[ad_1]

Value Investment Maestro Announces Investment Decisions for Q4 2023

David Herro (Trades, Portfolios), an experienced value investor and chief investment officer for international equities at Harris Associates, made notable changes to his portfolio in the fourth quarter of 2023. . His Herro’s, with a reputation for identifying undervalued companies with growth potential, has been named Morningstar’s International Stock Fund Manager of the Year and Manager of the Year for its investment philosophy.・Won awards such as The Decade. His recent N-PORT filings reveal strategic buys, sells, and adjustments that reflect his commitment to investing in companies with strong management teams and increasing shareholder value.

Summary of new purchases

David Herro (Trades, Portfolios) added two new stocks to his portfolio in the latest quarter.

-

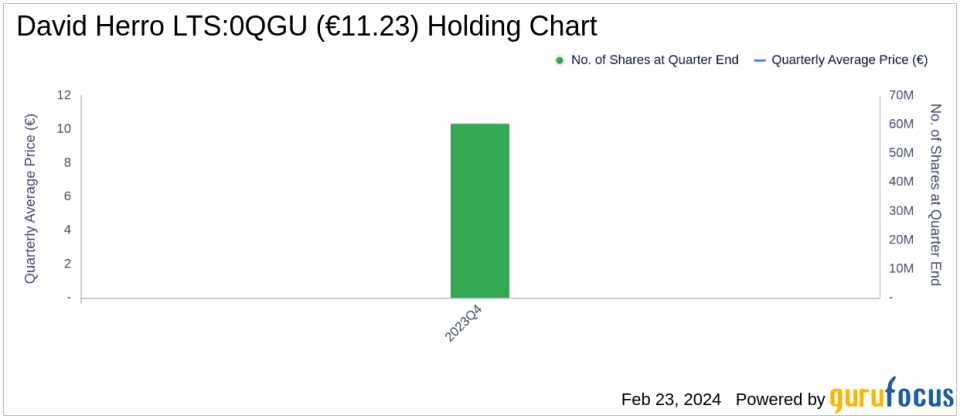

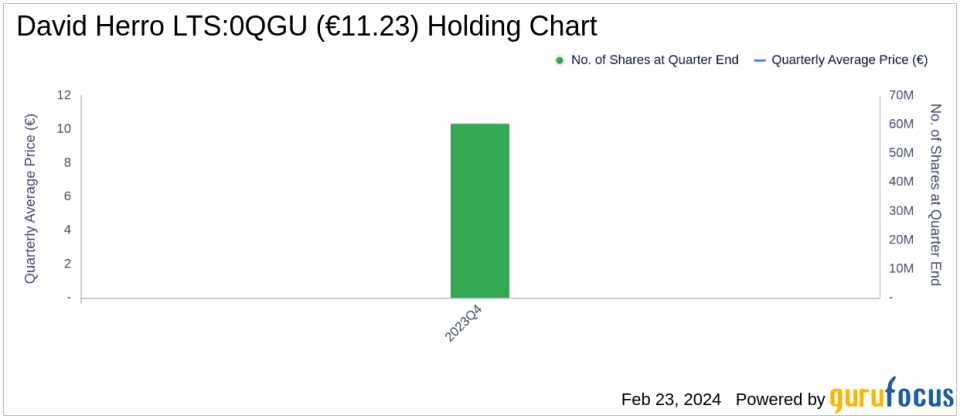

CNH Industrial NV (LTS:0QGU) emerged as the most important addition with 60,303,299 shares, representing 3.71% of the portfolio or a total of 734.29 million shares.

-

Alibaba Group Holding Ltd (HKSE:09988) is the second largest new entrant, making up about 1.38% of the portfolio with 28,167,500 shares, valued at HK$272.71 million.

Key position rises

Herro also strengthened its existing 25 stocks. The most notable increases are:

-

Bayer AG (XTER:BAYN) acquired an additional 3,712,500 shares for a total of 14,204,682 shares. This increases his number of shares by 35.38% and affects his portfolio by 0.7%, bringing his total to 527.36 million shares.

-

Fresenius Medical Care AG (XTER:FME) adds 2,747,100 shares for a total of 12,191,573 shares. This adjustment increases his number of shares by 29.09%, for a total of 510.9 million shares.

Overview of sold out positions

During the fourth quarter of 2023, David Herro (Trades, Portfolio) completely sold three holdings:

-

CNH Industrial NV (MIL:1CNHI) was completely sold, with all 44,302,799 shares sold, impacting the portfolio by -2.89%.

-

Alibaba Group Holding Ltd (NYSE:BABA) was liquidated and all 29,556,200 shares were sold, impacting the portfolio by -1.73%.

Reduction of key positions

Herro also cut positions in 34 stocks. Some of the most significant reductions include:

-

Ryanair Holdings PLC (NASDAQ:RYAAY) was reduced by 1,077,130 shares, resulting in a decrease in the number of shares by -30.02% and a portfolio impact of -0.56%. The average price for the quarter was $109.81, with a return of 21.09% over the past three months and 6.71% year-to-date.

-

Capgemini SE (XPAR:CAP) was reduced by 562,000 shares, reducing the number of shares by -26.5% and portfolio impact by -0.53%. The average trading price for the quarter was $177.19, with a return of 20.91% over the past three months and 17.35% year-to-date.

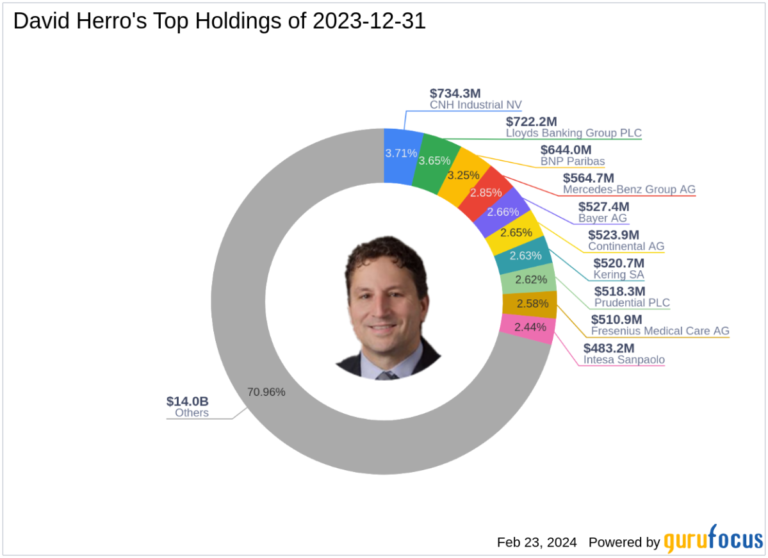

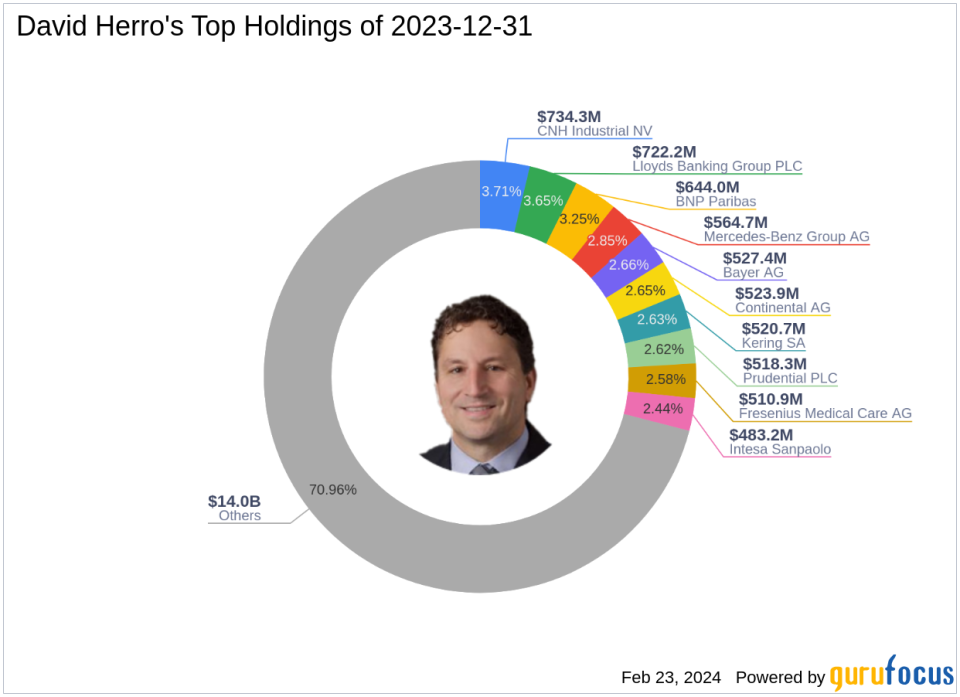

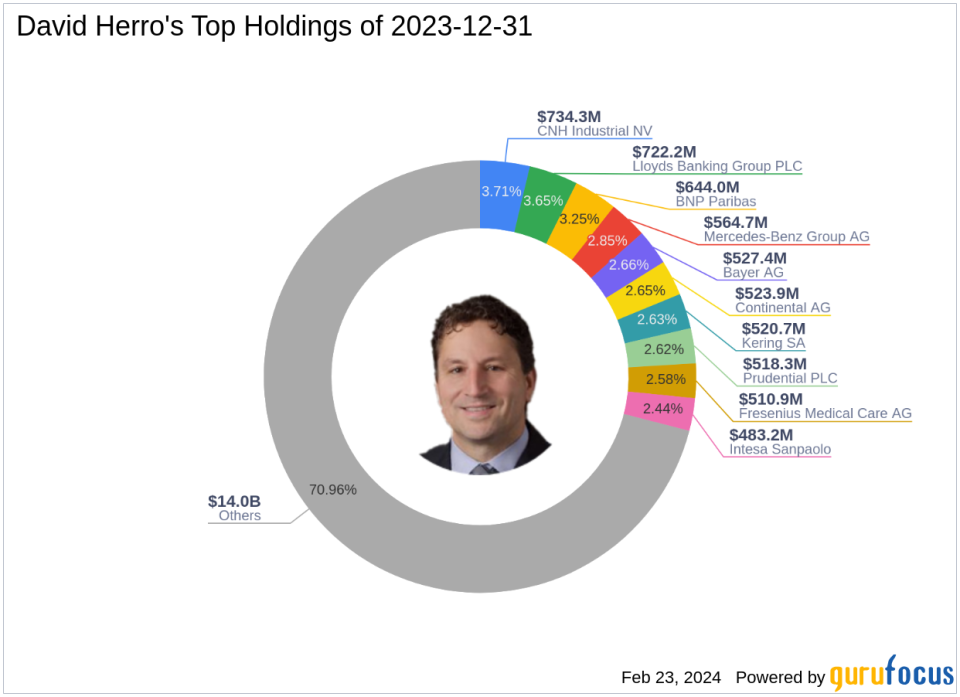

Portfolio overview

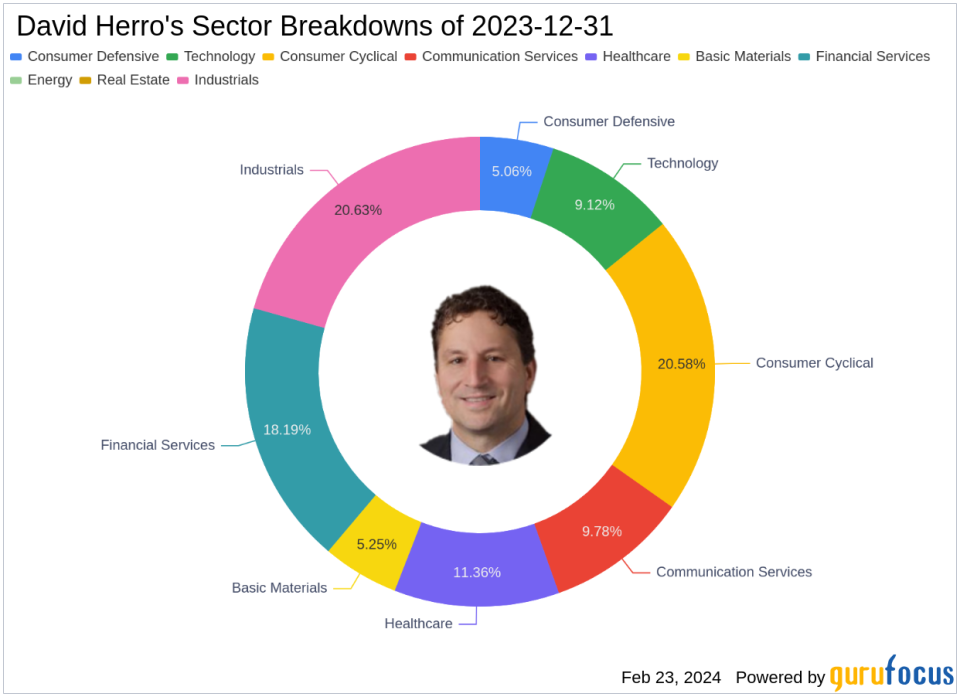

At the end of the fourth quarter of 2023, David Herro’s (Trades, Portfolio) portfolio consisted of 63 stocks. Top holdings include CNH Industrial NV (LTS:0QGU) with 3.71%, Lloyds Banking Group PLC (LSE:LLOY) with 3.65%, BNP Paribas (XPAR:BNP) with 3.25%, and Mercedes-Benz Group AG Contains 2.85% of (XTER). :MBG) and 2.66% for Bayer AG (XTER:BAYN). Investments are mainly concentrated in his eight industries: industrials, consumer circulation, financial services, healthcare, communication services, technology, basic materials, and consumer defense.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link