[ad_1]

A key investment theme for 2024 will be a focus on longevity, or extending lifespans, according to economists who lead geopolitical investing at PwC.

Alexis Crowe, author of the Observer Research Foundation’s Annual Outlook 2024 and visiting senior fellow at the foundation, said the report, which considers economies around the world, predicts that spending on longevity will increase. told me that the investment amount would vary depending on the situation. Depends on where you’re looking.

“Biohacking is all the rage in the United States, and I think we’re moving further into a longevity trajectory. It’s time for individuals to pursue their own DIY biology,” says Tom, also a long-term investor in his role at PwC. said Mr. Crow, who is focused. “This trend is fueling growth in the biotechnology, pharmaceutical, life sciences, venture capital, and health and wellness sectors.”

The trend of biohacking yourself can be as simple as taking anti-aging supplements, or as wealthy entrepreneurs spend more than $2 million a year on various medical interventions and targeted tests. There are also big things like being present. To keep him young, as reported by Fortune Well. In terms of venture capital, probiotics company Pendulum Therapeutics, for example, is backed by investors such as Sequoia Capital.

Biohacking goes hand in hand with the “consumerization of medicine,” Crowe said. Americans in particular have spent significant amounts of money on alternative medicine due to the high cost of health care. Crowe’s report points to other recent studies that estimate the U.S. complementary and alternative medicine market will be worth $411.4 billion by 2030.

“Cautiously optimistic”

Crowe also pointed to wealth management as a significant investment opportunity and sees continued consolidation in the United States. The high interest rate environment has put a lot of stress on alternative asset managers, making them “ripe targets” for consolidation, he said.

As for the overall economy, Crowe seems upbeat. “For the first time in eight years of making this outlook, I’m actually cautiously optimistic about the U.S. economy,” he said. The report said households and businesses “were able to weather interest rates remarkably well and are in relatively good shape, indicating that the elusive soft landing has been achieved.”

Prices rose just 0.2% from November to December, according to the Federal Reserve’s preferred inflation measure, according to a government report Friday. The pace is roughly in line with pre-pandemic levels and just barely above the Fed’s annual target of 2%.

Crow’s base case is a soft landing. But geopolitics could turn that on its head. For example, she noted that “any escalation in the Strait of Hormuz and the Red Sea regarding the Middle East conflict could significantly increase inflation due to higher oil prices.” This could push West Texas Intermediate (WTI) oil prices above $100 per barrel, Crow said. U.S. crude oil reached about $78.01 per barrel on Friday.

Cheryl Estrada

sheryl.estrada@fortune.com

Upcoming events: Fortune’s CFO Collaborative is an invitation-only group of CFOs from leading companies who come together virtually and in-person to have deep conversations about what’s top of mind for finance leaders. Next month’s theme is “Determining the GenAI Value Proposition.” In this intimate dinner discussion scheduled for February 28th in Houston, Texas, Held in partnership with Workday and Deloitte, this event explores how companies can make the most of the AI revolution and the operational and organizational changes they need to embed GenAI. Join me and my colleague Jeff Colvin. luck Senior Editor-in-Chief to sit down with Niccolo De Masi, Chairman of Futurum Group, a global technology advisory firm, and influential CFOs in Houston and beyond.

This is an invite-only event, but CFOs can apply to participate here. If you would like more information, please email CFOCollaborative@Fortune.com.

Leader board

Jay Martin Mr. Martin has been promoted to CFO of Credit Acceptance Corporation (Nasdaq: CACC), effective January 23. Mr. Martin joined the company in 2003 and most recently served as his SVP of Finance and Accounting. He will continue to lead the finance department alongside Chief Financial Officer Doug Bask.

ryan garner He has been appointed CFO of ECS, a provider of technology, science and engineering solutions. Mr. Garner joins ECS from Navistar Defense, LLC, a company that designs and manufactures tactical wheels for government and Department of Defense customers, where he served as CFO. Prior to joining Navistar, Garner served as CFO of CACI International Inc.’s National Security and Innovative Solutions division.

big deal

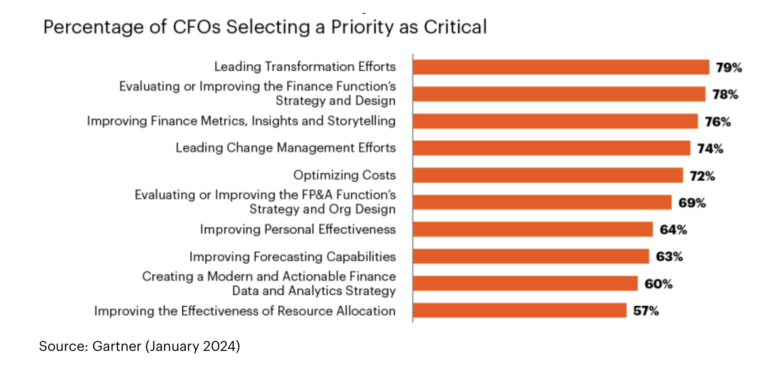

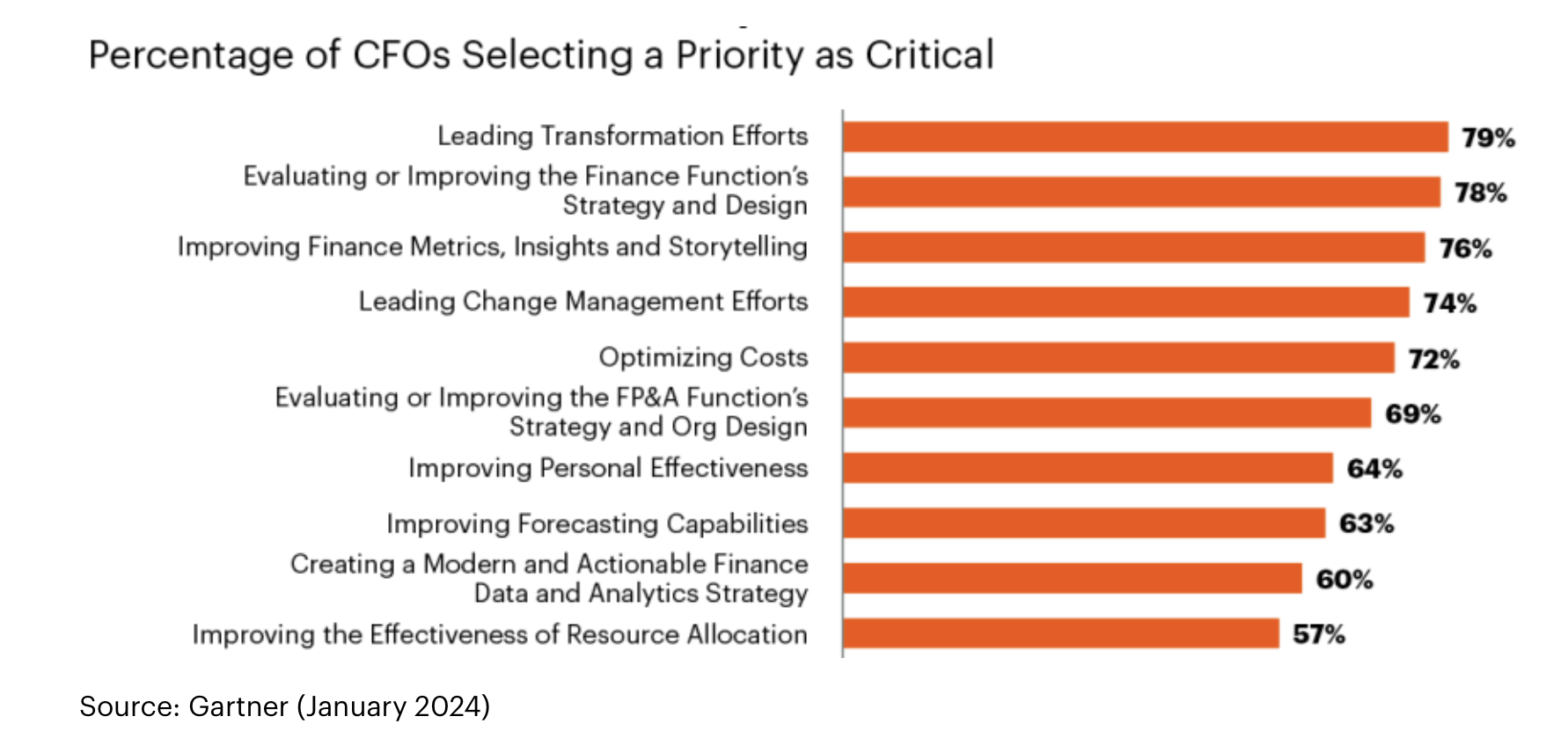

Transformation and improvement are key themes for finance leaders this year, according to a Gartner survey of 185 CFOs. Leading transformation efforts (79%), improving the strategic design and capabilities of finance teams (78%), and improving financial metrics and storytelling (76%) are 3 out of the top 5 important priorities. That’s one.

even deeper

“Do you want to be a better leader? Stop thinking about work after hours” report harvard business reviewdescribes new research that shows that incessant rumination leaves managers exhausted and unable to show up in a way that leaders and employees notice.

overheard

“My message to young workers is to explore opportunities within your organization. The grass is always greener on the outside.”

—Shaid Shah, Global President, Mars Food & Nutrition. luck In an interview. Since joining the $50 billion global food and pet care giant in 2007, Mr. Shah has steadily risen through the ranks from Director of Sales.

[ad_2]

Source link