[ad_1]

CI Capital Asset Management’s investment team said in its year-end report that emerging markets, excluding China, have attractive equity valuations and positive real returns in fixed income markets, which will increase as inflation stabilizes. He said it was possible. They expect further increase in investor interest in the coming quarter.

The report highlights how some emerging economies, particularly Turkey and Egypt, where inflation rates reached around 60% and 35% respectively, suffered from a spike in inflation in early 2022 and a loss of investor confidence following the Ukraine war. I showed you what I was doing.

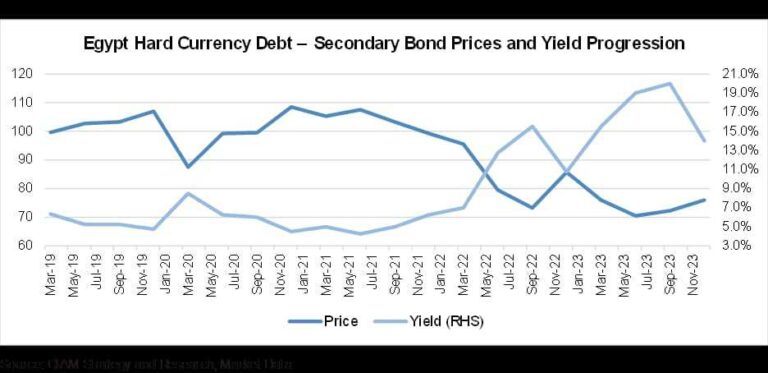

The report singled out Egypt as an example of a market hit by fear that became a “self-fulfilling prophecy.” When foreign investment fled at the beginning of the global crisis, Egyptian authorities quickly reduced the trade deficit and fulfilled all external obligations for the year. However, negative press coverage continued, Egypt’s credit rating was downgraded based on the Egyptian government’s alleged slow implementation of reforms, and the value of Egypt’s assets, currency, and bonds, including dollar bonds, declined.

This brought the yield on Egyptian dollar-denominated bonds to 17-18%, which was higher than Egypt’s local-currency bonds a year and a half ago! The improvement in investor sentiment that has begun in recent months, with yields on Egyptian dollar bonds rising to around 13-14%, and likely to continue, especially if the US changes monetary policy, has strengthened the sector. may present lucrative investment opportunities. It has been severely affected by the recent crisis.

CI Global Asset Management is one of Canada’s largest investment management companies. We offer a wide range of investment products and services. CI Global Asset Management is a subsidiary of CI Financial Corp., a global asset and wealth management company with total assets of $438 billion as of November 30, 2023.

[ad_2]

Source link