[ad_1]

Stocks of retail giant Costco Wholesale Corporation (Nasdaq:Cost) fell more than 4% in after-hours trading Thursday. The company, which operates a membership warehouse and e-commerce website, missed Wall Street’s second-quarter revenue expectations. Considering the decline in COST stock, Oppenheimer analyst Rupesh Parikh suggested a buy on the dip ahead of the second quarter print.

Parikh raised his price target on Costco to $805 from $760 on March 5th. Additionally, analysts maintained a “buy” rating on the stock. Parikh expects Costco’s second-quarter earnings to continue to be weighed down by special dividend payments and the associated loss of interest income, but maintains a long-term fundamental view. Notably, the company paid a special dividend of $15 per share on January 12th.

With this background in mind, let’s take a look at Costco’s second quarter results.

Costco delivers mix in second quarter

Costco reported mixed second-quarter financials. Total revenue amounted to $58.44 billion, an increase of 5.7% over the previous year. The company’s sales benefited from his 5.6% increase in comparable sales and his 8.2% increase in dues. Costco’s e-commerce sales increased 18.4% from the previous year. Despite this, sales fell short of analysts’ average estimate of $59.1 billion.

The company’s earnings per share were $3.92, an increase of 18.8% from the same period last year, and beat analysts’ expectations of $3.62. Costco’s second-quarter EPS was supported by his $94 million tax benefit from special dividend deductions.

What is the outlook for Costco stock?

Costco stock has risen more than 19% since the beginning of the year, and is up about 66.5% over the year. Analysts maintain a cautiously optimistic outlook given the company’s stock price rise.

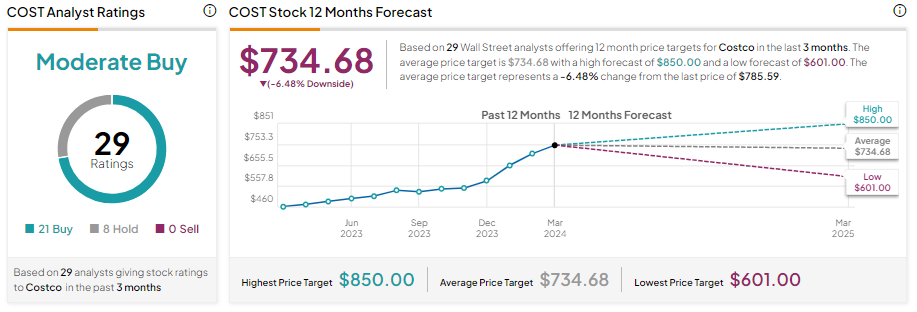

The stock has received a “Moderate Buy” consensus rating with 21 Buy recommendations and 8 Hold recommendations. However, the average analyst price target is $734.68, suggesting a potential downside of 6.48% from current levels.

disclosure

[ad_2]

Source link