[ad_1]

Demand for chips that provide the processing power to train and support artificial intelligence (AI) models is rapidly increasing as governments and technology companies around the world race to deploy AI applications.This is exactly why Nvidia has seen strong revenue and profit growth in recent quarters.

Nvidia’s AI graphics processing units (GPUs) are in such high demand compared to supply that customers will reportedly have to wait 36 to 52 weeks for delivery of their flagship H100 processors. Unsurprisingly, chipmakers are looking to ramp up production capacity for these AI chips, which could sustain impressive stock gains.

However, NVIDIA has returned 239% over the past year, so the stock trades at a premium, with a price-to-sales ratio of 40x and a trailing earnings multiple of 96x. Of course, NVIDIA’s forward earnings multiple of 36x indicates that the stock is expensive. Although the company is expected to deliver impressive earnings growth, a five-year price-to-earnings ratio (PEG) of just 0.7 suggests the stock is actually undervalued relative to expected growth. It means.

Still, some investors may want to look for cheaper alternative investments they can buy to profit from the AI boom.I would recommend the following to those investors: applied materials (NASDAQ:AMAT) –Companies that will benefit from Nvidia’s efforts to increase production of AI chips.

Applied Materials Benefits from AI-Driven Semiconductor Spending

Applied Materials makes semiconductor manufacturing equipment that enables chipmakers and foundries to manufacture chips and integrated circuits. We derive a significant portion of our revenue from sales. samsung, taiwan semiconductor manufacturingand intel.

In fiscal year 2023 (ending October 29, 2023), Samsung and Taiwan Semiconductor Manufacturing Co., Ltd. (also known as TSMC) together accounted for 34% of Applied Materials’ revenue. Intel’s contribution was less than 10%. It wasn’t surprising that Applied Materials’ latest results beat expectations, given that these companies are looking to increase spending on semiconductor equipment in 2024.

Applied Materials announced its first quarter 2024 financial results on February 15th. For the period ending January 28, the company’s revenue was roughly flat year over year at $6.7 billion, but this was better than his $6.48 billion. Consensus estimate. Non-GAAP earnings rose 5% year over year to $2.13 per share, easily beating Wall Street’s expectations of $1.91 per share.

Management’s guidance turned out to be a bonus. Applied Materials expects second-quarter earnings to be $1.97 per share at the midpoint of its guidance range and revenue to be $6.5 billion. Analysts had expected earnings of $1.79 per share on sales of $5.9 billion. However, Applied noted that “capital spending by cloud companies is reaccelerating, fab utilization is increasing across all device types, and memory inventory levels are normalizing,” which could lead to a Explains why the outlook is better than expected.

AI in particular is increasing the opportunities that businesses can address. For example, Applied Materials estimates that demand for high-bandwidth memory (HBM) deployed in AI servers could grow at a 50% annual rate over the next few years. The company also points out that the semiconductor die size required to manufacture HBM is more than twice that of a standard dynamic random access memory (DRAM) die. Therefore, chip manufacturers will need to significantly increase their production capacity to meet the growing HBM demand.

Meanwhile, the advanced chip packaging processes used to make AI chips are also giving Applied a boost. In the latest earnings call, CEO Gary Dickerson said:

In fiscal 2024, we expect HBM Packaging’s revenue to grow to approximately $500 million, quadrupling from the prior year. Additionally, revenue from Advanced His Packaging product portfolio is expected to grow to approximately $1.5 billion across all device types.

Applied Materials also notes that the expanded deployment of high-performance AI data centers will begin mass production of gate-all-around (GAA) transistors, which are 30% more efficient than fin field-effect (FinFET) transistors. The company estimates that its addressable market “could grow by $1 billion for every 100,000 wafers started each month.” [GAA transistor] capacity. “

Unsurprisingly, Applied Materials’ largest customer, Samsung, quickly turned to GAA to manufacture advanced chips using the 3nm process node. Furthermore, the market for GAA transistors is reported to be growing at an annual rate of 39%. This bodes well for Applied Materials, which claims the company is “on track to gain share and capture more than 50% of spending on process equipment used in this new transistor module.” ing.

Stock prices may rise due to accelerating growth

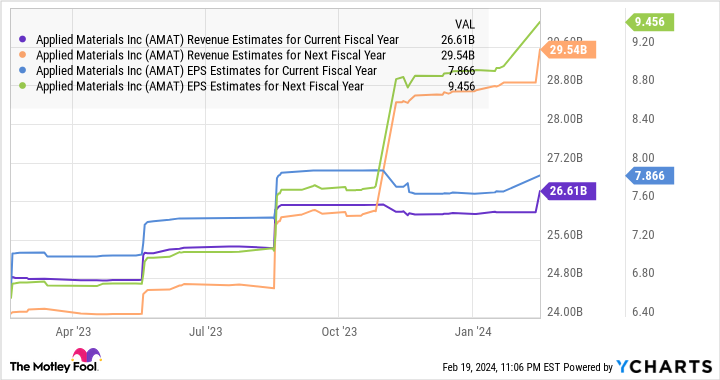

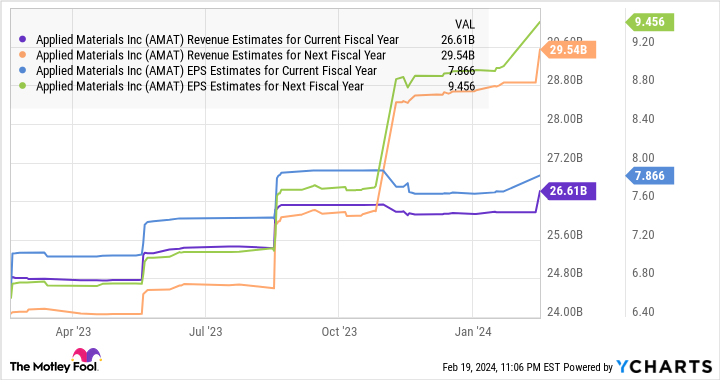

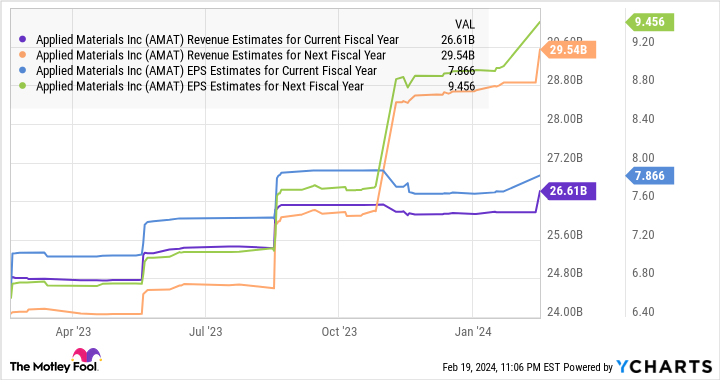

Applied expects fiscal 2024 sales of $26.1 billion, roughly in line with fiscal 2023 sales of $26.5 billion. However, the company’s first-quarter results and guidance for the current quarter suggest it could outperform expectations amid an improving spending environment.

It’s also worth noting that Applied Materials’ profits increased year-over-year. However, analysts expect earnings for fiscal 2024 to be $7.73 per share, down from $8.05 a share last year. Again, the company’s bottom-line first quarter results and current quarter guidance of close to $2.00 per share in Q2 2023 adjusted earnings at midpoint provide a positive surprise on this front. It shows that it is possible.

More importantly, analysts expect Applied Materials’ sales and profits to increase significantly in fiscal year 2025.

Applied Materials currently trades at a price-to-earnings ratio of 22 times. This is well below Nvidia’s price-to-earnings ratio. Of course, Nvidia is growing at a much faster pace, but conservative investors looking for cheap AI stocks to buy right now might consider Applied Materials. Given the surge in semiconductor spending due to AI, it may not be available at such attractive levels in the future.

After all, Applied Materials is up 6% after its latest quarterly report and looks well-positioned to maintain this momentum and continue the bull market.

Should you invest $1,000 in Applied Materials right now?

Before buying Applied Materials stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Things investors can buy right now…and Applied Materials wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 20, 2024

Harsh Chauhan has no position in any stocks mentioned. The Motley Fool has positions in and recommends Applied Materials, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: Long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Did you miss Nvidia? 1 “Artificial Intelligence (AI) Chip Stocks to Buy Before the Bull Market Hits” was originally published by The Motley Fool.

[ad_2]

Source link