[ad_1]

-

The company posted strong revenue growth year over year, up 12.9% in the third quarter and 15.6% in the nine months.

-

Operating profit in the third quarter increased significantly by 322.2%, demonstrating operational efficiency and market demand.

-

Strategic settlement with the Department of Justice ensures legal compliance and future operational stability.

-

Continued investment in technology and human capital to maintain a competitive edge in consulting services.

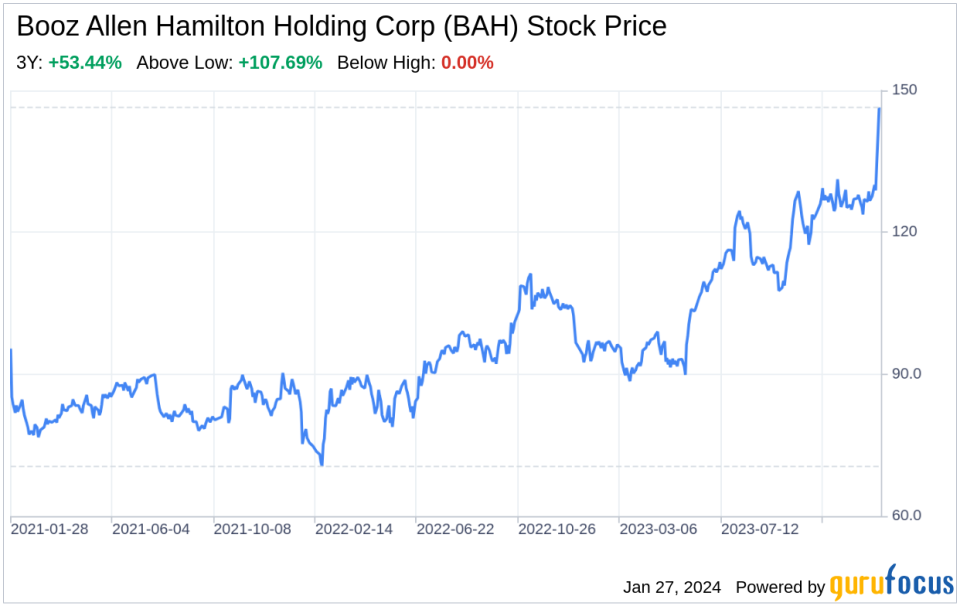

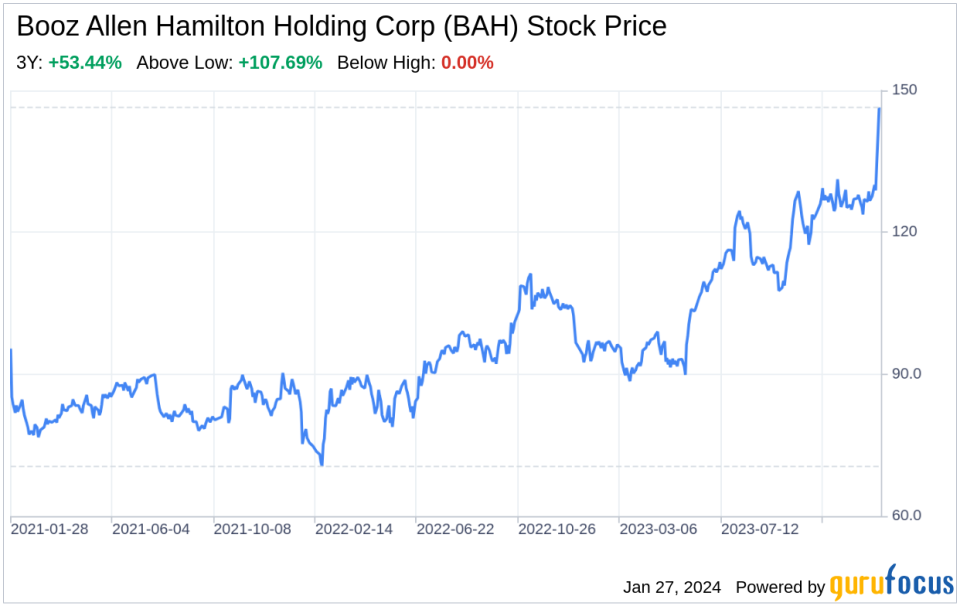

Booz Allen Hamilton Holding Corporation (NYSE:BAH), a well-known provider of management consulting services to the U.S. government, recently released its 10th quarter filing dated January 26, 2024. The company, known for its technology and engineering consulting expertise, showed impressive financial performance in its latest quarter. With Q3 revenue up 12.9% year-over-year and 15.6% over nine months, BAH is in strong financial shape. Operating profit for the third quarter increased significantly by 322.2%, demonstrating operational efficiency and strong market demand for the company’s services. Despite facing legal challenges, BAH has reached a strategic settlement with the Department of Justice to ensure compliance and future operational stability. The company continues to invest in technology and human capital to remain competitive in the consulting services industry.

Strengths

Financial performance and customer base: Booz Allen Hamilton Holding Corporation (NYSE:BAH) has shown solid financial growth, with quarterly sales up 12.9% and nine-month sales up 15.6%, and has a strong market presence. It shows the demand for the service. The company’s diverse customer base, which includes nearly every cabinet-level department of the U.S. government, provides a stable revenue stream and opportunities to cross-sell and upsell services.

Operational efficiency: The company’s operating income increased 322.2% in the third quarter, reflecting operational efficiencies and effective cost management. This financial strength allows BAH to invest in strategic initiatives such as technological advances and talent acquisition, further strengthening its market position.

Compliance with laws and regulations: BAH’s recent settlement with the Department of Justice demonstrates a commitment to regulatory compliance, which is critical to maintaining BAH’s reputation and eligibility for government contracts. This proactive approach to resolving legal issues minimizes the risk of future litigation and ensures continued confidence from our clients.

Weakness

Reliance on government contracts: BAH relies heavily on U.S. government contracts, which, while providing a stable source of revenue, also exposes us to risks associated with federal budget constraints and policy changes. Significant reductions in government spending or changes in priorities could adversely affect BAH’s financial performance.

Competitive market: The management consulting and technology services market is highly competitive, with numerous players vying for government and corporate contracts. BAH must continually innovate and differentiate its products to maintain competitiveness and market share.

Legal and regulatory risks: Despite the recent settlement, BAH operates in an environment with strict legal and regulatory requirements. Ongoing compliance is essential to avoid fines, legal costs, or loss of contracts that can negatively impact a company’s financial health and reputation.

opportunity

Advances in technology: BAH’s expertise in cloud computing, cybersecurity and digital solutions positions it to take advantage of the growing demand for advanced technology services. Continuing to invest in these areas will allow BAH to expand its service offering and attract new customers.

International expansion: BAH has a strong presence in the United States, but there are also significant growth opportunities in international markets. Expanding our global footprint allows us to diversify our revenue streams and reduce our dependence on U.S. government contracts.

Strategic acquisition: BAH’s strong financial position allows it to pursue strategic acquisitions that allow it to strengthen its capabilities, enter new markets and acquire new technologies. This growth strategy further strengthens the company’s competitiveness and fosters long-term value creation.

threat

Changes in government budget: Changes in U.S. government spending and budget allocations threaten the stability of BAH’s revenues. Businesses need to manage these fluctuations and adapt their business strategies accordingly to mitigate potential negative impacts.

Technological destruction: Rapid technological change requires BAH to continually invest in research and development to stay ahead of new trends. Falling behind in innovation can lead to lost contracts and reduced market relevance.

Intensifying competition: The competitive environment in consulting services is becoming increasingly competitive, with new entrants and existing competitors expanding their offering. To maintain its market position, BAH must differentiate through superior service quality, innovation, and customer relationships.

In conclusion, Booz Allen Hamilton Holding Corporation (NYSE:BAH) has demonstrated strong financial fundamentals, operational efficiency, and a commitment to compliance, and is well positioned for future growth. But to remain successful, the company must address its dependence on government contracts, navigate competitive markets, and take advantage of technology and international expansion opportunities. Proactively managing threats such as government budget fluctuations and technological disruption allows BAH to continue growing in the dynamic consulting services industry.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link