[ad_1]

CES 2024, the world’s largest technology show, took place this week. Nvidia (NASDAQ:NVDA) It showed its presence.

Given the major advances in the data center business, attention has been diverted from the gaming division, which was once the company’s main source of revenue.

However, at this year’s event, NVDA announced the latest updates to the RTX/Ada Lovelace series of client GPUs, introducing the “Super” series. These products are touted to offer improved performance and energy efficiency compared to the existing 40 Series lineup, and all at a budget-friendly cost. Additionally, the company’s ACE (Avatar Cloud Engine) microservices provide game developers with the ability to integrate intelligent, dynamic avatars into their games, bringing generative AI to the forefront of the gaming industry.

Deutsche Bank analyst Ross Seymour, who attended the event and spoke with NVIDIA executives, emphasized that gaming remains a top priority for the company. “Although the company’s gaming business has been under the spotlight in recent quarters, NVDA believes the business’ distribution channels remain healthy after ‘strong’ sales during the holiday period, and AI PC We see the arrival of “gaming PC upgrade cycles occurring over the next 12 to 36 months” to potentially drive significant growth,” the analyst explained.

In the automotive business, Nvidia has remained resilient despite complaints of weakness from rival Mobileye. The company attributes its success to a faster and more customer-friendly development process, resulting in success and new vehicle launches in China. With L2+ now the minimum technology level required by automotive OEMs, Nvidia sees an “industry-wide shift to software-defined vehicles.”

“Overall,” the five-star analyst summed it up: business. ”

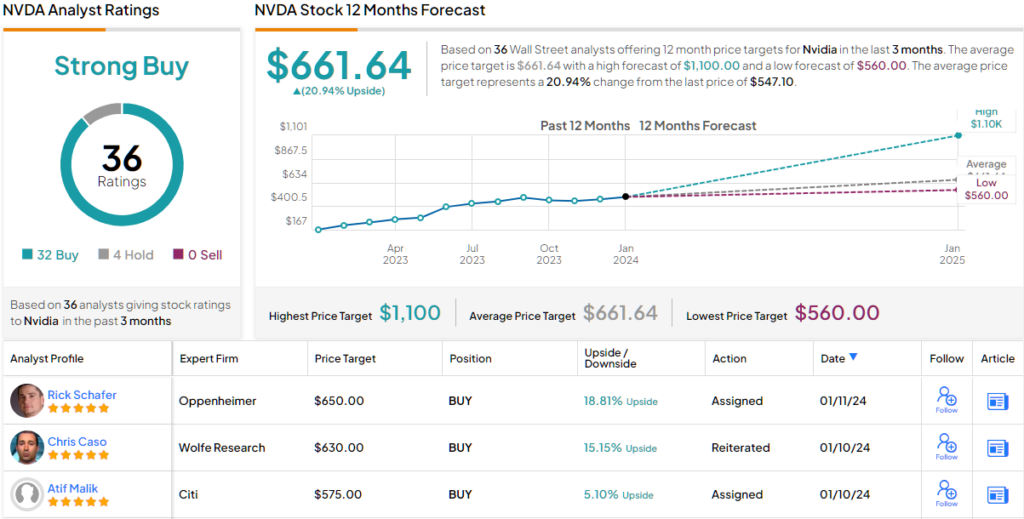

But while this sounds like support, the analyst is currently refraining from making a bull case for NVIDIA, as the stock is trading very close to Rosner’s $560 price target. The company maintains a hold (or neutral) rating on the stock. (Click here to see Seymour’s track record)

Still, Mr. Rosner is in the minority on Wall Street. His three others will join him on the sidelines, but they’re completely outnumbered by his 32, making the consensus view here a “strong buy.” Analysts believe the stock could rise as much as 21% in the coming months, considering the average target is currently $661.64. (look Nvidia stock price prediction)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.

[ad_2]

Source link