[ad_1]

Hedge fund manager Cathie Wood owns Nvidia (NASDAQ:NVDA) stock price rise. She continues to sell her NVDA stock ahead of fourth quarter earnings. wall street journal report. Notably, NVIDIA stock is up nearly 47% since the beginning of the year. Moreover, it has increased by approximately 252% in one year. The semiconductor giant will announce its financial results for the fourth quarter of fiscal year 2024 on February 21st.

When you talk to journal, Wood said Nvidia is a leader in the field of artificial intelligence (AI). However, she believes NVDA is a cyclical stock and expects increased competition and destocking to pose challenges. Wood acknowledged that she recently sold about $4.5 million worth of Nvidia stock.

Nvidia stock: Analysts raise price target

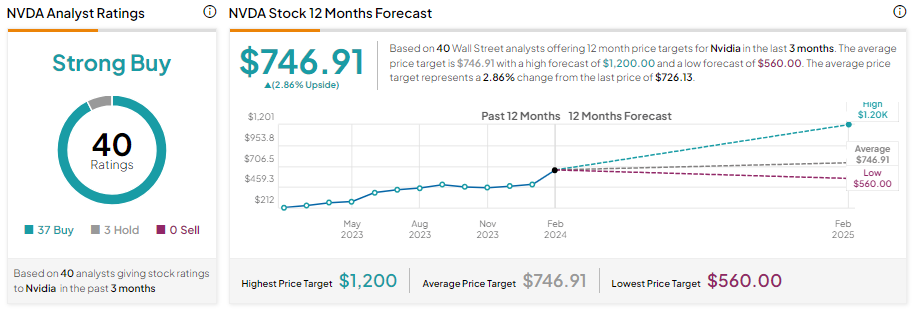

Although Wood has sold NVDA stock, analysts remain optimistic about the stock’s prospects, with several raising their price targets and maintaining their bullish stance.

February 16: Wedbush (price target increased from $600 to $800), Wells Fargo (price target increased from $675 to $840), Barclays (price target increased from $650 to $850) , analysts at Oppenheimer (raised price target from $650 to $850) announced on February 16th. ). These analysts expect NVDA to generate solid earnings and provide a promising outlook throughout the year.

Nvidia – Consensus forecast for Q4

Analysts expect NVIDIA to report revenue of $20.37 billion, up from $6.05 billion in the year-ago quarter. Strong momentum in the data center business, driven by demand for AI computing, will support the company’s top-line growth.

A significant increase in sales could weigh on fourth-quarter earnings. Wall Street expects NVDA to report earnings per share of $4.59 in the fourth quarter, compared with $0.88 a year ago.

Is Nvidia stock a buy, sell, or hold?

Nvidia stock has a consensus rating of “Strong Buy” based on 37 buy recommendations and 3 hold recommendations. However, due to the significant rise in the company’s stock, analysts’ average price target of $746.91 suggests a potential upside of 2.86% from current levels.

disclosure

[ad_2]

Source link