[ad_1]

Editor’s note: KC BizCare is a partner of Startland News.

a Newly announced partnership with international nonprofit organization Kiva will boost Kansas City entrepreneurs who have had difficulty securing traditional bank financing, providing social underwriting and access to affordable start-up capital It is expected that this will happen.

Kiva Kansas City (Kiva KC)is a crowdfunded microloan program for small businesses that provides entrepreneurs with access to interest-free loans ranging from $1,000 to $15,000.

Established in partnership with the City of Kansas City, Missouri KC Biz Care Secretariat, this program is operated on the following basis. Kansas City Economic Development Corporation (EDCKC).

Corian Rice of the National League of Cities’ Center for Urban Solutions speaks with Nia Richardson of KC BizCare during the November 2022 grand opening of KC BizCare’s new office at City Hall. Photo by Nikki Overfelt Chifalu, Startland News

“The purpose of the new crowdfunding loan program is to increase opportunities for KC entrepreneurs to access affordable start-up capital for their businesses,” he said. Nia Richardson, KC BizCare Office Managing Director, as well as the City of Kansas City’s Office of Digital Assets. “The National League of Cities was instrumental in making this possible through their CIE program and microlending grants. Their programs provided the tools and resources needed to bring the first hub to Kansas City. provided to us.”

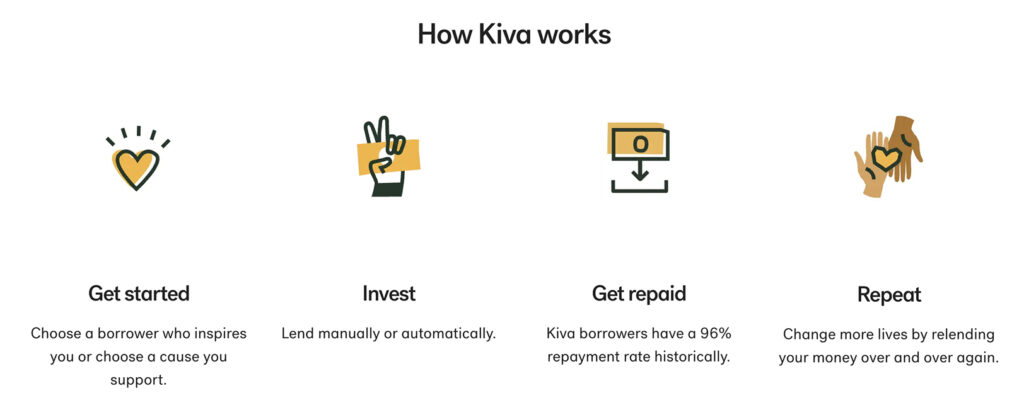

Kiva KC works closely with local entrepreneurs to guide them through the loan application, financing, and repayment process. The program allows lenders to contribute as little as $25 to provide affordable financing to small businesses to support job creation and positive community impact.

Through the newly established Kiva KC site, members of the Kansas City community can sign up to lend money to local business owners and international entrepreneurs who have access to the global Kiva network.

click here Explore Kiva KC. Applications are now being accepted.

Kiva’s ability to provide affordable financing to marginalized entrepreneurs, coupled with EDCKC’s deep knowledge of Kansas City’s local entrepreneurial ecosystem, is sure to have a significant impact on the small business community. the nonprofit said.

Warren S. Galloway, Senior Partnership Manager at KivaUS, said: “We found that identifying capital is one of the biggest challenges cited by business owners.As a result, we find that entrepreneurs not only receive funding, but also receive technical support from EDCKC and their partners in the community. , we see it becoming an economic engine for the community.”

Borrowers who apply for and are approved for a Kiva loan must have received loans as small as $25 from 5 to 40 friends, family, or personal networks. This proves the borrower’s creditworthiness and is part of Kiva’s social underwriting process. Once the borrower reaches the loan goal, he will be posted on Kiva’s online platform where he will raise the remainder of the approved loan amount.

To qualify for Kiva Kansas City:

- Borrowers and businesses must be based in the United States

- Borrower must be 18 years or older

- Loan must be used for business purposes

- Businesses must not engage in multi-level marketing, direct sales, pure financial investments, etc.

- The borrower or business must not be subject to foreclosure, bankruptcy, or lien

- Home-based businesses are eligible for Kiva loans

Businesses must have a business bank account connected to PayPal. Kiva loans are made and repaid through PayPal.

Kiva KC was established through the participation of the City of KCMO in 2022-2023. City Inclusive Entrepreneurship (CIE) Program We have partnered with the National League of Cities (NLC) for microloans. The city is working to build a microlending platform to serve entrepreneurs who don’t have access to traditional finance.

The Kiva KC Hub was funded in part by a $250,000 Capital Access Grant from the Ewing Kauffman Foundation, a $15,000 CIE grant from the National League of Cities, and a $10,000 Dollarwise grant from the U.S. Conference of Mayors.

Tracy Lewis, President and CEO of the Economic Development Corporation of Kansas City (EDCKC), will speak at the Downtown KC Office Summit in October 2023. Photo by Taylor Wilmore, Startland News

“We are pleased to partner with the City of Kansas City to establish a Kiva hub in our region,” he said. Tracy Lewis, President and CEO of EDCKC. “This relationship allows us to mentor and support the important small businesses that help expand our economic ecosystem, while also bringing in disadvantaged participants who are typically excluded. Masu.”

RELATED: EDKCC boasts the right team at the right time, CEO says agency is rebuilding its reputation

With a focus on helping minority and women entrepreneurs take back control of their finances, EDCKC established the role of Capital Access Manager for Kiva KC.

“We will now be able to guide interested borrowers locally in Kansas City through the Kiva application, financing and repayment process, making the program even more accessible,” said Regina Sosa, capital access manager at EDCKC.

The Kiva KC initiative is part of a new small business “Get Started” capital program launched in 2024 by EDCKC and the KC BizCare Office. Small Business Subsidy Program within a campaign that has already started.

Related: KC announces new capital program for small businesses, starting with Microbiz subsidy

[ad_2]

Source link