[ad_1]

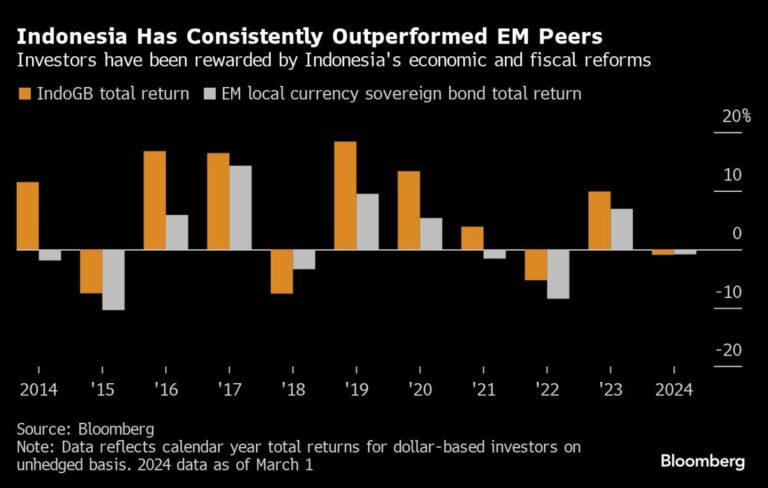

(Bloomberg) — Global fund managers are betting on Indonesian government bonds, seeing them as key beneficiaries of the expected U.S. Federal Reserve easing cycle.

Most Read Articles on Bloomberg

Ashmore Group said Indonesia’s relatively high inflation-adjusted policy rates provide plenty of room for cuts once the Fed begins easing. Fidelity International sees carry potential in Indonesia’s flat yield curve. abrdn plc cites healthy government finances as the reason for purchasing rupiah bonds.

“It’s pretty hard to ignore a market like Indonesian bonds,” said Jerome Tay, an investment manager at Abdon in Singapore. They are likely to outperform their regional peers this year, he said.

Indonesia’s inflation-adjusted interest rate is currently 3.25%, the highest in Asia after the Philippines and Thailand, giving the central bank plenty of room to cut borrowing costs to stimulate the economy. Furthermore, the fiscal deficit, which is at a 12-year low, makes government bonds more attractive.

There are concerns that the Fed’s delay in cutting interest rates this year and programs such as the free lunch scheme proposed by Indonesia’s new president Prabowo Subianto are eating away at gains in rupiah bonds. Still, the 1% decline was the smallest loss in Asia’s emerging economies, according to data compiled by Bloomberg.

Ian Samson, portfolio manager at Fidelity (Singapore), said: “Indonesia started in a very strong fiscal position, so we are able to provide some fiscal relief without upsetting markets or incurring significant negative consequences.” There’s probably room to do that.” “Indonesia government bonds are one of the top picks in the Asian duration spectrum, especially in the five-year part of the curve, which would benefit more from near-term easing expectations.”

Gustavo Medeiros, Ashmore’s head of global macro research, maintains an overweight position in Indonesian government bonds, while favoring long-term interest rates because he expects the market to be less volatile than his peers.

Latin American alternative words

The premium offered by Indonesia’s 10-year bonds over U.S. bonds of the same maturity has narrowed to near the lowest levels this year, which could curb some of the demand for rupiah bonds abroad. The fund could instead opt for Latin American bonds, where central banks have already started easing.

“Foreign interest is muted in Brazil, Mexico and Eastern Europe because of their high yields and the prospect of policy action,” said Philip McNicholas, Asia sovereign strategist at Robeco Group in Singapore. “Bank Indonesia has made it clear that it will not act until the Fed does, so investors can afford to manage their positions at or slightly below benchmark weights for now.”

The Global Fund made net purchases of $106.1 million in Indonesian government bonds on February 29, the highest amount in six weeks, according to Treasury data. Only about 14% of Indonesia’s total debt is still held by foreigners, but at the beginning of 2020 the proportion had reached about 40%.

Rupiah stability

Indonesia’s central bank has so far refrained from cutting interest rates as it focuses on keeping the rupiah stable as the dollar strengthens on sharply lower expectations for Fed rate cuts.

“We know that the domestic economy needs stimulus through policy interest rates, but under the current global uncertainty, we will not adjust interest rates yet,” Bank Indonesia Deputy Governor Judah Agung said at a forum on Thursday. I can’t do that.”

Still, some funds are now taking steps to prepare for when rates start to fall.

“Indonesia is likely to follow the Fed quite closely, so we see Indonesian bonds as a good instrument to play in the future global monetary easing cycle,” Fidelity’s Samson said. He said that while developed market yield curves have largely inverted, the curve for rupiah bonds is quite flat, “which means it’s a better carry heading into an easing cycle.” said.

–With assistance from Chandra Asmara and Marcus Wong.

(Updated the 10th paragraph regarding foreign bond purchases.)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link