[ad_1]

global trade finance market

DUBLIN, March 6, 2024 (Globe Newswire) — “Global Trade Finance Market by Product (Commercial Letters of Credit, Guarantees, Standby Letters of Credit), Transactions (Domestic, International), End Users – 2024-2030 Added to “Forecast” report ResearchAndMarkets.com Recruitment.

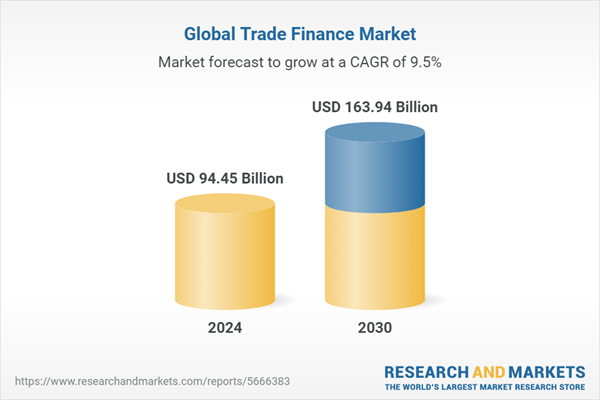

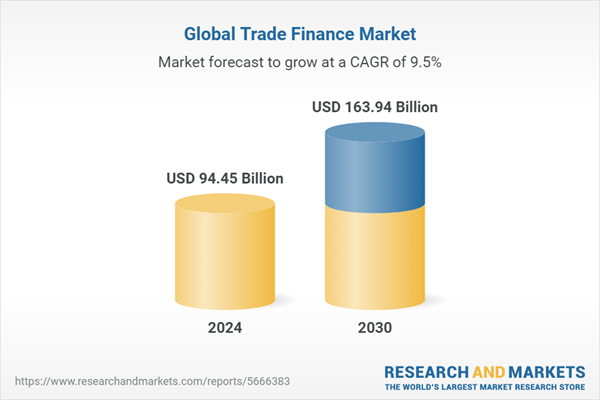

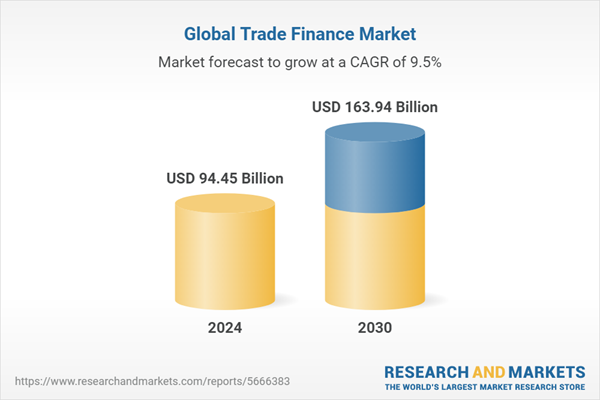

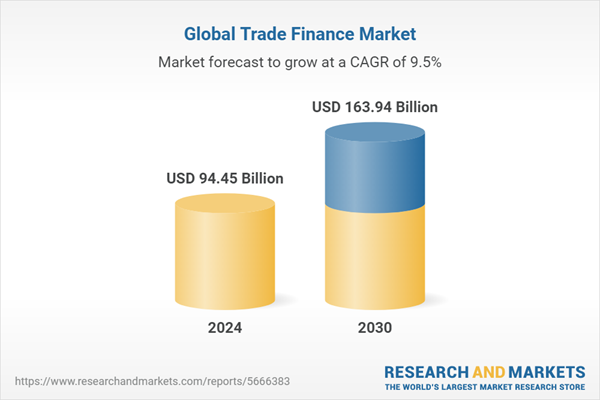

The trade finance market size is estimated to be USD 86.61 billion in 2023 and USD 94.45 billion in 2024, and is expected to grow at a CAGR of 9.54% to reach USD 163.94 billion by 2030. I am.

Market share analysis is a comprehensive tool that provides an insightful and detailed examination of the current state of vendors in the trade finance market. Careful comparison and analysis of vendor contributions in terms of overall revenue, customer base, and other key metrics to help businesses better understand their performance and the challenges they face in competing for market share Become. Additionally, this analysis provides valuable insights into the sector’s competitive characteristics, including factors such as accumulation, fragmentation advantage, and amalgamation characteristics observed over the base year period studied. This expanded level of detail enables vendors to make more informed decisions and devise effective strategies to gain a competitive edge in the market.

Main company overview

The report delves into the recent key developments in the trade finance market and focuses on the key vendors and their innovative profiles. These include AlAhli Bank, ANZ Bank, Banco Santander SA, Bank of America Corporation, BNP Paribas SA, Citigroup Inc., Commerzbank AG, Credit Agricole, Deutsche Bank AG, Euler hermes Group, HSBC Holdings PLC, ICBC, Japan Export/Import Banks include JPMorgan. Chase & Co., Mitsubishi UFJ Financial Inc., Morgan Stanley, NatWest Group PLC, Riyadh Bank, Standard Chartered, UniCredit SpA, and Wells Fargo & Company.

Market segmentation and coverage

This research report categorizes the Trade Finance market to forecast revenue and analyze trends in each of the following submarkets:

-

product

-

transaction

-

End-user

This report provides valuable insights on the following aspects:

-

Market Penetration: Provides comprehensive information about the market served by key companies.

-

Market Development: Delve deep into lucrative emerging markets and analyze their penetration across mature market segments.

-

Market Diversification: Provides detailed information on new product launches, untapped geographic regions, recent developments, and investments.

-

Competitive Assessment and Intelligence: Perform a thorough assessment of leading companies’ market share, strategies, products, certifications, regulatory approvals, patent status, and manufacturing capabilities.

-

Product development and innovation: Provides intelligent insights into future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

-

What is the market size and forecast for the trade finance market?

-

Which products, segments, applications, and areas should you consider investing in during the forecast period for the Trade Finance market?

-

What are the technology trends and regulatory frameworks in the trade finance market?

-

What is the market share of the key vendors in the trade finance market?

-

Which modes and strategic moves are suitable for entering the trade finance market?

Key attributes:

|

report attributes |

detail |

|

number of pages |

180 |

|

Forecast period |

2024-2030 |

|

Estimated market value in 2024 (USD) |

$94.45 billion |

|

Projected market value to 2030 (USD) |

$163.94 billion |

|

compound annual growth rate |

9.5% |

|

Target area |

global |

Main topics covered:

1.First of all

2. Research method

3. Summary

4. Market overview

4.1. Introduction

4.2. Trade Finance Market, by Region

5. Market Insight

5.1. Market trends

5.1.1. Driver

5.1.1.1. Increase in international trade activity

5.1.1.2. The need for safety and security in trade activities

5.1.1.3. The adoption of trade finance by SMEs is rapidly increasing

5.1.2. Restraints

5.1.2.1. Issues related to trade wars and high implementation costs

5.1.3. Opportunity

5.1.3.1. Technological advances and digitalization in trade finance

5.1.3.2. Increased investment and strategic alliances for trade finance development

5.1.4. Challenges

5.1.4.1. Lack of trade finance for developing and low-income countries

5.2. Market segmentation analysis

5.3. Market trend analysis

5.4. Cumulative effects of high inflation

5.5. Porter’s Five Forces Analysis

5.6. Value chain and critical path analysis

5.7. Regulatory framework

6. Trade finance market, by product

6.1. Introduction

6.2. Commercial Letters of Credit

6.3. Warranty

6.4. Standby Letter of Credit

7. Trading financial markets, by trading

7.1. Introduction

7.2. Domestic

7.3. International

8. Trade Finance Market by End User

8.1. Introduction

8.2. Banks and financiers

8.3. Importers and exporters

8.4. Insurance companies and export credit agencies

9. American Trade Finance Market

10. Asia Pacific Trade Finance Market

11. Trade finance markets in Europe, the Middle East and Africa

12. Competitive environment

12.1. FPNV Positioning Matrix

12.2. Market share analysis by major companies

12.3. Competitive scenario analysis by major companies

13. Competitive Portfolio

For more information on this report, please visit https://www.researchandmarkets.com/r/ihqz3n.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

[ad_2]

Source link