[ad_1]

Housing is the biggest risk to the economy for small businesses, and solutions require public-private partnerships and innovative tax breaks, KPMG recently said. Canada Survey results show

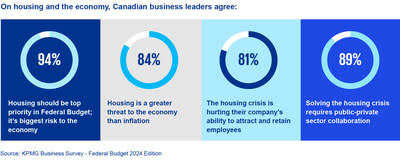

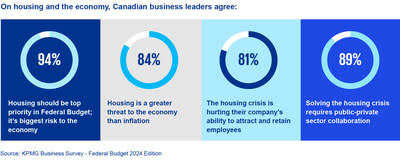

Toronto, March 27, 2024 /CNW/ – overwhelming majority (94 percent) of Canada’s business leaders believe housing is the biggest risk to the economy and should be prioritized in the next federal budget, a recent survey by KPMG found. Ta. Canada.

They say nearly nine in 10 expect the housing crisis to hurt economic growth this year (87 percent) states that rising costs of living, driven primarily by housing costs, are forcing organizations to pay for labor costs, impacting their ability to attract and retain talent that is already in short supply.

“The ripple effects of rising house prices and lack of supply are rippled through the economy,” he said. caroline charmest,economist, montrealBased at a KPMG partner Canada. “New Canadians and young Canadians are being locked out of purchases, and rentals are finding them scarce and expensive. Some who were able to enter the market a few years ago thanks to record low interest rates. , now faces the risk of default if interest rates are reset to above 20 million yen.”All of this means that key talent pools, especially in urban areas where housing prices are soaring and in areas where housing is scarce, are at risk. This is weighing heavily on business leaders who are struggling to attract and retain talent.”

The survey found that nearly nine in 10 business leaders want more innovative public and private sector housing solutions (89 percent) Public-private collaboration will be necessary.

But community challenges extend beyond housing to the infrastructure and services needed to support a growing population, he said. chris sainsburySmart Cities Partner and National Leader, KPMG Canadaoriginally Vancouver.

“The core questions are: Who are we building housing for? How do we serve them? How do we build the cities and communities we all want to live in?” he says.

He added that the federal government doesn’t have much influence beyond tax policy and funding, and state and local governments have relatively limited influence over actual construction rates. vivian chan, VancouverKPMG partner in the Global Infrastructure Advisory Group based in .

“Just doing more and faster is not enough,” says Chan. “Providing housing requires new models that bring together all levels of government, nonprofits, and the development community. We have an opportunity to rethink and reinvent the way we build cities and communities. But , which requires governments to do something fundamentally different.”

She says the main concern for local governments is whether they now and continue to have the resources to properly design and service the surge in much-needed new housing.

“The reality is that most municipalities don’t have the bandwidth or technology to navigate the complexities of accessing much-needed federal grant programs,” Chan said. “What is important is not just the amount of money available to start construction, but the reliability and sustainability of the funding sources for all the infrastructure needed to support housing development.”

Main findings

-

94 percent 534% of small and medium-sized businesses (SMBs) business leaders say high housing costs and lack of supply are the biggest risks they face Canada’s Should be a top priority in the upcoming federal budget

-

87 percent They say rising costs of living (mainly due to housing costs) are forcing organizations to spend more to attract and retain talent.

-

87 percent Budgets include rising labor costs due to competition for talent, inflation, and rising prices for affordable housing.

-

89 percent He says public and private sector cooperation is needed to solve the housing crisis.

-

81 percent They say high prices and a lack of affordable housing are hurting their ability to attract and retain employees.

-

87 percent is expected to put inflationary pressure on Canada Will last until housing shortages and high rents are solved

-

84 percent Say that high prices/lack of affordable housing are a bigger threat/risk to the economy than inflation

innovative housing tax breaks

More than 8 out of 10 people (86 percent) believes the government should use the income tax system to make housing more affordable, including making mortgage interest tax deductible. 88 percent They argue that the federal government should maintain the current capital gains consolidation rate (50 percent) and the principal residence exemption and lifetime capital gains exemption.

Similarly, 85 percent An innovation similar to the tax-free First Home Savings Account, where Canadians save for their homes, to provide relief to existing homeowners facing mortgage renewals as a buffer against mass mortgage defaults. Agree that the government needs to introduce sustainable and repayable tax measures.

The federal government says it is working with other levels of government to reduce bureaucracy and encourage construction, and has introduced a variety of federal housing-related tax measures in recent years. Brian ArnewaneKPMG, Senior Advisor, National Tax Center Canada. These measures include favorable changes such as GST rebates on rental housing construction, as well as enhanced measures such as underutilized housing tax, ‘anti-flip’ tax and a two-year extension of the ban on foreign buyers. January 1, 2027), and the disallowance of deductible expenses for short-term rentals, he says.

“Our research reveals strong support from the business community for innovative tax policies to stimulate housing supply and construction and provide relief to homeowners facing rising interest rates and mortgage renewals. ” said Arnewein.is the most effective mechanism to deal with Canada’s When it comes to housing, there is a clear view among business leaders that more innovative thinking is needed and that government has an important role to play. ”

Learn more about how to streamline your grants management process.

Click here to read about how Contec can help address your housing and infrastructure challenges.

About KPMG Business Research – Union Budget 2024 Edition

At KPMG Canada Survey of 534 Canadian companies From February 3, 2024 to February 27, 2024, using Sago’s Methodify online survey platform. All respondents are executive or executive level decision makers. 31% of major companies 500 million dollars to 1 billion dollars Total annual income. 14 percent; 300 million dollars to $499 million; 35 percent; 100 million dollars and $299 million; 19 percent; 10 million dollars to $99 million And the remaining 1% is 9 million dollars below. His 75% of companies are private companies and 25% are publicly traded companies. 42% are family-owned businesses.

About KPMG Canada

KPMG LLP is a limited partnership, Canadian-owned and operated full-service audit, tax and advisory firm. For more than 150 years, our experts have provided consulting, accounting, auditing and tax services to Canadians, inspiring confidence, inspiring change and driving innovation. KPMG employs more than 10,000 people in more than 40 locations, based on our core values of integrity, excellence, courage and working together for better. Canada, serves private and public sector customers. KPMG is consistently ranked as one of: Canada’s We are a top employer and one of the best places to work in the country.

Our firm is established under the following laws: Ontario It is also a member of KPMG’s global organization of independent member firms affiliated with KPMG International, a UK company limited by guarantee. Each KPMG company is a legally separate and independent organization and describes itself as such. For more information, visit home.kpmg/ca.

To arrange an interview with a KPMG spokesperson, please contact:

caroline van hasselt

National communication

At KPMG Canada

(416) 777-3288

cvanhaselt@kpmg.ca

nancy white

National communication

At KPMG Canada

(416) 777-3306

nancywhite@kpmg.ca

SOURCE KPMG LLP

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/March2024/27/c5957.html

[ad_2]

Source link