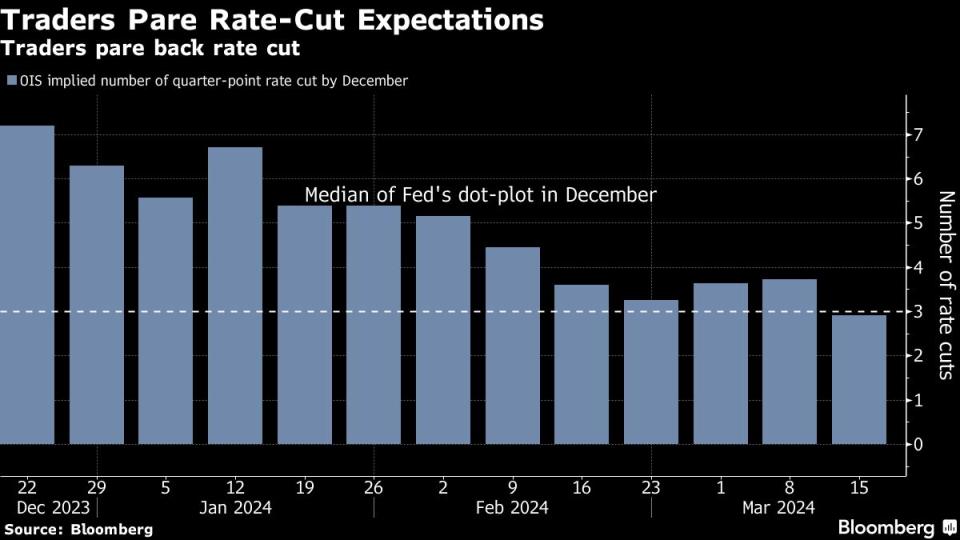

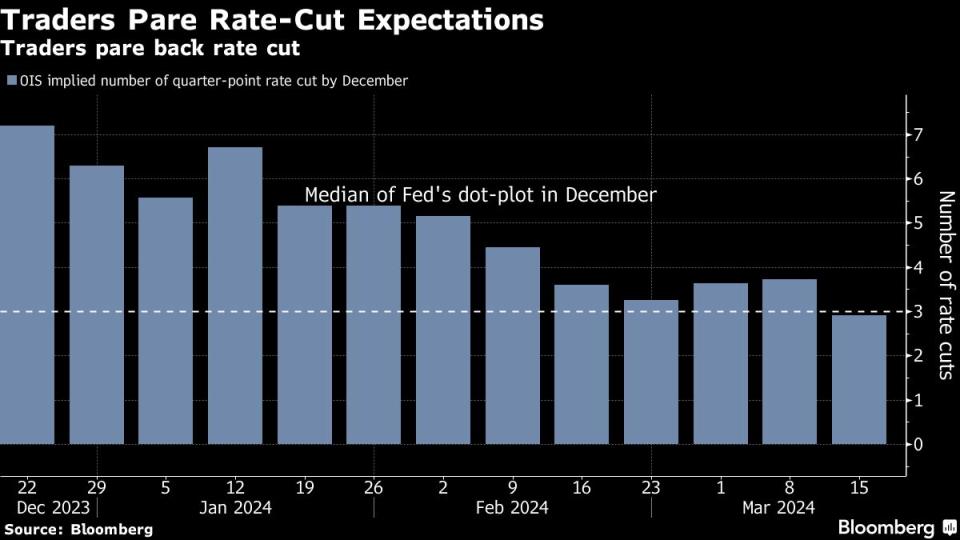

Interest rate swaps currently reflect market expectations that interest rates will be cut by less than three quarter points this year. That’s lower than the Fed’s median forecast in December and close to the shadow of the six rate cuts priced in at the end of 2023. And will the first move be lower? Investors are no longer even sure if it will happen in the first half of this year.

The change underscores growing concerns that U.S. central bankers, led by Federal Reserve Chairman Jerome Powell, will signal an even shallower easing cycle at this week’s two-day meeting starting Tuesday. Economists at Nomura Holdings have already lowered their forecast for the Federal Reserve to cut interest rates this year from three to two. And looking at recent trading activity in the options market, investors are wary of the risk of higher long-term yields and fewer interest rate cuts, even if the long-term outlook is that interest rates will ultimately fall. I understand that you are seeking protection.

“The Fed wants to ease, but the data doesn’t allow it,” said Earl Davis, head of fixed income and money markets at BMO Global Asset Management. “They want to keep the option to ease in the summer. But if the labor market tightens and inflation remains high, things will start to change.”

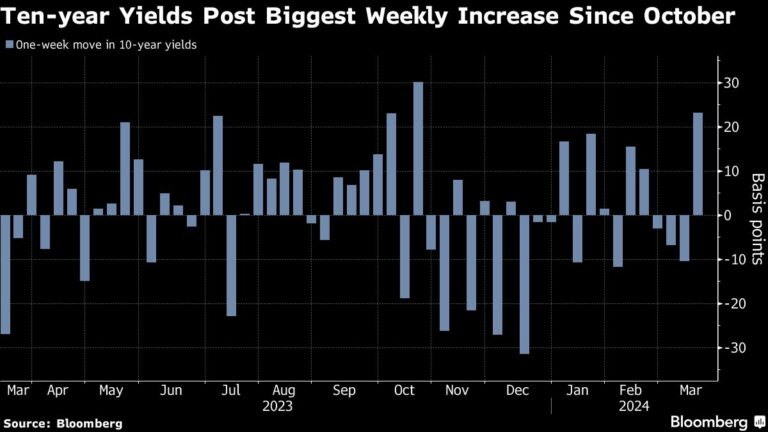

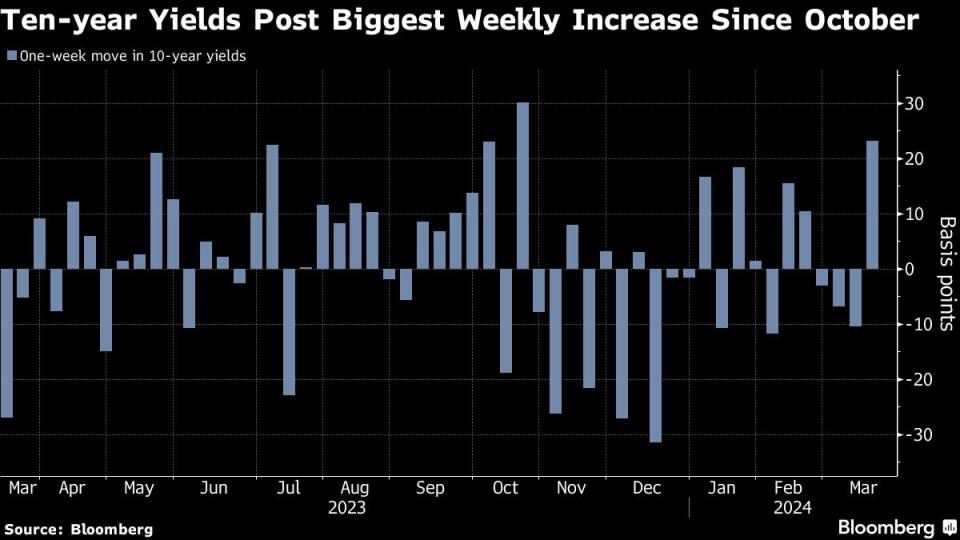

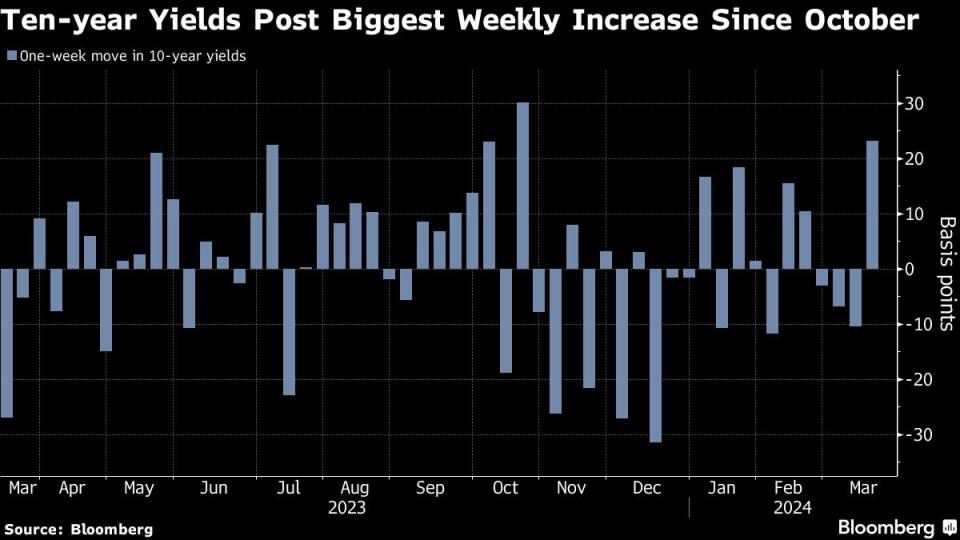

The yield on the U.S. 10-year Treasury rose 24 basis points last week to 4.31%, its highest level since October and close to its year-to-date high of 4.35%. Davis sees the 10-year Treasury yield rising toward 4.5% as an eventual gateway to buying bonds. The standard exceeded 5% last year for the first time since 2007.

U.S. two-year and five-year Treasury yields both rose more than 20 basis points, the biggest increases since May. The decline widened the annual loss on U.S. Treasuries to 1.84%.

As recently as December, bond traders were almost certain the Fed would begin easing at this week’s meeting. But after a slew of surprisingly positive data on growth and inflation, there is zero chance of a policy decision this week, a slight chance of a rate cut in May, and just a 60 chance of a rate cut in June. %. Traders are predicting a total cut of 71 basis points this year, with a three-quarters point cut no longer seen as guaranteed.

Meanwhile, Nomura now expects the Fed to ease in July and December, rather than in June, September, and December. “There is little urgency to ease, so the Fed will wait to see if inflation slows before initiating a rate-cutting cycle,” economists including Aichi Amemiya said in a note.

There is little room to change the Fed’s median interest rate forecast on the so-called dot plot. For the central bank’s median forecast to rise, just two policymakers would need to switch from three rate cuts to two this year.

Read more: Bond traders brace for dotplot, 3 cuts in question

“It won’t take long” for the median price to rise, said Ed Al Hussaini, interest rate strategist at Columbia Threadneedle Investments. “It’s the front of the curve that’s nervous. It’s very sensitive to short-term policy direction.”

Even if the median rate forecast for 2024 remains the same, the dots for 2025 and 2026, as well as the long-term “neutral” interest rate (a level considered neither stimulating nor constraining growth), will rise. likely, and the scenario will prompt traders to set prices. Tim Dewey, chief U.S. economist at SGH Macro Advisors LLC, said the rate cuts will be smaller.

“We do not believe market participants need to wait for the Fed’s permission” to price in lower interest rate cuts, Duy wrote. If the two-cut scenario doesn’t materialize this week, it could happen before the June meeting, but “at least market participants are pricing in it to happen by June,” he added. “The risks at the moment are clearly asymmetric.”

Bloomberg Intelligence Agency Announces…

“Changes are likely to be gradual, but if the 2025 point remains largely unchanged, the inevitable reaction to a rise in the 2024 point may be quickly ignored. The market is sensitive to the dot at the end of next year, meaning the interest rate market could focus on 2025.

— Ira Jersey, Chief U.S. Interest Rate Strategist

Baylor Lancaster Samuel, chief investment officer at Amerant Investments, said investors should stop sweating two or three rate cuts and lose sight of the bigger picture: the Fed’s next move is to cut rates, not raise them. He said it was not. That means now is the time to buy. You buy bonds and take on interest rate, or “duration” risk in Wall Street parlance.

“The timing is debatable, but in our view the Fed remains likely to cut rates before the end of the year,” Lancaster-Samuel said. “In that environment, we don’t think the risk of interest rate levels rising further from here is that high. Therefore, we think the opportunity cost of not taking duration is higher than the risk of taking duration.”

Option traders aren’t so optimistic. Traders bought hawkish protection for this year and next in options tied to collateralized overnight lending rates, which are linked to the central bank’s policy rate, after better-than-expected producer price data released last week. hurried.

Gregory Faranello, head of U.S. interest rate trading and strategy at Ameribet Securities, said: “Rising inflation and large deficits could mean the Fed will keep policy on hold for an extended period of time, with yields set to peak in 2023.” There is a possibility that it will move again.”

what to see

-

Economic data:

-

March 18: New York Fed Service Business Activities. NFIB Housing Market Index

-

March 19: Building permit. Housing construction begins. TIC flow

-

March 20th: MBA home loan application. FOMC meeting

-

March 21: Current account balance

-

March 21: Philadelphia Fed’s economic outlook. First unemployment insurance claim. S&P Global US Manufacturing PMI. Main index.Used home sales

-

-

Fed Calendar:

-

March 21st: Michael Barr, Vice Chair of Supervision

-

March 22: Fed Chairman Jerome Powell, Vice Chairman Philip Jefferson, and Governor Michelle Bowman attend a Fed Listens event.Barr; Atlanta Fed President Rafael Bostic

-

-

Auction calendar:

-

March 18: Invoices for 13 and 26 weeks

-

March 19th: Bill for 52 weeks. 42-day cash management bill. 20 Year Notes reopens

-

March 20th: 17 weeks of invoices

-

March 21: Bills for 4 and 8 weeks. TIPS restarts after 10 years

-

-With assistance from Edward Bolingbroke.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link