[ad_1]

Brian Maxwell, Chief Operating Officer of Dutch Brothers, Inc. (NYSE:BROS) sold 33,900 shares of the company’s stock on December 28, 2023, according to a recent SEC filing.

Dutch Bros. operates as a drive-thru coffee company in the United States. We offer a variety of coffee and non-coffee drinks. The company operates through directly operated stores and franchised stores. Dutch Bros., Inc. was founded in 1992 and is headquartered in Grants, Oregon.

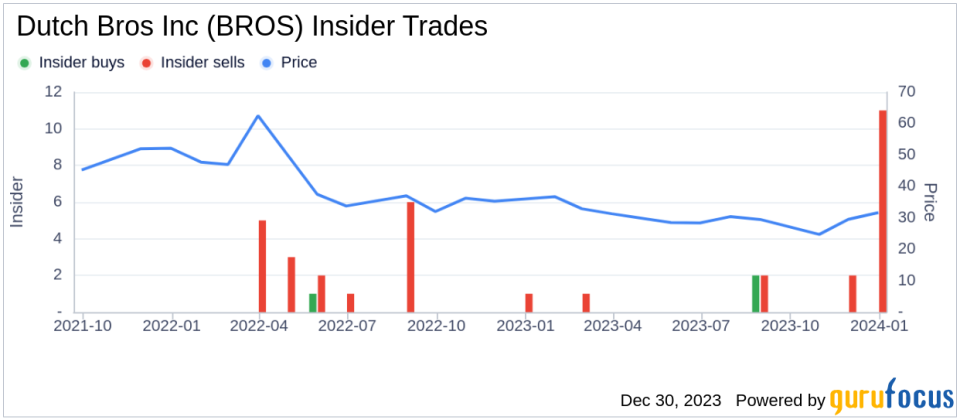

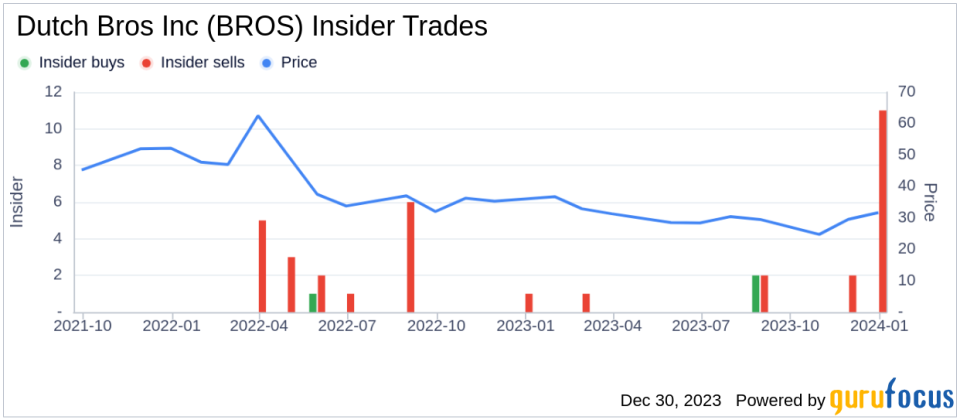

This insider has sold a total of 75,000 shares in the past year, but hasn’t bought any company stock. Recent transactions reflect a continuation of the insider selling pattern.

Dutch Brothers’ insider trading history shows that over the past year, there have been more insider sales than purchases, with 2 insider purchases and 18 insider sales.

In the latest insider trading day, shares of Dutch Brothers, Inc. traded at $32.08, giving the company a market cap of $2.388 billion. The company’s price-to-earnings ratio is 791.75, significantly higher than both the industry median of 23.95 and the company’s historical median price-to-earnings ratio.

Investors and stakeholders often monitor insider transactions as they can provide insight into a company’s performance and an insider’s perspective on the value of a stock. The data provided here is factual and does not contain any analysis or adjectives that might suggest an opinion or recommendation.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link