[ad_1]

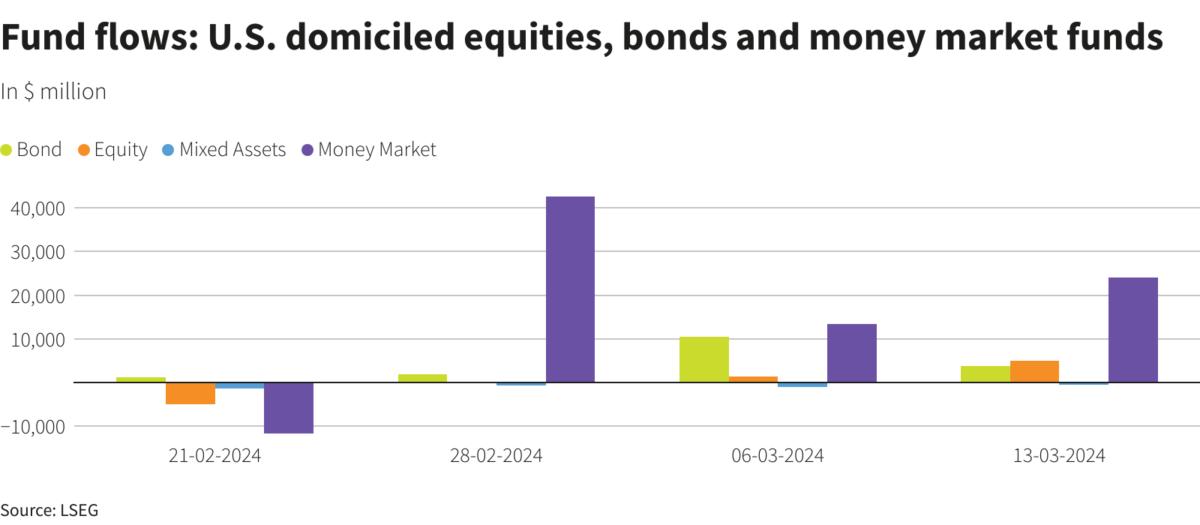

U.S. stock funds have a 10-month period ahead of them through March 13, as investors remained optimistic about a Wall Street rebound and clung to hopes of rate cuts this year, even as inflation proved stubborn. It was the third consecutive week of inflows in seven days.

Investors bought $4.93 billion in U.S. stock funds, the biggest weekly net purchase since Feb. 14, according to data from the London Stock Exchange Group (LSEG).

Wall Street’s record gains this year and recent comments from Federal Reserve Chairman Jerome Powell suggesting the central bank believes inflation has eased enough to start cutting interest rates Confidence in the family is increasing.

S&P500 SPX It hit an all-time high of 5189.26 last week and is up about 8% year-to-date.

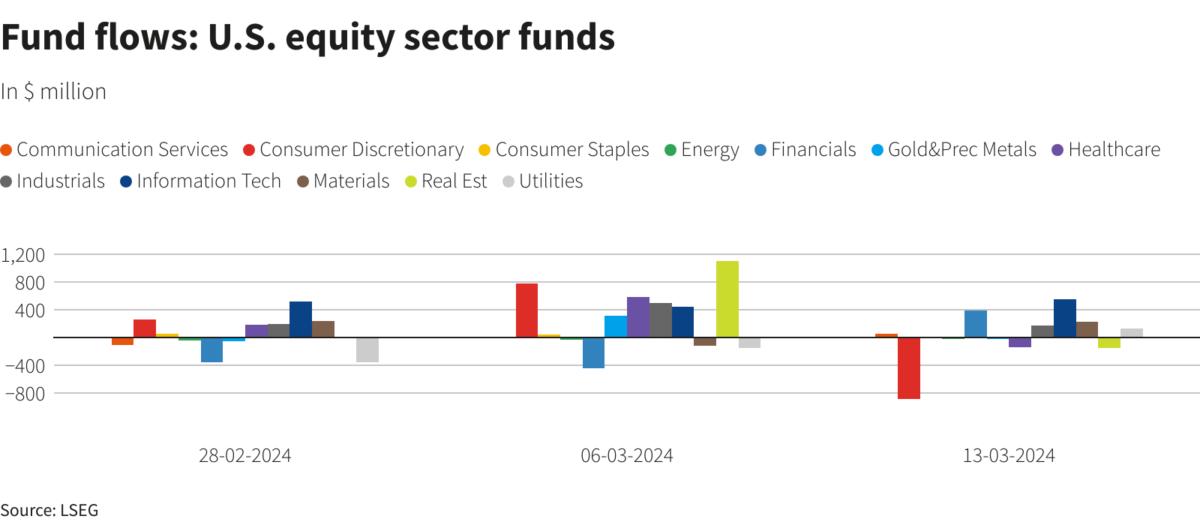

Investors bought US large-cap, small-cap, and multi-cap funds worth net amounts of $2.88 billion, $1.8 billion, and $771 million, respectively. Meanwhile, mid-cap stocks were net sellers by $584 million.

The tech and financial sectors attracted the largest net inflows with $554 million and $389 million, respectively. The Consumer Discretionary segment witnessed net withdrawals of $889 million.

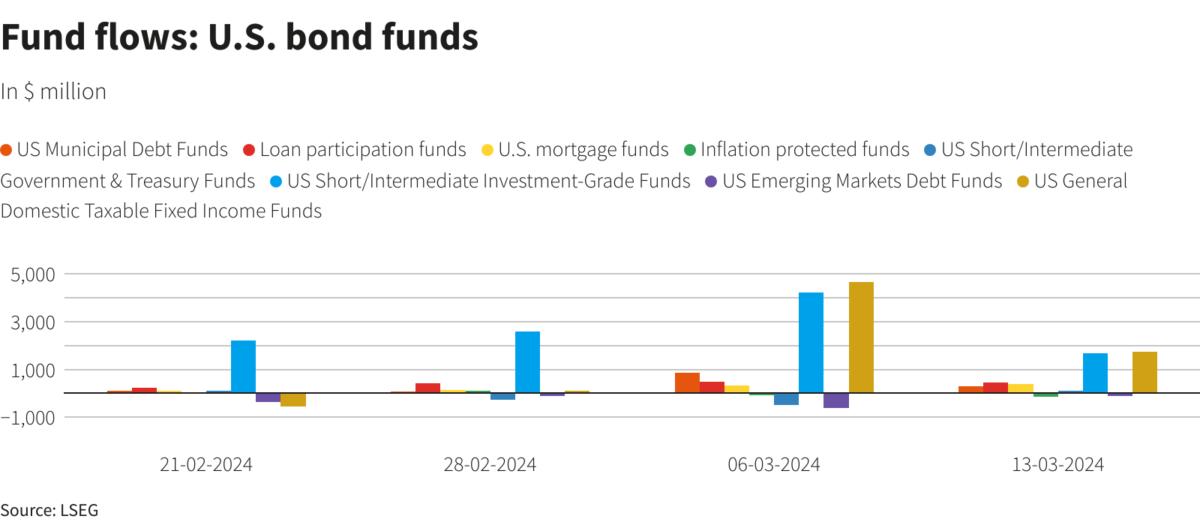

Net inflows into U.S. bond funds totaled $3.81 billion, a sharp slowdown from $10.54 billion the previous week.

Demand for U.S. general tax bonds cooled from $4.65 billion net to $1.76 billion net, and demand for short-term and intermediate investment grade funds cooled from $4.21 billion net to $1.64 billion. .

Flows into money market funds totaled a net $24.07 billion for the third week.

[ad_2]

Source link