[ad_1]

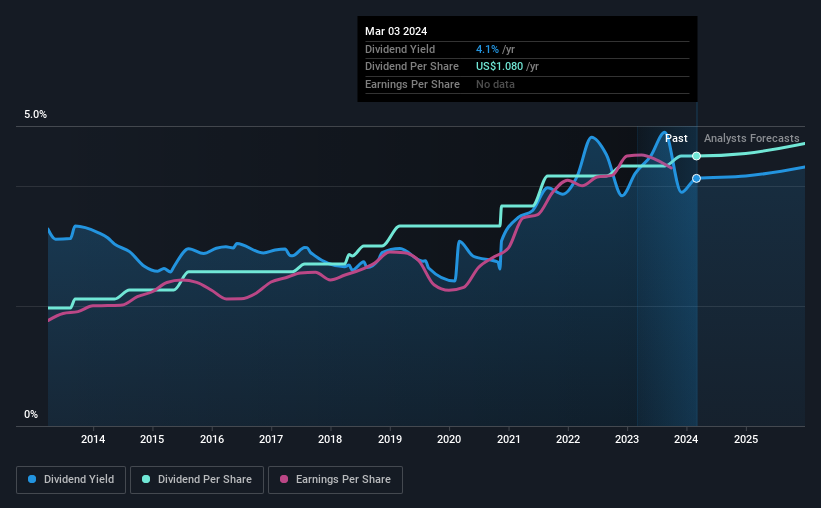

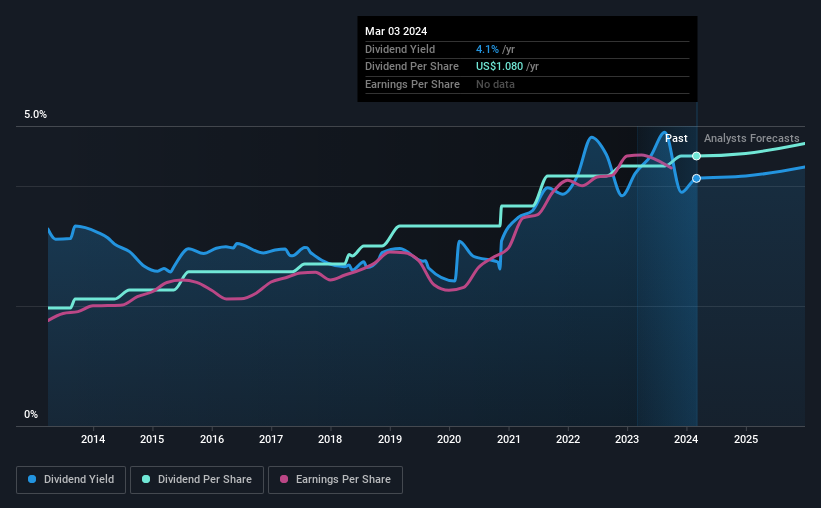

board of directors of ChoiceOne Financial Services, Inc. (NASDAQ:COFS) announced that it will pay a dividend of $0.27 per share on March 29th. This gives the company an attractive dividend yield of 4.1%, which is a huge boost to shareholder returns.

See our latest analysis for ChoiceOne Financial Services.

ChoiceOne Financial Services’ earnings easily cover distributions.

If the payments aren’t sustainable, a few years of high yields won’t matter much.

ChoiceOne Financial Services has been paying dividends for at least 10 years and has a long history of paying out a portion of its earnings to shareholders. Based on ChoiceOne Financial Services’ latest earnings report, the payout ratio is a respectable 35%, meaning the company can pay its dividend with some leeway.

EPS is expected to grow by 3.4% over the next three years. Analysts predict that the future payout ratio could be 38% over the same period, and we think this number can be maintained.

ChoiceOne Financial Services has a proven track record

The company has a consistent track record of paying dividends with little volatility. Over the past 10 years, his annual payments were $0.472 in 2014, and his most recent fiscal year payments were $1.08. This means that the company increased its distribution at a rate of approximately 8.6% per year during that period. These companies can be very valuable over the long term if they can maintain a reasonable growth rate.

ChoiceOne Financial Services’ dividend could grow

Investors in the company will be happy to receive dividend income for some time to come. We’re pleased to see that ChoiceOne Financial Services has grown its earnings per share at 9.6% per year over the past five years. ChoiceOne Financial Services has an upward trend in earnings and a low payout ratio, so there’s no doubt that it has the potential to increase its dividend in the future.

ChoiceOne Financial Services looks like a high dividend stock

In summary, it’s always positive to see a growing dividend, and we’re particularly pleased with its overall sustainability. The company easily earns enough to cover its dividend payments, and it’s great to see these earnings converting into cash flow. Considering these things, this looks like a good dividend opportunity.

Market movements prove how highly valued a consistent dividend policy is compared to a more unpredictable dividend policy. On the other hand, despite the importance of dividends, they are not the only factor that our readers need to know when evaluating a company. For example, we chose 1 warning sign for ChoiceOne Financial Services Here’s what investors should know before putting money into this stock. Is ChoiceOne Financial Services the opportunity you’ve been looking for? Why not check it out? Selection of high dividend stocks.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link