[ad_1]

Assessing FRT’s dividend sustainability and growth

Federal Realty Investment Trust (NYSE:FRT) recently announced a dividend of $1.09 per share, payable on April 15, 2024, with an ex-dividend date of March 12, 2024 Did. The company’s dividend history, yield, and growth rate are also in focus as investors look forward to future payouts. Let’s examine Federal Realty Investment Trust’s dividend history and assess its sustainability using data from GuruFocus.

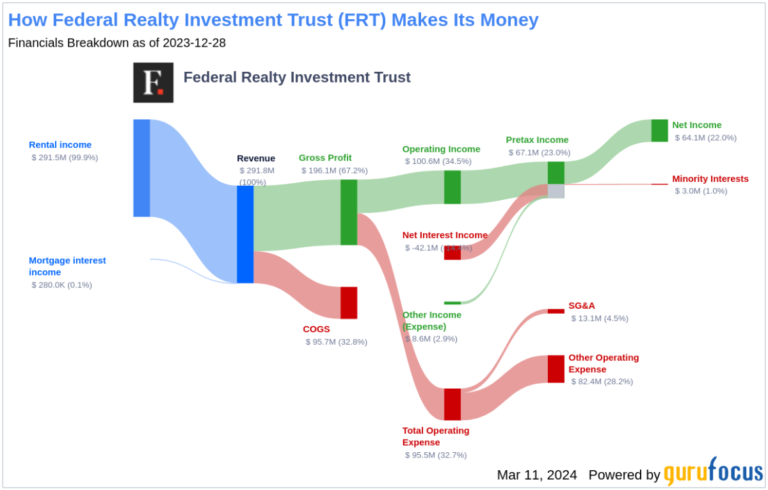

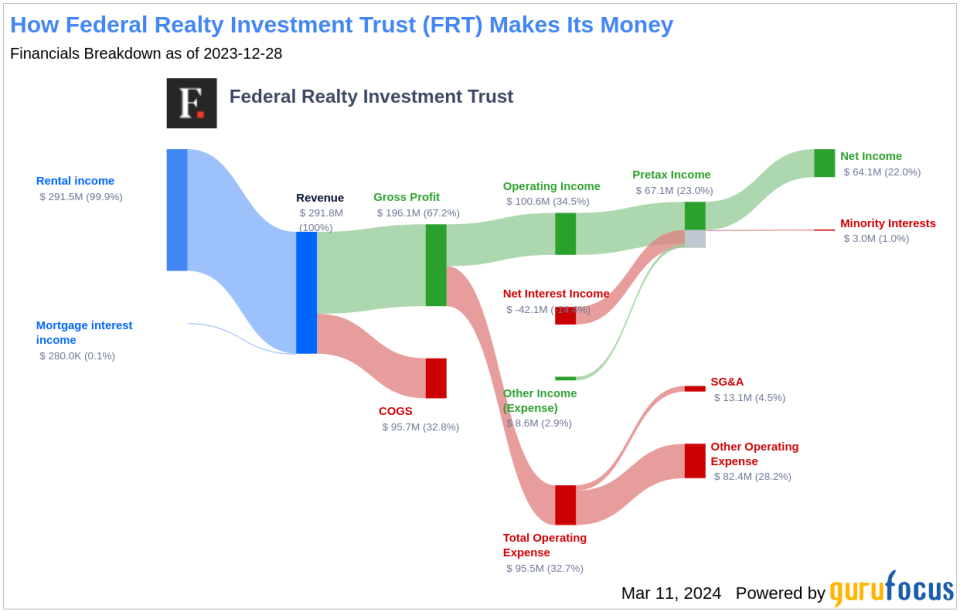

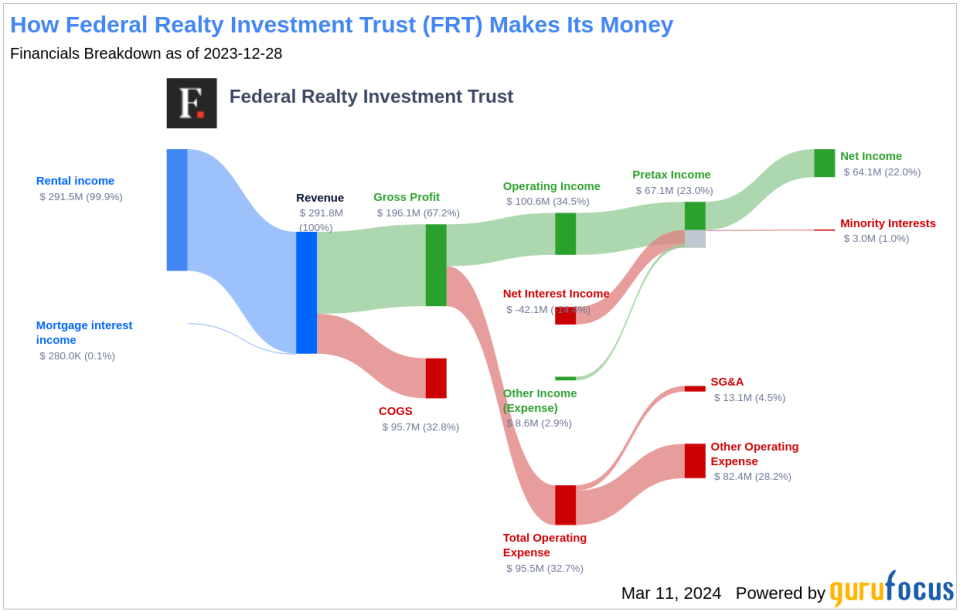

What does Federal Realty Investment Trust do?

Federal Realty Investment Trust is a retail real estate investment trust focused on shopping centers and owns high-quality real estate properties in eight metropolitan markets. The company’s portfolio includes interests in 102 properties consisting of 25.8 million square feet of retail space and more than 3,100 multifamily units. Federal Realty’s retail portfolio includes grocery-centered centers, super-regional centers, power centers, and mixed-use urban centers. Federal Realty is focused on owning assets in high-growth, highly desirable geographies, resulting in its portfolio having higher average population density and median household income than any other retail REIT. I am.

A glimpse of Federal Realty Investment Trust’s dividend history

Federal Realty Investment Trust has maintained a consistent dividend payment record since 1968. Dividends are currently distributed on a quarterly basis. Federal Realty Investment Trust has increased its dividend every year since 1968. That’s why the stock is listed as a Dividend King, an honor given to companies that have increased their dividends every year for at least the past 56 years. Below is a graph showing annual dividends per share to track historical trends.

Breakdown of Federal Realty Investment Trust’s dividend yield and growth rate

As of today, Federal Realty Investment Trust has a 12-month forward dividend yield of 4.25% and a 12-month forward dividend yield of 4.27%. This suggests that dividend increases are expected over the next 12 months. Over the past three years, Federal Realty Investment Trust’s annual dividend growth rate was 0.90%. When extended to a five-year period, this rate increased to 1.40% per year. Additionally, Federal Realty Investment Trust’s annual dividend growth rate per share over the past 10 years has been 3.30%.

Based on Federal Realty Investment Trust’s dividend yield and five-year growth rate, Federal Realty Investment Trust stock has a five-year cost yield of approximately 4.56% as of today.

Questions about sustainability: Dividend payout ratio and profitability

To assess dividend sustainability, you need to evaluate a company’s payout ratio. Dividend payout ratio helps determine the proportion of a company’s profits that it distributes as dividends. A low ratio indicates that the company is retaining a significant portion of its earnings, thereby ensuring that it has funds for future growth or unexpected economic downturns. As of December 31, 2023, Federal Realty Investment Trust’s dividend payout ratio was 1.61, which may suggest that the company’s dividend may not be sustainable.

Federal Realty Investment Trust’s Profitability Rank helps you understand the company’s earning power compared to its peers. GuruFocus ranks Federal Realty Investment Trust’s profitability at 8 out of 10 as of December 31, 2023, suggesting a positive outlook for profitability. The company has reported positive net income every year for the past 10 years, further cementing its strong profitability.

Growth indicators: future outlook

To ensure dividend sustainability, companies must have solid growth metrics. Federal Realty Investment Trust’s Growth Rank of 8 out of 10 suggests that the company’s growth trajectory is favorable compared to its competitors. Earnings are the lifeblood of any company, and combining Federal Realty Investment Trust’s earnings per share with his three-year earnings growth rate shows a strong earnings model. Federal Realty Investment Trust’s revenue grows on average at around 8.00% per year, which outpaces around 72.09% of its global competitors.

The company’s three-year EPS growth rate indicates its ability to grow earnings, which is a key factor in maintaining a dividend over the long term. Over the past three years, Federal Realty Investment Trust’s earnings have grown by an average of about 26.60% per year. This percentage is higher than about 78.37% of its global competitors.

Finally, the company’s 5-year EBITDA Growth rate of -1.00% is higher than around 39.26% of its global competitors, indicating room for improvement.

fascinating conclusion

In conclusion, Federal Realty Investment Trust’s consistent dividend track record, coupled with its strong profitability ranking and solid growth metrics, makes a compelling case for value investors. However, with the dividend payout ratio rising, careful consideration is needed to ensure the sustainability of the dividend. With its strategic focus on high-growth urban markets, Federal Realty Investment Trust may remain an attractive option for investors seeking dividend income. Will FRT’s commitment to shareholder return and growth strategy continue to benefit investors over the long term? For a deeper dive, GuruFocus Premium users can use the High Dividend Yield Screener to find stocks with high dividend yields. can be screened.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link