[ad_1]

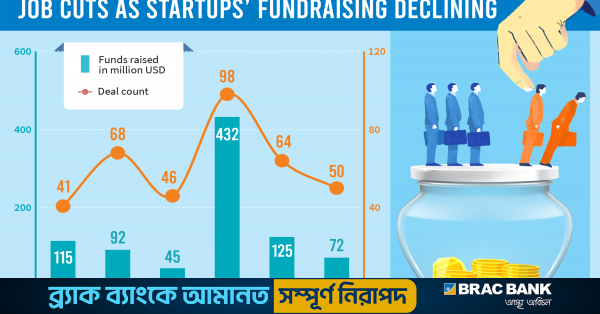

According to advisory firm Lightcastle Partners, the amount of disclosed investment in Bangladeshi start-ups fell from $125 million in 2022 to $72 million in 2023, but SoftBank’s investment in bKash in 2021 The total amount jumped to a record $432 million, including a $250 million investment. High inflation, which has hovered around 10% since March of this year, has forced consumers to tighten their belts and made it difficult for businesses to maintain sales volumes.

Suffering from a lack of funding and high inflation, Bangladeshi startups have resorted to aggressive cost-cutting and job cuts for more than a year, with startups’ labor costs falling by nearly a third since mid-2022. , industry officials said.

According to the company, the number of employees, excluding freelancers, has decreased from about 50,000 to about 35,000 in just over a year.

Two years ago, grocery delivery pioneer Chardar expanded into tier-2 cities, but a significant rise in commodity and energy prices forced it to suspend operations in certain areas. Consumers had unsustainable living costs and were not ordering large amounts. As a result, the company suffered financial losses that led to service suspension in those areas.

Before the crisis, Chardar employed about 3,200 people, but subsequent downsizing has reduced the company’s workforce to less than 2,300, according to co-founder and CEO Waseem Alim.

Even fast-growing startups that were hiring almost every month began to lay off employees at regular intervals in a phased manner to reduce labor costs.

Before the funding crisis surfaced in the middle of last year, more than 2,000 Bangladeshi startups, including e-commerce and mobile financial services, employed a total of about 50,000 people, said Mohammad Shahab Uddin, vice president of the Bangladesh E-Commerce Association. The employment (e-Cab) is a testament to the significant growth that has quadrupled employment opportunities in just a few years.

According to advisory firm Lightcastle Partners, the amount of disclosed investment in Bangladeshi start-ups fell from $125 million in 2022 to $72 million in 2023, but SoftBank’s investment in bKash in 2021 The total amount jumped to a record $432 million, including a $250 million investment.

High inflation, which has hovered around 10% since March of this year, has forced consumers to tighten their belts and made it difficult for businesses to maintain sales volumes.

Over the past year and a half, funding has become the most important issue for startups, with venture capital firms around the world holding back on funding even when startups show solid growth and great potential. said Shameem Ahsan, chairman of Venture Capital & Private. Bangladesh Equity Association (VCPEAB).

As a result, all but a few growing startups have had to halt expansion or downsize in order to cut costs and survive due to anticipated funding shortfalls.

Shaukat Hossain, director of VCPEAB and venture capital expert, said the employment scenario in the technology industry has reversed in 2022 as global financial markets enter a tightening cycle and startup investors become more conservative. Stated.

He estimates that payrolls for employees in the startup sector have already shrunk by a third, to about 35,000 people, excluding freelancers.

For example, Sheba Platforms, the country’s largest technology service ordering platform pioneer, was forced to put its expansion plans on hold last year after foreign investors pulled out at the eleventh hour.

Faced with a severe lack of funding, Sheba had to reduce the size of its team from more than 500 people to less than 100. But this year, with the support of local investors, Sheba is back and planning major expansion with its Small Business Solutions Package app. , resulting in the hiring of more than 250 new employees.

Adnan Imtiaz Halim, founder and CEO of Sheba, told TBS that the company currently employs about 330 people and will add about 50 more employees next year. He said he is aiming to add .

Technology entrepreneur AKM Fahim Mashroul, founder and CEO of Bdjobs, the country’s top job portal, said that unlike in many other countries, companies do not publicly announce job cuts. They said they were reluctant to communicate and most were taking a tricky approach to reducing staff.

Instead of transparent communication, many tech companies implemented downsizing plans in stages, citing various reasons. Additionally, some companies create confusion by combining employee and freelancer numbers when reporting the number of employees.

Industry insiders say employers receive a significant number of job applications from departing executives from prominent growth-oriented startups such as ShopUp and Foodpanda, which have become lucrative workplaces for thousands of individuals during the pandemic. He noted that the trend has been repeated throughout this year.

More than a dozen current and former employees told TBS on condition of anonymity, citing non-disclosure agreements, that the two startups have frequently made substantial and It is said that the number of direct jobs has been reduced.

Both startups reported cumulative losses of over Tk 650 million in 2022, according to regulatory filings from their overseas parent companies.

Foodpanda declined to comment, while ShopUp disputed information provided by insiders and disputed claims of significant job cuts.

Rather, ShopUp claimed that its sales will increase six times to around Tk 4 billion in 2023, riding on the bulk commodity business in the B-2-B segment. The company said all business segments are already profitable before taxes, depreciation and amortization.

However, the significant reduction in office floor space (already more than half) appears to coincide with the alleged job cuts. Both Foodpanda and ShopApp have been consolidating their former locations across five to seven floors in the Tokyo metropolitan area into a single-floor office since mid-2022.

Also in April, ShopApp announced a freelancer model based on direct hiring of delivery drivers from its third-party logistics arm, Redx, but insiders told TBS it was a team of more than 2,000 people. Ta.

Third-party logistics company Paperfly missed out on the second tranche of Tk100 million investment announced by Indian investors last year and ceased operations in September with about 700 employees amid severe cash crunch I had no choice but to do it. It then reopened on a smaller scale in November.

Shameem Ahsan said that in the changing funding environment, startups had to shift away from the focus on rapid growth before the Ukraine war and prioritize withstanding tough business conditions.

“Reducing administrative and payroll costs is a key element of cost optimization during challenging times,” he said.

In 2023, only a handful of leading startups have emerged as online job creators, with Sheba Platforms leading the list alongside the likes of courier-to-food-delivery-to-ride-sharing startup Pathao and homegrown smart logistics company SteadFast. ing.

According to Shahab Uddin of e-Cab, around 200 new startups have hired talent this year, contributing to reducing the impact of startups on the employment landscape. Otherwise, the recession in 2023 could have been even more severe.

During the crisis, governments grabbed the financing baton as foreign investors dragged their feet. Startup Bangladesh, a state-run venture capital firm, was keeping dozens of potential startups in the country alive.

Venture capital expert Shaukat Hossain said, “Funds need to be bigger, especially for growth-stage start-ups that have the potential to scale significantly in the fast-growing Bangladeshi economy.” .

The government is pursuing the vision of ‘Smart Bangladesh by 2041’ and aims to support the creation of 50 domestic unicorn startups that will lead to the creation of 1 billion jobs over the next 20 years.

The government has recognized MFS players bKash and Nagad as two unicorn startups in the country with a market value of over $1 billion.

According to Startup Bangladesh, startups have already created income opportunities for 1.5 million people in Bangladesh.

Neighboring India has emerged as one of the world’s most vibrant and fastest-growing startup ecosystems, with nearly 100,000 recognized startups, including over 100 unicorns. The country has serious hopes that its technology-enabled and highly scalable businesses will reach the top of the world. The goal is to become a $5 trillion economy.

However, as the funding winter continues, investment in Indian startups has fallen 60% year-on-year, reaching a seven-year low of more than $10 billion in 2023, according to Inc42. .

Venture capital investors and startup entrepreneurs say Bangladesh aims to attract $5 billion in foreign investment in startups every year and needs to remove barriers faced by investors while increasing the number of startup success stories. He said there is.

[ad_2]

Source link