[ad_1]

General Motors, Ford and Stellantis are now in a race that investors cheer, but may look back on as foolish in a few years.

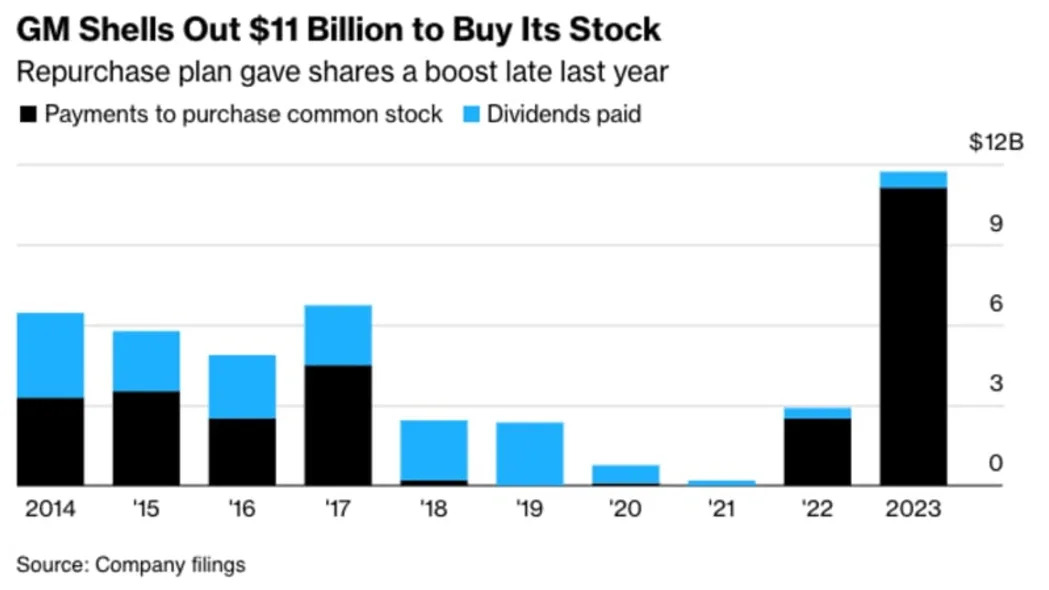

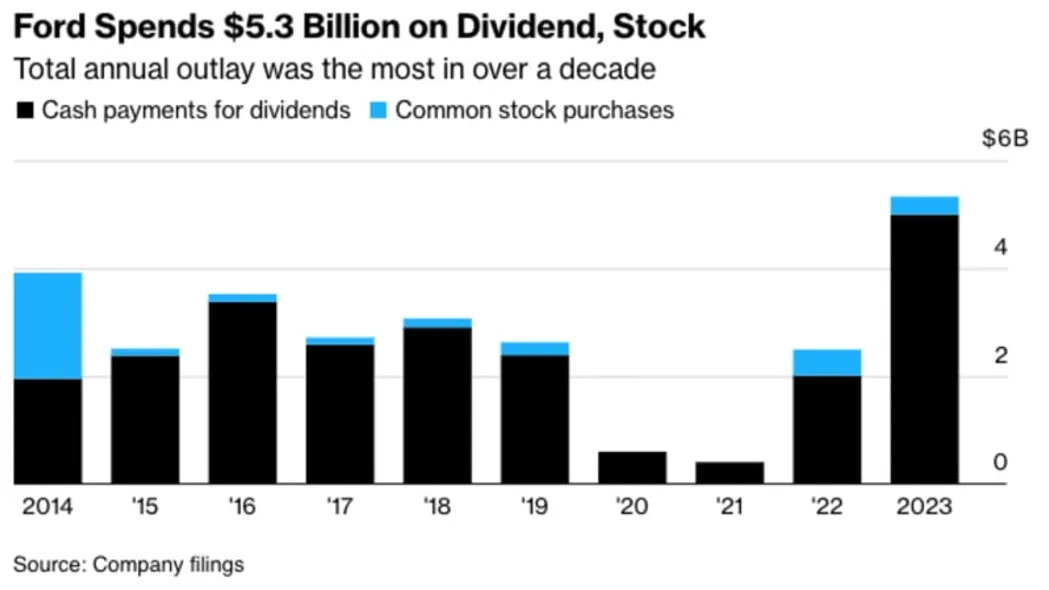

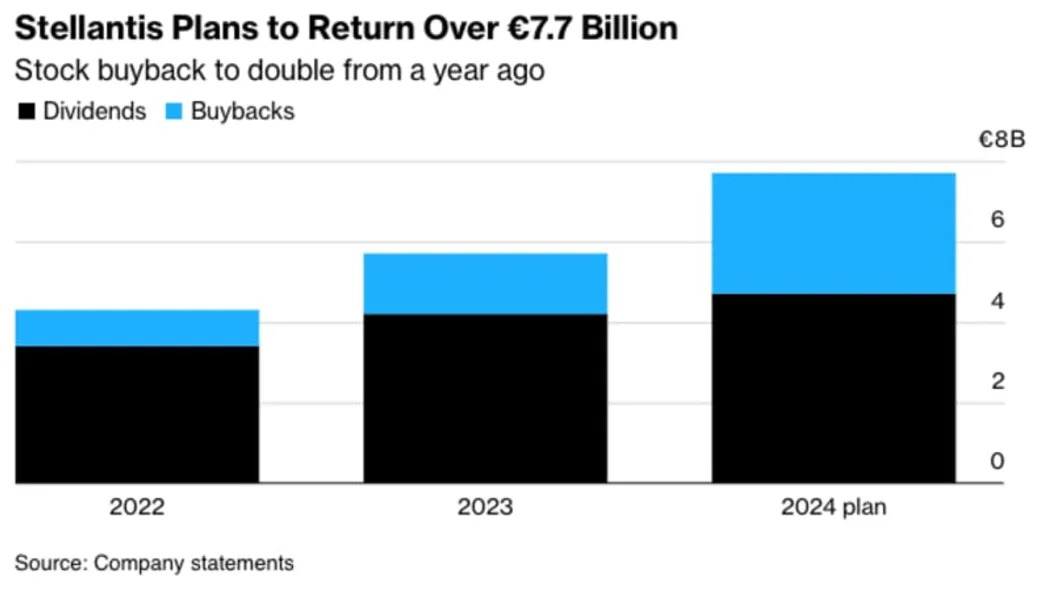

The three spent a combined $22.7 billion on stock buybacks and dividend payments last year. That’s a staggering sum for a company that was pleading poverty just a few months ago, when the United Auto Workers union demanded, and ultimately won, a more expensive labor contract.

It’s also an odd use of cash, considering how late these automakers have been in the transition to electric vehicles. The Detroit Three are increasingly hedging their bets on battery electric models, even as Tesla and China’s BYD overtake them. So far, their early bets have cost them big bucks, but cutting back on investment while allowing shareholders to splurge puts their long-term future at risk.

GM made the big move late last year when Chief Executive Officer Mary Barra announced the largest stock buyback plan in the company’s history and increased its dividend by a third.

It would be a different story if Barra achieved the “breakthrough year” he predicted for EVs in early 2023 and GM had the cash to spend, but that wasn’t the intention.

GM missed its EV production goal by a mile. The company’s battery joint venture factory has been plagued by persistent manufacturing issues, and as the year drew to a close, a software bug forced the company to halt sales of its new Chevrolet Blazer electric car shortly after its launch. lost.

Ford also didn’t have the year they had hoped for in terms of EVs. The company was forced to cut prices on its Mustang Mach-E sport utility vehicle and F-150 Lightning pickup truck to stay competitive with Tesla-led competitors. The company cut its weekly production schedule for plug-in trucks in half by the end of the year.

Ford’s EV business loses $4.7 billion a year and expects to be at least $5 billion in the red by 2024. Still, the company spent about the same amount on dividend payments, an especially important source of income for the Ford family.

While GM and Ford took a tough stance on Tesla, which largely failed, Stellantis has suffered little damage in the United States. Things change this year, with the company planning to launch eight battery-electric models with Jeep, Ram, Dodge, and Fiat badges, but these EVs will have a lot of work to do before catching up. .

Whether or not these models do well in the market, shareholders are doing well. Stellantis plans to spend more than 50% on dividends and share buybacks in 2023, and double share buybacks in 2024.

One automaker that doesn’t go out of its way to give cash to shareholders is Tesla. The company has never announced a dividend and has told investors it has no plans to pay any dividends for the time being.

Elon Musk has teased the idea of a stock buyback in 2022, at a time when shareholder anxiety over the Twitter acquisition was at its peak, but Tesla’s board of directors said it was possible to buy back more than 5 billion yen. It never pulled the trigger on a $10 billion share buyback. (For a thoughtful weigh-up of Tesla’s pros and cons, see Liam Denning’s latest Bloomberg Opinion column.)

GM, Ford and Stellantis have performed well in recent months even as industry-wide EV growth begins to slow. GM stock has soared 35% since the company announced its share buyback and dividend plan in late November. Ford is up 21% over the period, and Stellantis is trading at an all-time high.

But even though Tesla’s warning that its growth rate is “significantly slowing” has taken some of the wind out of the equation, Tesla is still a $638 billion company that Detroit can’t afford to take for granted. Don’t just take my word for it, just ask Ford CEO Jim Farley.

“The ultimate competition is going to be affordable Teslas and Chinese cars,” Farley said on Ford’s earnings call this month.

[ad_2]

Source link