[ad_1]

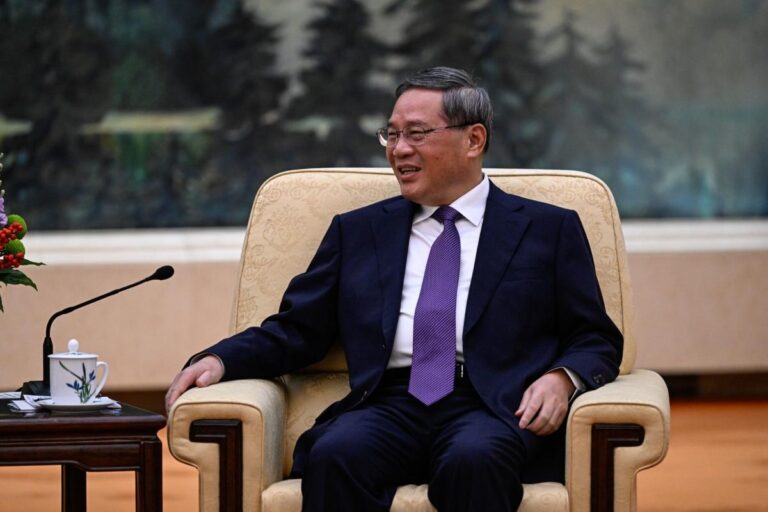

(Bloomberg) — Chinese Premier Li Qiang asked authorities to help stabilize the country’s slumping stock index and investor confidence after mainland China’s benchmark CSI300 index hit a five-year low on Monday. , called for “stronger” measures to be taken.

Most Read Articles on Bloomberg

Chinese stocks have been sold off for much of the past year, hurt by a variety of factors, from a protracted crisis in the housing market to sustained deflationary pressures across the economy. The Chinese government’s policy responses so far have not been enough to lift investor sentiment, who expect further monetary easing or a significant increase in fiscal stimulus.

At Monday’s meeting chaired by Li, China’s State Council was briefed on the review of capital market operations and related work, but did not provide details on what policies the Chinese government is taking, according to an official statement. has not been disclosed. I m thinking.

The bull market in the second half of 2022, triggered by China’s lifting of strict new coronavirus infection restrictions, did not last long, as one of the factors weighing down stock prices was concerns about a decline in consumer confidence. found. The CSI 300 has fallen about 20% over the past nine months.

In the past, China has sometimes intervened in markets by investing state assets. The country’s sovereign wealth fund made such a move in October.

“It looks like something was being prepared in response to the recent sell-off,” said Neo Wang, managing director of China research at Evercore ISI in New York. “The market has been poor enough to deserve all this attention,” he said, referring to domestically listed Chinese stocks and the upcoming mid-February holiday. I can’t afford to watch it.”

The State Council emphasized the need to improve the quality and investment value of listed companies, increase the flow of medium- and long-term funds into the market, and strengthen the inherent stability of the market.

Other measures include strengthening regulations governing capital markets. The State Council said after the meeting that China needs to improve macro policy coherence to consolidate economic recovery.

Bloomberg Economics speaks…

“It is certain that the delay in recovery is at the root of the stock price slump.”

It is important that the government deploys strong measures to quickly turn sentiment around.

– David Qu, Economist

Read the full report here.

Gradual measures may be on hold, but there is nothing to indicate “an extraordinary event that would fundamentally change market expectations,” said a managing director at advisory firm Teneo Holdings in New York. Gabriel Wildeau said. More broadly, he said, “At this point, it is clear that President Xi Jinping does not consider major stock indexes to be an important measure of the success or failure of his economic strategy.”

Still, the drop in Chinese stocks threatens to undermine international confidence in the country’s financial system as President Xi Jinping pushes to make China the world’s “financial superpower.” Foreign investors are already nervous about the Communist Party’s growing influence in the economy.

“We’ve pulled our clients out of China,” Alicia Levine, head of investment strategy at BNY Mellon Wealth Management, told Bloomberg TV on Monday. She said: “Political parties sit at the top of the corporate structure of every large and small company in China, and it is very difficult to invest as such.”

(Updates with analyst comment starting in 6th paragraph.)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link