[ad_1]

Fargo — Fargo’s elected officials on Tuesday, Dec. 26, discussed how to fund infrastructure projects without burdening taxpayers as the city faces financial woes. I came.

City Engineer Tom Nacums presented an update on the proposed 2024-2027 Engineering Capital Improvement Plan (CIP) during the Fargo City Commission meeting.

Nakamus said in November that the new $101 million CIP faces multiple funding challenges, and to overcome them, the city will cap special assessments at 20% in 2024, 20% in 2025, and 20% in 2025. He told the committee that he is considering raising the rate by 7.19% in 2026 and 2027. This increase is intended to counter rising construction costs and better address the construction inflation rate of the past 15 years.

Nacums said the proposed increase would not affect existing special assessments and would only affect homeowners whose neighborhoods have local road reconstruction projects between 2024 and 2027. Roughly 200 homes a year in Fargo are specially evaluated for such projects, he added.

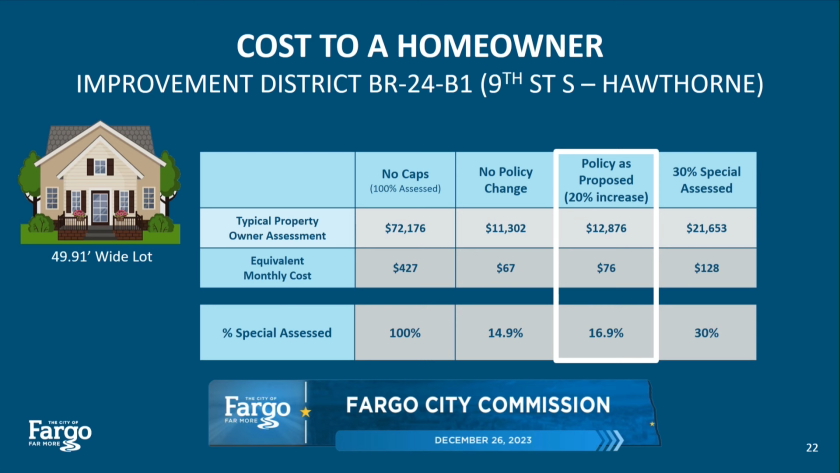

The commission on Tuesday awarded the bid for the Hawthorne District’s 2024 Core Area Reconstruction Project. Using the project’s numbers, the monthly cost of a special assessment would increase from $67 to $76 for a home on a 50-foot lot.

Screenshot / Fargo City

If approved, the special assessment would fund about 20% of street reconstruction projects over the next four years, up from 15% if the city rejects the proposed increase. By comparison, West Fargo residents would pay 60% of the cost of a similar project, Bismarck would pay 30%, and Grand Forks would pay 20%.

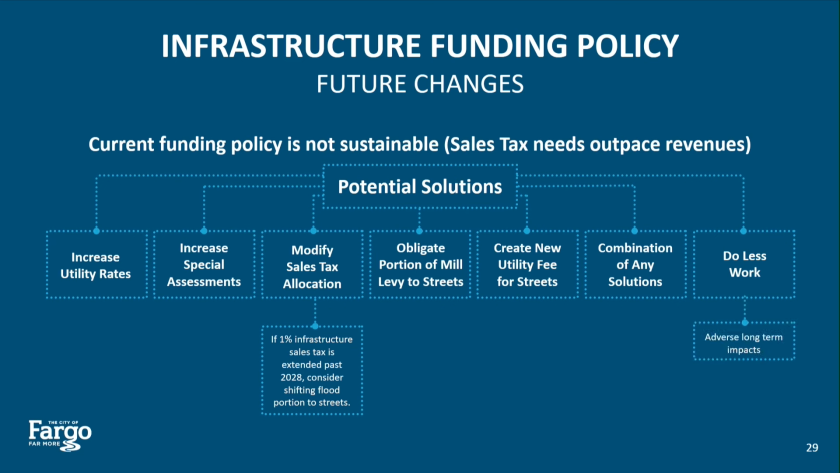

If the special assessment cap is not increased, the city could be left with a significant infrastructure funding shortfall and remain reliant on sales taxes to fund projects, Nakamus said. He said demand for sales taxes already exceeds revenue and that he expects the sales tax fund to reach a negative balance by 2027, even with a 20% increase in special assessments.

However, the opinions of the committee members were widely divided on this matter, with some calling for the special evaluation to be completely discontinued.

“We believe it is time to eliminate special assessments,” City Commissioner Dave Piepkorn said, echoing a similar statement made by Commissioner Arlette Preston in November.

David Samson/The Forum

Preston said at the Nov. 6 meeting that it would make more sense to “start moving away from the specials.” As cities become more densely populated in the coming years, traditional methods of paying special rates will Due to the larger site area, multifamily properties require lower special payments per person than adjacent single-family homes.

Piebkorn urged the city to consider other ways to fund infrastructure improvements, such as increasing the sales tax. CIP is currently funded through a combination of sales taxes, utility charges, special assessments, and state and federal funds.

Special assessments fund approximately 20% of total CIP funding.

The purpose of the special assessment is to limit the portion of the bill that residents are expected to pay for improvements that benefit their property, Nakamus said. The rest is paid by the city from taxes collected from the entire community.

Additionally, he added, the special measures aim to “ensure equity with all property owners across the city.”

Meanwhile, Strand wants the city to “prepare for the worst” and “tighten things up” by making significant spending cuts.

Strand said getting the state prairie dog fund is not certain, and since a portion of Fargo’s sales tax is due to expire in 2028, there is no guarantee that residents will vote in favor of extending that tax. Relying on sales tax to solve this problem is “hope and pray.”

Screenshot / Fargo City

He thinks the city needs to seriously consider cutting jobs. This would equalize expenditures and revenues and eliminate the need to pay additional costs to residents.

Without the prairie dog fund or sales tax, the city would rely on special assessments and utility fees to fund improvements, Nakamus said, and the city’s CIP cannot be further reduced without sacrificing infrastructure maintenance. he added.

“Not maintaining the infrastructure will ultimately cost the city and its residents more in the long run,” Nakamus said.

Strand asked the city to study what those costs will look like over the long term and find areas of reduction the city can afford so the city can reduce its spending. Every increase in cost impacts residents, he said.

Mr Preston believes the proposal to raise the cap on special assessments is a “band-aid” measure. On Tuesday, she called on the city to find long-term solutions to address revenue and spending imbalances.

“I’m concerned,” Preston said, “so…this time we’re going to increase (the special assessment) by 20%, but then when we look at long-term funds, will we increase it another 20%?”

The city needs a more permanent solution because reserves for infrastructure rebuilding are “depleting pretty quickly,” she said.

Nakamus said the cap increase alone makes a lot of sense and is only part of an overall solution to long-term financing. He pointed out that less than 4% of property owners protested the proposed cap increase for 214 properties scheduled for reconstruction projects in 2024.

“Most people seem to really understand the benefits of road improvements…and feel that the costs are proportionate to the benefits they’re getting,” Nakamus said.

Mr Mahoney said a solution to this problem is unlikely to materialize as soon as it addresses the current CIP imbalance. He proposed increasing the cap on this special assessment as part of the solution, adding that the city could take time to work on a more comprehensive solution.

“You have to be a little careful if you suddenly try to solve everything within a year,” Mahoney said. “This year’s change is a simple 20% increase, but it won’t have a huge impact and will keep protests to a minimum. This is a good sign that we are on the right track.”

The Committee is scheduled to vote on the CIP at its January 8, 2024 meeting.

[ad_2]

Source link