[ad_1]

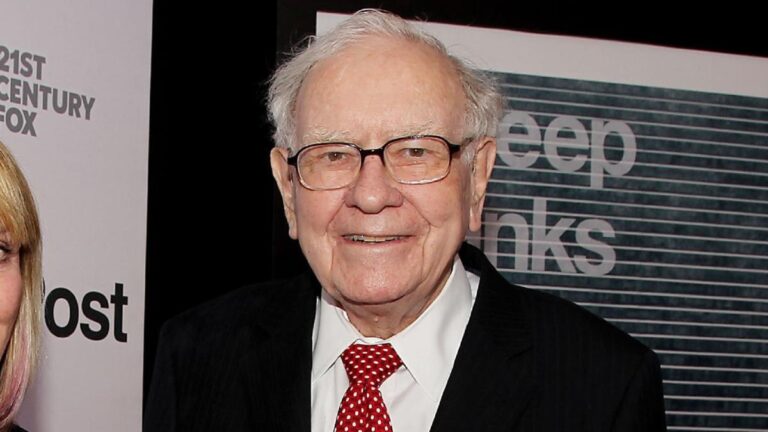

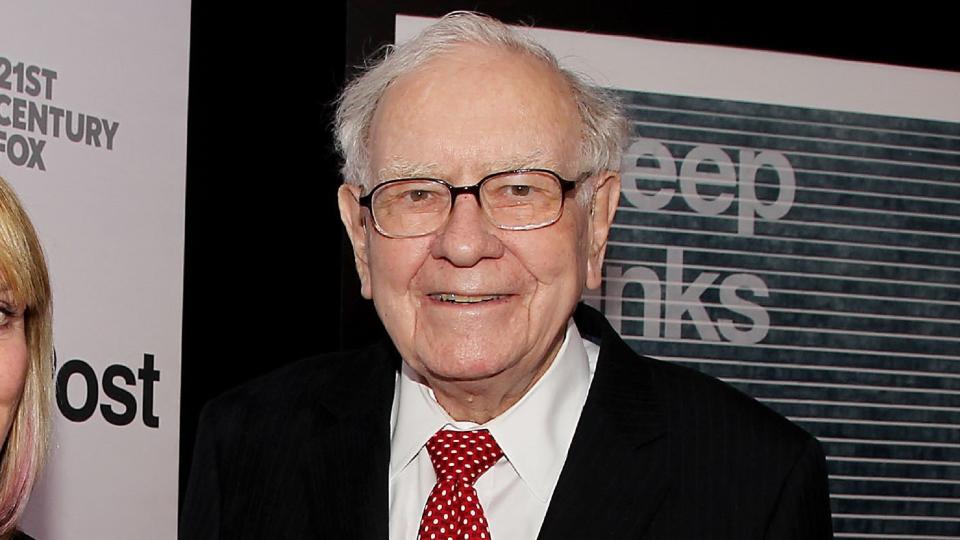

Legendary investor Warren Buffett, also known as the Oracle of Omaha, consistently ranks as one of the richest people in the world, with a net worth of nearly $120 billion in 2024. It’s no wonder his investment moves make national headlines and are imitated. Thousands of small investors are looking to benefit from his investment acumen.

I’m a Financial Advisor: All I Really Need Are These 5 Index Funds

Learn: How to get $340 in cash back per year on things you already buy

As CEO of publicly traded Berkshire Hathaway, Buffett is required to disclose most of his investment moves, but he falls far short of regulatory requirements when discussing his stock holdings. It is also famous for exceeding Although real estate has never been a key element of Buffett’s investment strategy, Berkshire Hathaway has owned a stake in STORE Capital, a REIT focused on single-tenant managed real estate.

sponsor: Do you owe the IRS more than $10,000? Schedule a free consultation to see if you qualify for tax relief.

What is a REIT?

A real estate investment trust (REIT) is a company that owns or operates income-producing real estate. To put it in a fancy way, it collects rent. Most of them are publicly traded on exchanges like the shares of other companies, making them ideal for small investors looking for real estate exposure or larger investments who don’t want to deal with the administrative burden of individual real estate purchases. Attractive for home. . Because REITs can generate frequent and stable cash income from the real estate they own, they also typically pay large dividends.

Buffets and REITs

STORE Capital is not the first REIT owned by Berkshire Hathaway, but only the most recent. However, Berkshire sold its stake in Store Capital in 2022 after announcing that it would be acquired by two outside investment funds. Since then, filings have revealed that Berkshire Hathaway no longer owns stock in other REITs.

I became a self-made millionaire: 5 stocks you shouldn’t sell

That doesn’t mean Buffett is no longer interested in real estate. Given Berkshire Hathaway’s size, buying real estate piecemeal isn’t a viable strategy, but there are other ways to get into the sector. Berkshire’s filings show that in 2023, the company bought nearly $1 billion worth of stock in major homebuilders, including DR Horton, Lennar Corp. and NVR Corp.

Details of GOBankingRates

This article originally appeared on GOBankingRates.com: Does Warren Buffett invest in REITs?

[ad_2]

Source link