[ad_1]

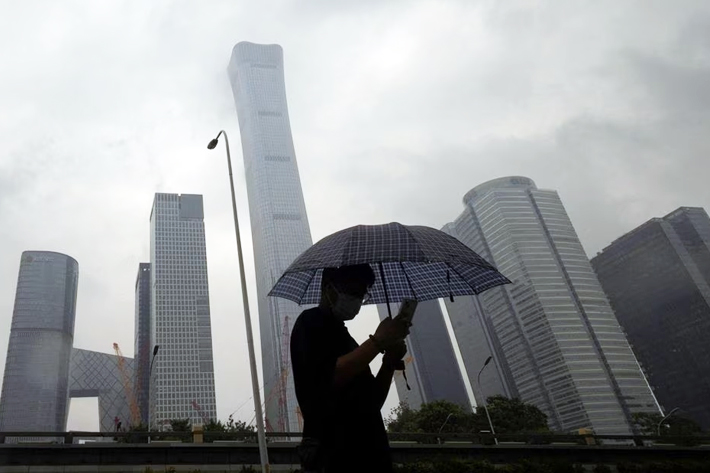

Foreign direct investment (FDI) into China slowed last year to its worst pace in 30 years, in another sign of waning global business interest in the world’s second-largest economy.

China’s direct investment debt (a measure of net foreign capital inflows into the country) reached $33 billion in 2023. data The State Administration of Foreign Exchange (SAFE) made the announcement on Sunday.

This was more than 80% lower than the $180.2 billion figure. 2022.

Also AF: EU vows to stop ‘unfair competition’ in new Chinese subsidy investigation

This data shows that FDI into China has declined for the second consecutive year, Nikkei Asia reportIt added that last year’s numbers were less than 10% of the record foreign inflows seen in 2021, valued at $344.1 billion.

In the July-September quarter of 2023, China First quarterly deficit in history FDI suggests that outflows far exceed inflows.

However, the final quarter’s data showed some improvement, with net inflows into the country of about $17.5 billion.

The decline in foreign interest in China comes at a critical time for the country, which is grappling with deflation risks and weak consumer demand.

Meanwhile, China’s sluggish post-COVID-19 recovery, coupled with deteriorating relations with the West and an ongoing crisis in the real estate sector that threatens to spill over into financial services, is prompting foreign companies to relocate overseas. ing.

A vague but strict anti-espionage law enacted by Xi Jinping’s government last year is also weighing on business sentiment as the economy soars. raid, fine and Banned from leaving the country imposed on foreign companies and their employees.

fraying geopolitical ties

Sentiment among US companies expanding into China is weak record low It hit its lowest level last year, but rebounded slightly in December ahead of a summit between Mr Xi and US President Joe Biden.

Last year’s survey of US and UK companies in China found that companies postpone investment Geopolitical tensions and regulatory mismatches have led to an influx into the country.

For example, a Nikkei report noted how chip-related foreign inflows have slowed as US efforts to slow China’s entry into the semiconductor industry have increased.

In 2018, China accounted for 48% of global chip-related foreign direct investment, but by 2022 that number has fallen to just 1%, Nikkei Shimbun reported, citing Rhodium Group data. .

Similarly, in January, US chip designer Teradyne announced The company had pulled $1 billion worth of manufacturing equipment from China.

Meanwhile, Chinese leaders continue to appeal to the business community to increase investment in the country.

Last month, Chinese Premier Li Qiang spoke to business leaders at Davos The country’s economic recovery will continue to provide global momentum. He added that the Chinese government will take steps to address the concerns of global companies.

“Choosing to invest in the Chinese market is not a risk, but an opportunity,” Li said.

Also read:

China’s Lunar New Year spending increases by 47%, surpassing pre-COVID-19 levels

China suffers biggest drop in consumer prices since 2009

China’s deflation and economic slump hint at another turbulent year

China’s real estate sector will remain depressed for many years: Goldman

U.S. committee calls for ban on investment in China’s critical technology sectors

Huawei and SMIC plan to defy US sanctions with 5nm chips: FT

Tensions between China and the West are reshaping global business

China’s economy is in trouble, US Nobel Prize winner says – NYT

Wealthy families and private companies flee China by billions – NYT

[ad_2]

Source link