[ad_1]

It’s hard to overlook a big yield, but a sky-high dividend yield can be a sign of risk.That is if AGNC investment (NASDAQ:AGNC), offers a huge yield of 15%. It’s much better to lower your expected yield and buy on unfavorable terms. real estate income (New York Stock Exchange: O). A yield of 5.9% isn’t very attractive, but it’s actually promising. Here’s why you should forget about AGNC and buy Realty Income instead.

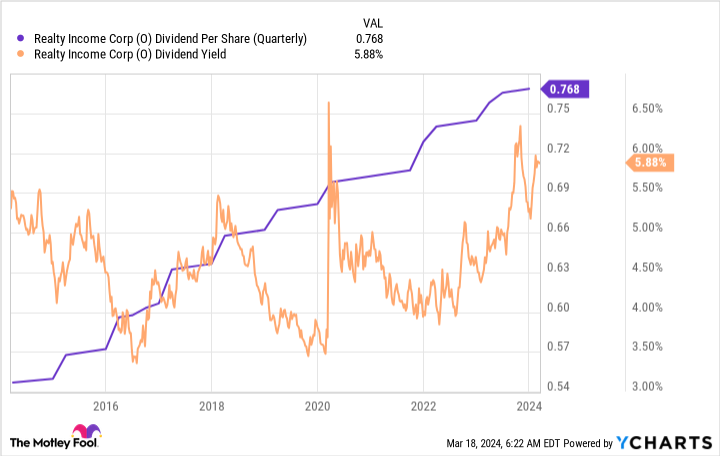

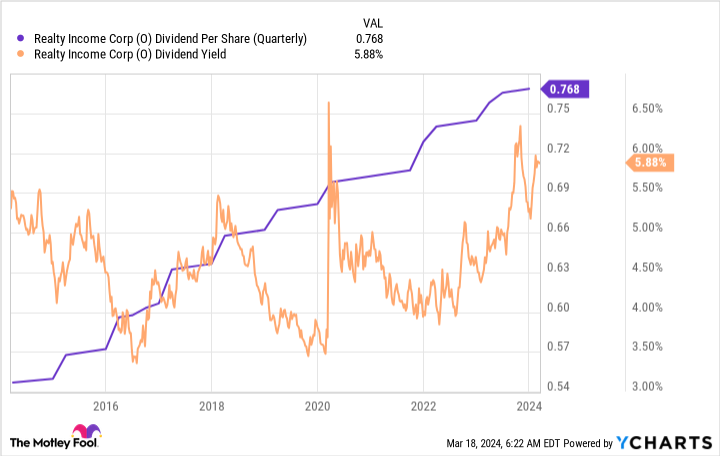

All you need is one graph

There is an old saying that a picture is worth a thousand words. In the case of AGNC Investment, that picture is actually a graph. Shown below. To summarize this picture in as few words as possible, the dividend is highly volatile and has been steadily declining for at least a decade. Stock prices are following suit, and are trending downward.

What’s interesting is that the dividend yield (blue line) has remained fairly high throughout. This is just a basic calculation of dividend yield, but even though investing in AGNC would have reduced a dividend investor’s income and capital over the past 10 years, his AGNC appears on the Dividend Yield screen regularly. means that it will be displayed. This is so bad for investors who are trying to make a living off the income their portfolios generate.

Most investors should pass on this stock and consider reliable dividend stocks like Realty Income instead.

Real estate income is a dividend machine

Realty Income and AGNC are both real estate investment trusts (REITs). But AGNC is a unique type of REIT that buys mortgage securities, a complex and risky niche in the REIT space. Real estate income is more boring. Purchase physical real estate and lease it to tenants. Substantially all of the company’s portfolio is net leased. This means that a single tenant is leasing the property and is responsible for most of the operating costs at the property level. A single property is high risk, but a large portfolio as a whole has very low risk. Realty Income is the largest net lease REIT with a portfolio of over 15,000 properties.

At about 5.9%, the yield is near the highest level in a decade, suggesting now is an attractive time to buy Realty Income stock. The first question to ask is, “Why are yields historically high?” The answer is because interest rates have risen and the cost of capital for real estate income (and other REITs) has risen. While this is certainly a headwind, the real estate market has adapted to changes in interest rates in the past and is likely to do so again.

Realty Income, on the other hand, is the largest pure lease REIT by a wide margin. The company is more than twice the size of its next closest competitor, giving it a scale advantage when it comes to purchasing new assets. In fact, the company has acquired several of its fellow REITs in recent years, adding industry consolidation to its growth opportunities. Underpinning the bullish thesis is an investment-grade balance sheet and an increasingly diversified portfolio, including a growing presence in Europe.

Evidence of the company’s success is in its dividend, which has increased for 29 consecutive years. Although the annual dividend growth rate is modest at around 4.3%, it’s clear that income investors can rely on Realty’s income to continue paying out at all times. If you’re looking for a sustainable high yield, Realty Income is a much better choice than AGNC.

be careful what you wish for

If you only look at a stock’s dividend yield, you run the risk of experiencing serious distress. AGNC is a great example. Despite regularly cutting its dividend, its yield remained high. If history is any guide, real estate income will serve dividend investors better. And the fact that REITs are currently unpopular and offer historically high yields is a long-term opportunity that shouldn’t be overlooked.

Should I invest $1,000 in AGNC Investment Corp. right now?

Before purchasing AGNC Investment Corp. stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and AGNC Investment Corp. wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 21, 2024

Reuben Gregg Brewer holds a position in the real estate revenue sector. The Motley Fool has a position in and recommends Realty Income. The Motley Fool has a disclosure policy.

Forget about AGNC investing and buy this great dividend stock instead. The original article was published by The Motley Fool.

[ad_2]

Source link