[ad_1]

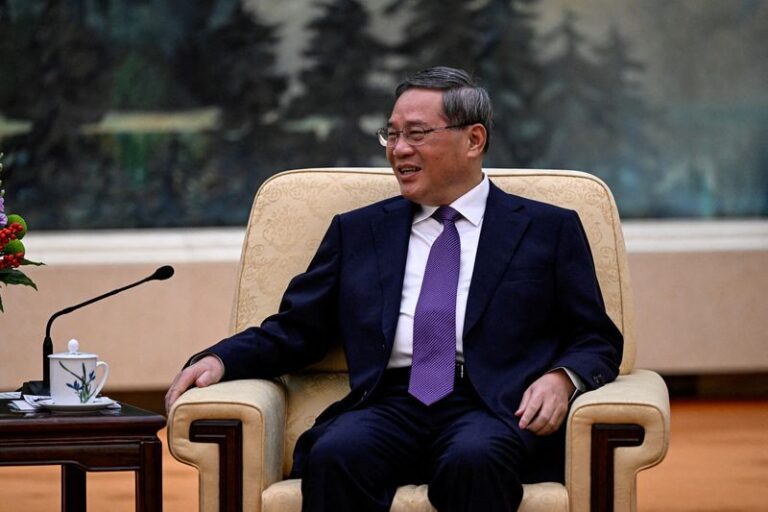

BEIJING (Reuters) – China will carefully study the issues of market access and cross-border data flows and will issue new regulations in these areas soon, Premier Li Qiang said on Sunday. spoke to an audience of policy makers.

“We sincerely welcome companies from all over the world to invest in China and deepen their foothold in China,” Li said.

China is also promoting the development of emerging industries such as biologics manufacturing and will strengthen the development of artificial intelligence and the data economy, Li said at the China Development Forum in Beijing.

The Chinese government eased some restrictions on overseas investment on Tuesday after investment inflows fell by nearly 20% from January to February. China’s cyberspace regulator on Friday eased some security rules on data exports that had worried foreign companies in the country.

Li said at the two-day forum that China’s inflation rate and central government debt burden are relatively low, leaving room for further macro policy measures. He pointed to measures China took last year to reduce real estate and debt risks, saying they were effective.

Li noted the previously announced 1 trillion yuan ($140 billion) of super-long-term special bonds, which he said would stimulate investment and stabilize economic growth.

China’s $18 trillion economy, the world’s second-largest, faces headwinds including a real estate crisis, local government debt problems, industrial overcapacity, deflation risks and a slowdown in foreign investment.

The high-level forum, held annually by the Chinese government since 2000, is an opportunity for global CEOs and Chinese policymakers to discuss overseas investment. Regular attendees include Apple CEO Tim Cook and Bridgewater His Associates founder Ray Dalio.

Reuters reported last week that Lee has no intention of meeting with foreign CEOs visiting Japan at this year’s forum. However, the Wall Street Journal reported Thursday that President Xi Jinping is scheduled to meet with U.S. business leaders on Wednesday after the meeting, which comes as Beijing continues to lock down U.S. companies amid increased outflows of foreign capital. It was reported that this was a sign that he wanted to persuade.

Concerns about the business environment, economic recovery and politics have led to a worsening of foreign companies’ attitudes toward China after China abandoned ultra-strict coronavirus control measures at the end of 2022.

A new action plan to stem the slowdown in foreign investment will create a level playing field for foreign companies, lift restrictions on foreign access for the country’s vast manufacturing sector and allow expansion in sectors such as telecommunications and health care. It is intended to promote

Although the economy has gotten off to a solid start this year, analysts say Lee’s annual growth rate of about 5% is “unambitious” given weak household consumption due to the real estate crisis and sluggish income growth and job market uncertainty. It is evaluated as “target”.

(1 dollar = 7.2293 Chinese Yuan)

(Reporting by Xu Jing, Qiaoyi Li and Colleen Howe in Beijing and Brenda Goh in Shanghai; Editing by Lincoln Feast and William Mallard)

[ad_2]

Source link