[ad_1]

(Bloomberg) — The world’s best-performing ESG fund in 2023 was founded by Ark Investment Management LLC and is powered by a huge bet on cryptocurrencies.

Most Read Articles on Bloomberg

The $2.4 billion Nikko AM Ark Positive Change Innovation Fund (ticker NIPCIPJ LX) returned 68% last year, more than double the return delivered by the S&P 500. Its largest holding is Coinbase Global Inc., accounting for nearly a tenth of the fund. , according to data compiled by Bloomberg. Nikko Ark Fund is registered as a fund that “promotes” ESG under European regulations.

That caps a year of outperformance in a year in which investments in environmental, social and governance-themed funds have faced significant headwinds. Traditional cleantech ESG assets such as wind and solar, which have reserves as capital-intensive projects in these sectors, have been upended by rising interest rates. But his ESG funds, which chose other areas of technology, performed much better.

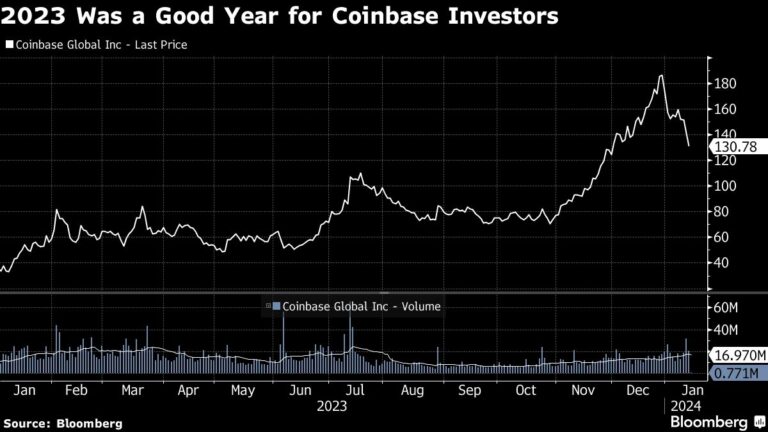

The 21% drop in the S&P Global Clean Energy Index last year coincided with a nearly five-fold jump in the market value of Coinbase, the largest U.S. cryptocurrency exchange. Crypto enthusiasts then started 2024 on a high after the U.S. Securities and Exchange Commission moved forward with the long-awaited approval of a number of Bitcoin exchange-traded funds. (Bitcoin’s rally has since evaporated, some analysts say, in a classic case of “buying rumors and selling facts.”)

Read more: Coinbase at the heart of the Bitcoin ETF machine attracts envy and risk

Thomas Hartman Boyce, a portfolio manager at Ark, said the SEC approval gives Coinbase stock “significant room to maneuver” thanks to its position as the “primary custodian of Bitcoin’s underlying assets.” .

Coinbase is “absolutely the name we believe most in the digital asset category,” he said in an interview.

The fund obtains its model portfolio from Ark Investment Management, founded by Cathie Wood. It is then analyzed and executed by Nikko Asset Management. Hartman-Boyce said the investments are in disruptive technologies that align with the United Nations Sustainable Development Goals. Although he acknowledges that mining Bitcoin consumes a lot of energy, he says the foundation of the fund’s sustainability is tied to transparency around transactions and the provision of financial services to the unbanked. He said he is doing so.

Overall, ESG funds that eschewed traditional green assets and instead focused their efforts on technology outperformed last year. The best performer was his JPMorgan US Technology Fund (JPMUSTC LX), which distributed almost 65% to investors. The fund, like Nikko Ark’s portfolio, is registered as “promoting” ESG (a category formally known as Article 8 of the European Union’s Sustainable Finance Disclosure Regulation).

Hartman-Boyce said Ark is targeting at least 15% compounded annual interest over the next five years on high-conviction public stocks such as Coinbase, Crispr Therapeutics, Block Inc. and Pacific Biosciences of California. He said he is targeting a rate of return.

Investors in the fund are accustomed to volatility, with the fund likely to see a slump of more than 50% in 2022 followed by a strong rally in 2023, according to data compiled by Bloomberg. And so far this year, Coinbase is down about 25%. Of the 28 Coinbase analysts monitored by Bloomberg, 10 recommend Sell, with an average price target of about 7% below the actual trading price.

Peter Graf, Nikko’s chief investment officer for the Americas, said the fund remains committed to its strategy and allocation despite a volatile macroeconomic outlook and a tough start for tech stocks. “We want to provide long-term exposure” to sustainability-related innovations, he said.

“We don’t want to characterize this as just a growth portfolio,” Graf said. “There’s definitely some small-cap flavor. It’s really a bottom-up portfolio that has a strong correlation to growth. But if you think about each individual company, new technologies are going to do well, regardless of the business cycle. It’s the idea of being deaf.”

–With assistance from Suvashree Ghosh.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link